Direct Deposit Form

What is the direct deposit form?

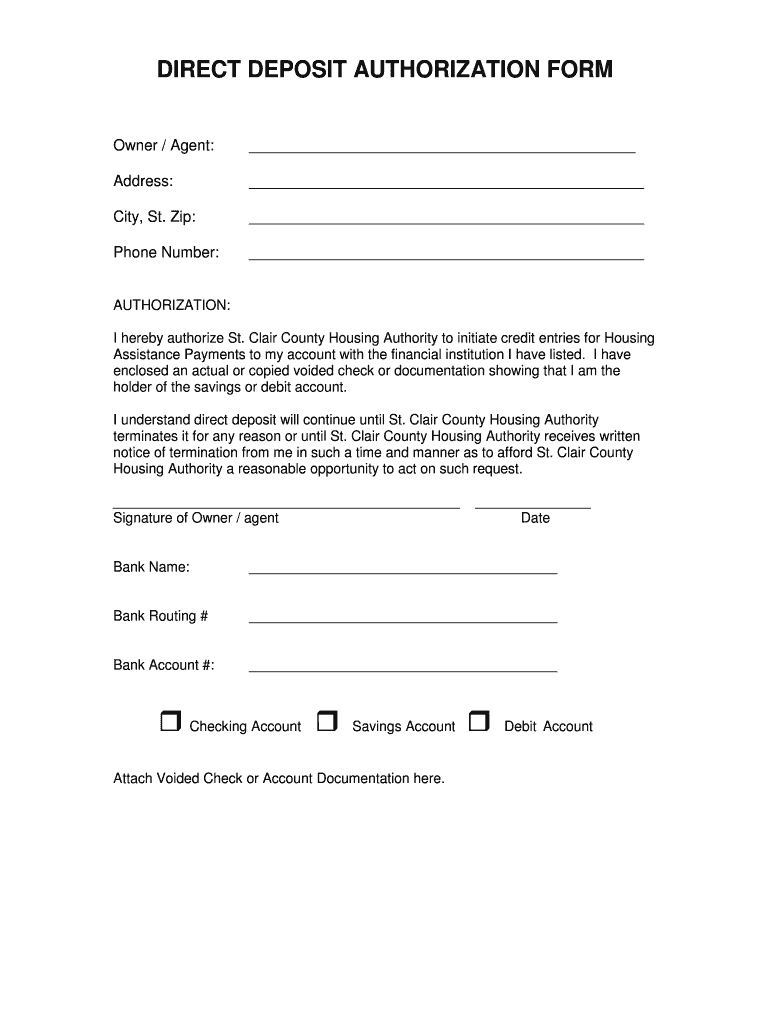

The direct deposit form is a document that allows individuals to authorize their employer or financial institution to deposit funds directly into their bank account. This form is commonly used for payroll, government benefits, and other recurring payments. By opting for direct deposit, recipients can enjoy faster access to their funds, eliminating the need for physical checks and reducing the risk of lost or stolen payments.

How to use the direct deposit form

Using the direct deposit form involves a few straightforward steps. First, gather your bank account information, including the account number and routing number. Next, complete the form by providing your personal details, such as your name, address, and Social Security number. After filling out the necessary fields, submit the form to your employer or the institution responsible for processing your payments. It's essential to double-check the information for accuracy to avoid any delays in receiving your funds.

Steps to complete the direct deposit form

Completing the direct deposit form requires careful attention to detail. Follow these steps:

- Obtain the direct deposit form from your employer or financial institution.

- Fill in your personal information, including your full name and address.

- Provide your bank account details, including the account number and routing number.

- Indicate the type of account (checking or savings).

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to the appropriate party, ensuring you keep a copy for your records.

Key elements of the direct deposit form

Several key elements are essential for the direct deposit form to function correctly. These include:

- Personal Information: This includes your name, address, and Social Security number.

- Bank Account Details: Your bank account number and routing number are crucial for directing funds accurately.

- Account Type: Indicate whether the account is a checking or savings account.

- Authorization: Your signature and date signify your consent for direct deposit.

Legal use of the direct deposit form

The legal use of the direct deposit form is governed by various regulations, including the Electronic Funds Transfer Act (EFTA). This act ensures that consumers are protected when authorizing electronic payments. It is important to ensure that the form is filled out accurately and submitted to authorized parties only. By adhering to these guidelines, individuals can ensure that their direct deposit arrangements are legally compliant and secure.

Digital vs. paper version

Both digital and paper versions of the direct deposit form serve the same purpose, but they differ in convenience and security. The digital version allows for quicker processing and easier submission, often through secure online portals. In contrast, the paper version may require mailing or in-person delivery, which can result in delays. Choosing the digital format can enhance efficiency, especially in today’s fast-paced environment.

Quick guide on how to complete direct deposit forms

The simplest method to obtain and endorse Direct Deposit Form

On a corporate scale, unproductive procedures concerning document approval can take up a signNow amount of work hours. Endorsing documents like Direct Deposit Form is a typical aspect of operations across all sectors, which is why the effectiveness of each contract’s lifecycle impacts the organization’s overall productivity so heavily. With airSlate SignNow, endorsing your Direct Deposit Form can be as straightforward and rapid as possible. You will discover on this platform the latest version of nearly any template. Even better, you can endorse it instantly without the need to install external software on your computer or print anything as physical copies.

Steps to obtain and endorse your Direct Deposit Form

- Browse our collection by category or utilize the search box to locate the document you require.

- Inspect the template preview by selecting Learn more to confirm it's the correct one.

- Click Get form to start editing immediately.

- Fill out your form and insert any essential information using the toolbar.

- Once finished, click the Sign feature to endorse your Direct Deposit Form.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options if needed.

With airSlate SignNow, you have everything required to handle your documents efficiently. You can find, fill out, modify, and even send your Direct Deposit Form all in one tab with ease. Simplify your procedures by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

How do I change my direct deposit to a different account?

Contact the person who helped you to create your direct deposit in the first place.Very likely, this will be a person who works in the payroll department of your company.This time say, “I would like my net paycheck to be deposited here, instead of there.”They will likely have you fill out a form of some kind. Your signature will serve as the authorization for them to change the direct deposit account number.They will make the necessary arrangements to help you achieve the effect you’re looking for.

-

How do Hollywood actors get paid?

All Hollywood actors have to be members of the Screen Actor's Guild to perform in major productions. That means that they have to be compensated in a manner which can be audited by the guild to ensure that they are being paid fairly. This means checks, wire transfers, etc. Cash payments would not allow that to occur.Depending upon what level the performer is on there are several methods where they could be compensated:They can create an LLC (Limited Liability Company) or a corporation and have themselves paid through that. This allows them to be a private entity and can lessen their tax burden in many states. They would receive a 1099 at the end of each quarter and their business staff would be responsible for paying their taxes and withholding. These are often referred to as “loan outs.” They could, if they were bit performers, be paid normally and then receive a W-2 at the end of the year. The production company would do all of their withholding and issue them the necessary tax documentation. This method is not favored by many actors as it leaves them dependent on the production company to take care of their tax matters.Some smaller productions overseas might be willing to pay extras in cash on a daily basis. However, many producers would be loath to do this as it could cause security issues and it is a temptation for fraud and abuse.Some of the major stars receive what are term to gross points, which are percentage of the gross movie profits. These can be exceptional, especially if the film is a hit, so only a few performers will receive them. Many are promised “net profit points” which are nearly worthless as even the most profitable films rarely show a profit due to Hollywood accounting techniques.

-

How do you set up direct deposits with Bank of America?

If you are trying to set up direct deposit for your paycheck from your job. Most companies have their personalized direct deposit forms wich can be obtained from the payroll department or HR. You can also use the form below:You need to check wether the deposit will be for your checkings or savings account. You will also need to write your account's routing number and your account number which can be found on a bank of america check:After you fill out the form, you will need to give it to your payroll department or HR.

-

How can you describe the function of direct deposits?

Direct Deposit is a deposit made directly into a person's bank account and the funds will be ready for use on the same day that the deposit takes place.A direct deposit is used paychecks from work or tax refund checks.The benefits of direct deposit is that the person has inmediate access to that money as opossed if the person was to take the paycheck to the bank and deposit it which could take 1 or 2 days for the check to clear.Another benefit is that the person does not have to spend time and money by going to the cashing check places and paying a fee just to cash their own checks.The way to set up a direct deposit is that a direct deposit form is given to the employee to fill out. Such direct deposit form must be returned with the employee's name, name of the bank, bank routing number, bank account number and signature. The direct deposit form will be given to the payroll or human resources which will be resposible for processing it and from there on, the employee will receive the paycheck money into the bank account every pay period, rather than receiving a paycheck.As for tax refunds direct deposits; the person would have to check the direct deposit option on the tax refund form and enter the bank routing number and the bank account number.

-

How do I set up a direct deposit for a Chase debit card?

If you have money in your bank account at Chase, it will transfer funds from your (usually a checking) account when you use your Chase debit card. The debit cards are associated with an account at the bank that issued them so you just use it as a debit card or use a pin at an ATM (preferably a Chase one or you will incur transactions fees generally). You don’t have to load a bank debit with cash but you need to have cash in the account that is affiliated with your credit because this will be the source of the fundsIf I am not answering your question or I misunderstood it please let me know.

-

I hired an intern. What paperwork should I have him fill out?

Congrats on hiring an intern for your business. I would suggest having the intern fill out your normal new hire packet.This would include mandatory state and federal forms as well as forms like an emergency contact form and direct deposit form. For a complete list of suggested forms you can refer to:How to Build a New Hire PacketTHE MANDATORY FORMS YOUR NEW HIRES MUST COMPLETE PLUS FREE TRAININGThese posts also include a nice checklist to help you keep track of everything. I hope that this helps. Good luck with your intern!AmandaThe HR StrategistAmanda Whetstone

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Is there a way to set up direct deposit through my job for two people?

When you fill out your direct deposit form, you should be able to provide different accounts and specify how much goes to each. If you form doesn't have that option, ask your HR or whoever takes care of payroll. Please note some companies won't allow this - its extra work. In that case, you can set up a recurring transfer from your bank account to their bank account. To do that, ask you bank or go on their website.

Create this form in 5 minutes!

How to create an eSignature for the direct deposit forms

How to make an eSignature for the Direct Deposit Forms in the online mode

How to create an eSignature for the Direct Deposit Forms in Google Chrome

How to generate an eSignature for signing the Direct Deposit Forms in Gmail

How to generate an electronic signature for the Direct Deposit Forms right from your mobile device

How to make an eSignature for the Direct Deposit Forms on iOS devices

How to generate an eSignature for the Direct Deposit Forms on Android

People also ask

-

What is a Direct Deposit Form and why do I need one?

A Direct Deposit Form is a document that authorizes your employer or payer to deposit your paycheck directly into your bank account. It streamlines the payment process, ensuring that your funds are safely deposited without the need for physical checks. Using a Direct Deposit Form can help you avoid bank visits and delays in receiving your payments.

-

How can I create a Direct Deposit Form using airSlate SignNow?

Creating a Direct Deposit Form with airSlate SignNow is simple. You can customize templates to suit your specific needs, add your branding, and include necessary fields for signatures and bank information. Once completed, you can easily send the form for eSignature to your employees or clients.

-

Is there a cost associated with using the Direct Deposit Form feature?

airSlate SignNow offers a range of pricing plans that include unlimited access to features like the Direct Deposit Form. Depending on your chosen plan, you can take advantage of additional functionalities and integrations, making it a cost-effective solution for managing your eSigning needs.

-

What are the benefits of using airSlate SignNow for my Direct Deposit Form needs?

Using airSlate SignNow for your Direct Deposit Form offers numerous benefits, including enhanced security, quick turnaround times, and a user-friendly interface. The platform ensures that all signatures are legally binding and can be stored securely in the cloud for easy access and compliance.

-

Can I integrate airSlate SignNow with my payroll system for Direct Deposit Forms?

Yes, airSlate SignNow seamlessly integrates with various payroll systems and HR software. This allows you to automate the process of collecting and managing Direct Deposit Forms, ensuring that your payroll operations run smoothly and efficiently.

-

How does eSigning a Direct Deposit Form work with airSlate SignNow?

eSigning a Direct Deposit Form with airSlate SignNow is straightforward. After creating your form, you can send it electronically to the signer, who will receive a link to review and sign. Once signed, you will receive a notification, and all parties can access the completed document securely.

-

Are Direct Deposit Forms legally binding when signed electronically?

Yes, Direct Deposit Forms signed electronically through airSlate SignNow are legally binding. The platform complies with the ESIGN Act and UETA, ensuring that your eSignatures are secure and recognized by law, just like traditional handwritten signatures.

Get more for Direct Deposit Form

Find out other Direct Deposit Form

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple