Form 3520 2015

What is the Form 3520

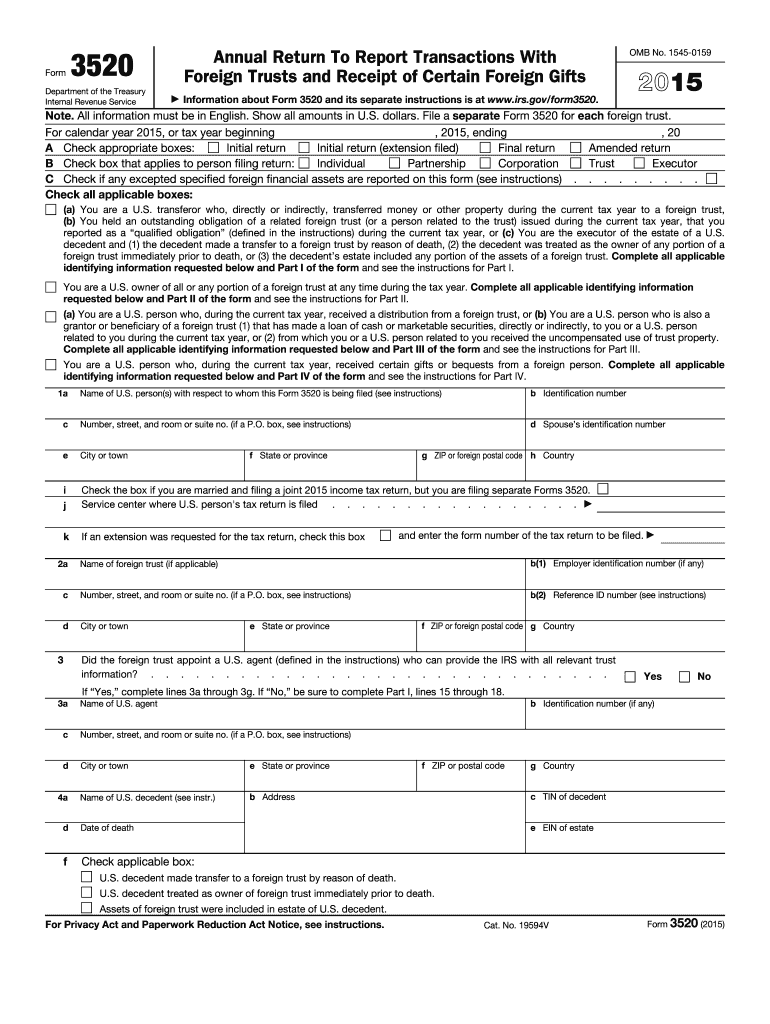

The Form 3520 is a tax form used by U.S. taxpayers to report certain transactions with foreign trusts, as well as the receipt of certain foreign gifts. This form is crucial for individuals who have foreign financial interests or who receive substantial gifts from foreign entities. The purpose of the Form 3520 is to ensure compliance with U.S. tax laws and to provide the IRS with information about foreign financial activities that may impact a taxpayer's tax obligations.

How to use the Form 3520

Using the Form 3520 involves accurately reporting specific financial transactions and gifts. Taxpayers must fill out the form when they establish a foreign trust, receive distributions from a foreign trust, or receive gifts exceeding a certain threshold from foreign individuals or entities. It is essential to provide detailed information about the transactions, including the amounts and the parties involved, to avoid penalties and ensure compliance with IRS regulations.

Steps to complete the Form 3520

Completing the Form 3520 requires careful attention to detail. Here are the key steps:

- Gather necessary information about foreign trusts or gifts.

- Fill out the identification section, including your name, address, and taxpayer identification number.

- Report any transactions with foreign trusts in the designated sections.

- Include details about any gifts received from foreign sources, specifying the amount and donor information.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The Form 3520 must be filed by the due date of the taxpayer's income tax return, including extensions. Typically, this means the form is due on April 15 for most individuals, but it can be extended to October 15 if an extension is filed. It is crucial to adhere to these deadlines to avoid penalties associated with late filings.

Penalties for Non-Compliance

Failure to file the Form 3520 when required can result in significant penalties. The IRS imposes a penalty of five percent of the amount of the unreported foreign gift or trust distribution for each month the form is late, up to a maximum of 25 percent. Additionally, failure to report a foreign trust can result in a penalty of $10,000. Understanding these penalties emphasizes the importance of timely and accurate filing.

Legal use of the Form 3520

The legal use of the Form 3520 is governed by U.S. tax laws, which require transparency regarding foreign financial interests. By filing this form, taxpayers fulfill their legal obligation to report foreign gifts and transactions with foreign trusts. Compliance with these regulations helps prevent tax evasion and ensures that taxpayers are meeting their responsibilities under U.S. law.

Quick guide on how to complete form 3520 2015

Complete Form 3520 seamlessly on any device

Online document organization has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without wait. Manage Form 3520 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to adjust and eSign Form 3520 without hassle

- Obtain Form 3520 and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your changes.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3520 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3520 2015

Create this form in 5 minutes!

How to create an eSignature for the form 3520 2015

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 3520 and why is it important?

Form 3520 is a tax form required by the IRS for U.S. taxpayers who receive large gifts or inheritances from foreign individuals or need to report foreign trusts. Understanding Form 3520 is crucial to ensure compliance with tax regulations and avoid potential penalties. By using airSlate SignNow, businesses can conveniently eSign and manage their Form 3520 documents with ease.

-

How can airSlate SignNow help me with Form 3520?

airSlate SignNow offers an efficient platform for sending and eSigning Form 3520 documents, ensuring that you meet all necessary compliance requirements. With a user-friendly interface, you can streamline your workflow and save time on document management. Additionally, it allows for easy tracking of your Form 3520 submissions.

-

What features does airSlate SignNow provide for managing Form 3520?

airSlate SignNow provides features such as customizable templates, advanced signature technology, and real-time document tracking for managing Form 3520. These tools enable users to create, send, and sign documents quickly and securely. The platform also supports document storage, making it easier to retrieve your Form 3520 and related documentation whenever necessary.

-

Is airSlate SignNow cost-effective for businesses dealing with Form 3520?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to manage Form 3520 and other documents. With various pricing plans available, users can choose a plan that fits their budget while ensuring they have access to essential features. This affordability makes it easier for businesses to stay compliant without overspending.

-

Can I integrate airSlate SignNow with other software for Form 3520 management?

Absolutely! airSlate SignNow integrates seamlessly with various popular business software, enhancing your ability to manage Form 3520 alongside other business processes. Whether you are using CRM systems or document management tools, airSlate SignNow can improve your efficiency and document flow. This connectivity allows for better tracking and storage of your Form 3520.

-

How secure is airSlate SignNow for handling Form 3520?

airSlate SignNow prioritizes the security of your documents, including Form 3520. The platform uses advanced encryption and compliance with industry standards to ensure that your sensitive information is safe. You can confidently eSign and send your Form 3520 knowing that it is safeguarded against unauthorized access.

-

Can airSlate SignNow help ensure timely submission of Form 3520?

Yes, airSlate SignNow can signNowly improve the timeliness of your Form 3520 submissions. By using its electronic signature capabilities, you can quickly get necessary approvals and avoid delays associated with traditional paper-based processes. This ensures that your Form 3520 is submitted on time, helping you maintain compliance with IRS deadlines.

Get more for Form 3520

- Dws esd 61app form

- 1f p 746 form

- Kansas gas service dorm 12159 4 15 form

- Student and spouse will not file and are not required to file a 2018 income tax return with the irs form

- Notice 989 rev 8 2015 commonly asked questions when irs determines your work status is employee form

- One form is required for each request

- Hp official site sign up here hp instant ink form

- Sc 408a form

Find out other Form 3520

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile