Public Partnerships Direct Deposit 2014

What is the Public Partnerships Direct Deposit

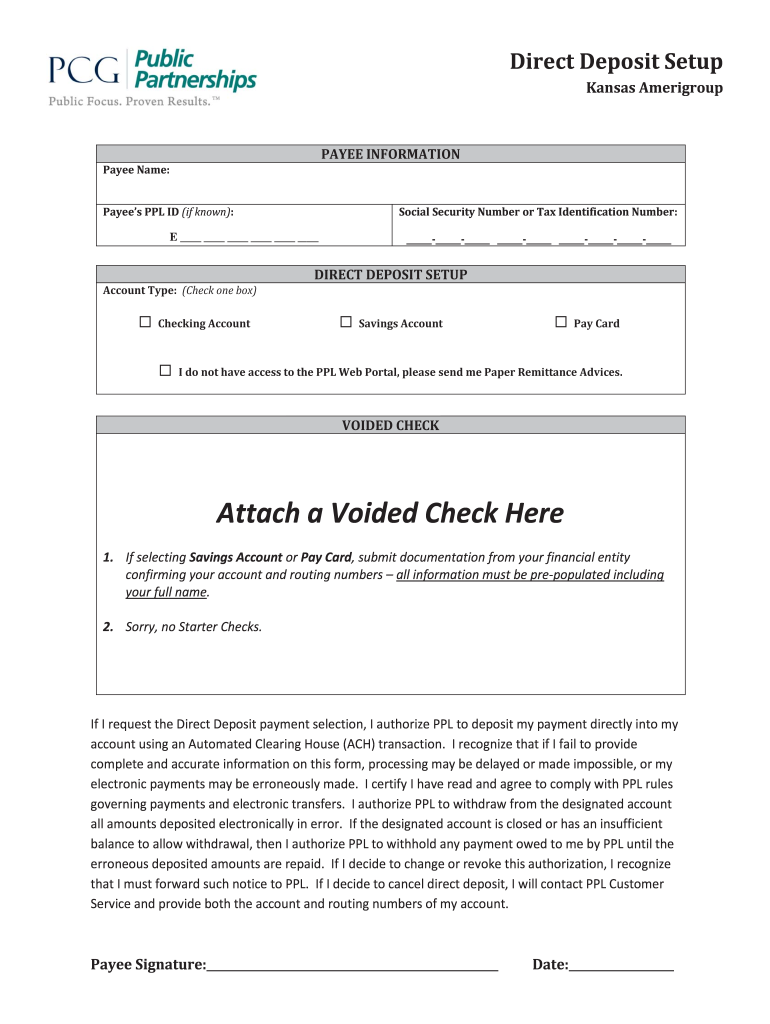

The Public Partnerships Direct Deposit is a financial arrangement that allows individuals to receive payments directly into their bank accounts. This method is often utilized by public agencies to streamline the disbursement of funds, such as wages, benefits, or reimbursements. By opting for direct deposit, recipients can enjoy faster access to their funds, eliminating the need for physical checks and reducing the risk of lost or stolen payments. This system is particularly beneficial for those who rely on timely payments for their financial stability.

How to use the Public Partnerships Direct Deposit

Using the Public Partnerships Direct Deposit involves a straightforward process. First, individuals must complete the necessary forms, providing their banking information, including account numbers and routing numbers. This information ensures that payments are directed to the correct financial institution. Once the forms are submitted, the public agency will process the request, and payments will be deposited directly into the specified account on scheduled payment dates. It is essential to keep banking information updated to avoid any interruptions in payment.

Steps to complete the Public Partnerships Direct Deposit

Completing the Public Partnerships Direct Deposit requires several key steps:

- Gather necessary information, including your bank account number and routing number.

- Obtain the Public Partnerships Direct Deposit form from the relevant agency.

- Fill out the form accurately, ensuring all information is correct.

- Submit the completed form to the appropriate department, either online or by mail.

- Verify that your banking details are correct and monitor your account for the first deposit.

Legal use of the Public Partnerships Direct Deposit

The legal use of the Public Partnerships Direct Deposit is governed by federal and state regulations that ensure the protection of personal financial information. Compliance with laws such as the Electronic Fund Transfer Act (EFTA) is crucial, as it outlines the rights and responsibilities of both the payer and the payee. Additionally, agencies must adhere to privacy standards to safeguard sensitive information during the direct deposit process. Ensuring that all legal requirements are met helps maintain the integrity and security of the payment system.

Key elements of the Public Partnerships Direct Deposit

Several key elements define the Public Partnerships Direct Deposit:

- Banking Information: Accurate account and routing numbers are essential for successful transactions.

- Authorization: Recipients must provide explicit consent for direct deposit to occur.

- Payment Schedule: Understanding when deposits will be made is important for financial planning.

- Security Measures: Agencies implement various security protocols to protect personal information.

Who Issues the Form

The Public Partnerships Direct Deposit form is typically issued by the public agency responsible for administering the payments. This could include state or local government departments, social service agencies, or other public entities. Recipients should ensure they are using the most current version of the form, as updates may occur to comply with changing regulations or to improve the process.

Quick guide on how to complete public partnerships direct deposit

Complete Public Partnerships Direct Deposit seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Public Partnerships Direct Deposit on any platform with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to edit and eSign Public Partnerships Direct Deposit easily

- Access Public Partnerships Direct Deposit and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Public Partnerships Direct Deposit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct public partnerships direct deposit

Create this form in 5 minutes!

How to create an eSignature for the public partnerships direct deposit

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is public partnerships direct deposit?

Public partnerships direct deposit is a payment method that allows organizations to streamline their financial processes. By utilizing this feature, businesses can ensure timely payments to employees and contractors directly into their bank accounts, simplifying the payment workflow.

-

How does airSlate SignNow support public partnerships direct deposit?

airSlate SignNow enhances public partnerships direct deposit by providing a platform where you can easily send and eSign necessary documents. This feature allows for seamless integration of payment information, ensuring that your contracts and payment authorizations are securely handled.

-

What are the benefits of using airSlate SignNow for public partnerships direct deposit?

Using airSlate SignNow for public partnerships direct deposit offers numerous benefits, including faster payment processing and reduced paperwork. The platform's user-friendly interface allows for easy tracking of payment approvals, which increases efficiency and accountability for your organization.

-

Is airSlate SignNow cost-effective for managing public partnerships direct deposit?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing public partnerships direct deposit. With competitive pricing plans, businesses can save on administrative costs while ensuring that their direct deposit processes are streamlined and efficient.

-

What features does airSlate SignNow offer for public partnerships direct deposit?

AirSlate SignNow offers several features tailored for public partnerships direct deposit, including electronic signatures, document templates, and secure storage. These features not only enhance the direct deposit process but also help ensure compliance and reduce turnaround time for financial transactions.

-

Can airSlate SignNow integrate with accounting software for public partnerships direct deposit?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software to facilitate public partnerships direct deposit. This integration allows for automatic updates of payment records and simplifies the overall financial management process.

-

How secure is the public partnerships direct deposit process with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and secure authentication processes to protect sensitive information related to public partnerships direct deposit, ensuring that your financial data remains safe and confidential.

Get more for Public Partnerships Direct Deposit

- Texas temporary restraining order and notice form

- Texas revocation form

- Lead based paint disclosure form pdf

- Texas texas installments fixed rate promissory note secured by personal property form

- Durable power attorney form texas

- Texas texas articles of organization for professional limited liability company pllc form

- Attestation form

- Petition birth certificate form

Find out other Public Partnerships Direct Deposit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors