Lpt8 Form

What is the Lpt8

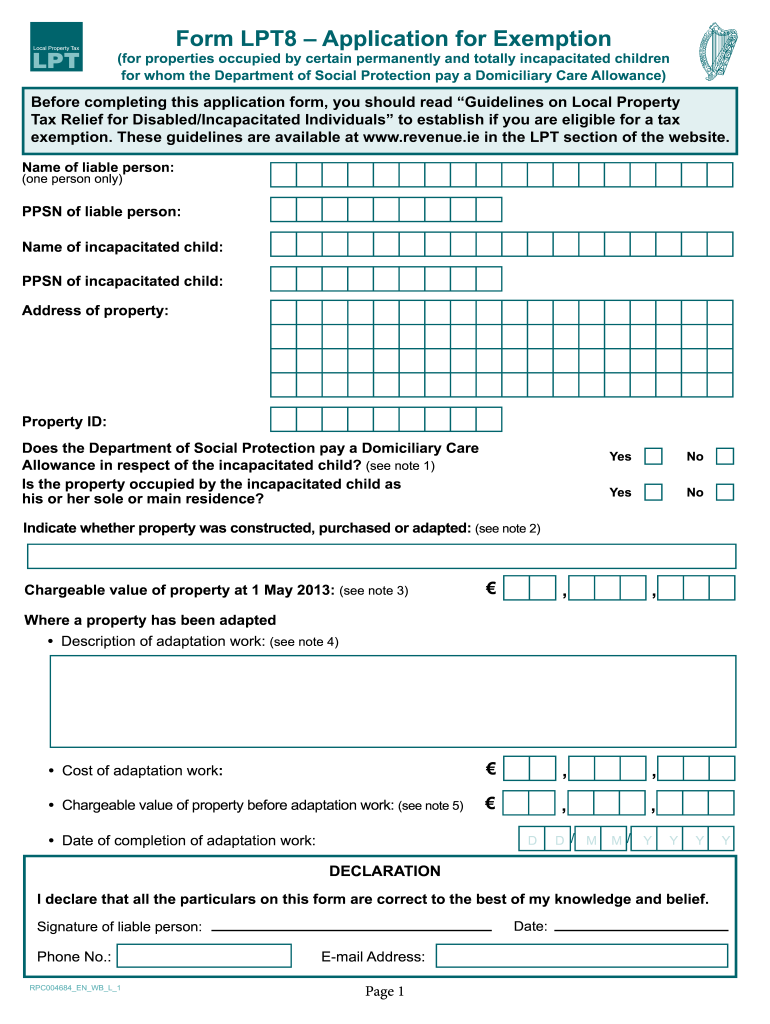

The Lpt8 form, also known as the Ireland Lpt8 revenue, is a crucial document used for tax purposes in Ireland. It is primarily associated with local property tax assessments. This form enables property owners to declare their property details and assess their tax liabilities accurately. Understanding the Lpt8 is essential for compliance with local tax regulations and ensuring that property taxes are calculated correctly.

How to use the Lpt8

Using the Lpt8 form involves several steps to ensure accurate completion. First, gather all necessary information regarding the property, including its value, location, and ownership details. Next, fill out the form with the required information, ensuring all fields are completed accurately. Once completed, the form can be submitted electronically or printed for mailing. It is important to keep a copy of the submitted form for your records.

Steps to complete the Lpt8

Completing the Lpt8 form involves a systematic approach:

- Gather Information: Collect all relevant property details, including ownership and valuation.

- Fill Out the Form: Accurately input the required information in the designated fields.

- Review: Double-check all entries for accuracy to avoid errors.

- Submit: Choose your submission method—either electronically or by mail.

Legal use of the Lpt8

The legal use of the Lpt8 form is governed by specific tax regulations in Ireland. It is essential for property owners to understand that submitting this form is not just a formality but a legal requirement. Failure to submit the Lpt8 can result in penalties or fines. Additionally, the information provided must be truthful and accurate, as discrepancies can lead to further legal implications.

Eligibility Criteria

To be eligible to file the Lpt8 form, property owners must meet certain criteria. This includes being the legal owner of the property and having the necessary documentation to prove ownership. Properties that are exempt from local property tax, such as certain types of public housing or properties owned by charities, may not require the submission of the Lpt8. It is important to check the specific eligibility requirements based on local regulations.

Form Submission Methods

The Lpt8 form can be submitted through various methods, providing flexibility for property owners. The options include:

- Online Submission: Many property owners prefer to submit the form electronically through official government portals.

- Mail: The form can also be printed and mailed to the appropriate tax authority.

- In-Person: Some may choose to submit the form in person at designated tax offices.

Required Documents

When completing the Lpt8 form, certain documents are typically required to support the information provided. These may include:

- Proof of Ownership: Documentation that verifies ownership of the property.

- Property Valuation: Evidence of the property's market value, which may include recent appraisals.

- Identification: A valid form of identification may be required to confirm the identity of the property owner.

Quick guide on how to complete lpt8

Complete Lpt8 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Lpt8 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Lpt8 with ease

- Obtain Lpt8 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Lpt8 to ensure clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lpt8

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the ie application exemption?

The ie application exemption is a special provision that allows certain businesses to bypass standard application processes for electronic signatures. It simplifies the compliance requirements for eSigning documents, making it easier for organizations to move forward without delays caused by paperwork.

-

How does airSlate SignNow assist with the ie application exemption?

airSlate SignNow provides a seamless platform equipped with features that comply with the ie application exemption guidelines. Our user-friendly solution enables businesses to send, eSign, and manage documents efficiently, ensuring that all necessary exemptions are met without complexity.

-

Is there a cost associated with utilizing the ie application exemption through airSlate SignNow?

While the ie application exemption itself does not have a direct cost, using airSlate SignNow may involve standard subscription fees based on your chosen plan. These plans are designed to be cost-effective, ensuring businesses can leverage the benefits of the exemption without straining their budgets.

-

What features does airSlate SignNow offer to support the ie application exemption?

airSlate SignNow offers a variety of features tailored to support the ie application exemption, including customizable templates, real-time tracking, and secure cloud storage. These tools facilitate efficient document management while ensuring compliance with exemption requirements, streamlining the eSigning process.

-

Can I integrate airSlate SignNow with other software platforms while using the ie application exemption?

Yes, airSlate SignNow offers extensive integration capabilities with popular software platforms, allowing businesses to enhance their workflows while utilizing the ie application exemption. This means you can connect your existing tools seamlessly, improving efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the ie application exemption?

By using airSlate SignNow in conjunction with the ie application exemption, businesses can enjoy signNow time savings and improved operational workflows. The application exemption allows for quicker approvals and document processing, which means faster transactions and less downtime.

-

Is airSlate SignNow compliant with the legal requirements for the ie application exemption?

Absolutely, airSlate SignNow is built to comply with the legal requirements surrounding the ie application exemption. Our solution ensures that electronic signatures are legally binding and meet industry standards, giving users confidence in their document transactions.

Get more for Lpt8

- District court petition to seal records clark county form

- Use this form if your child is at least 14 years old

- Fillable online name child consent childdocx fax email pdffiller form

- Notice of petition to change minor childs name form

- Fillable online district court clark county nevada form

- Your spouses name form

- Second childs name form

- For change of name for themselves and form

Find out other Lpt8

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template