Form 4952, Investment Interest Expense Deduction 1040 Com 2012

What is the Form 4952, Investment Interest Expense Deduction 1040 com

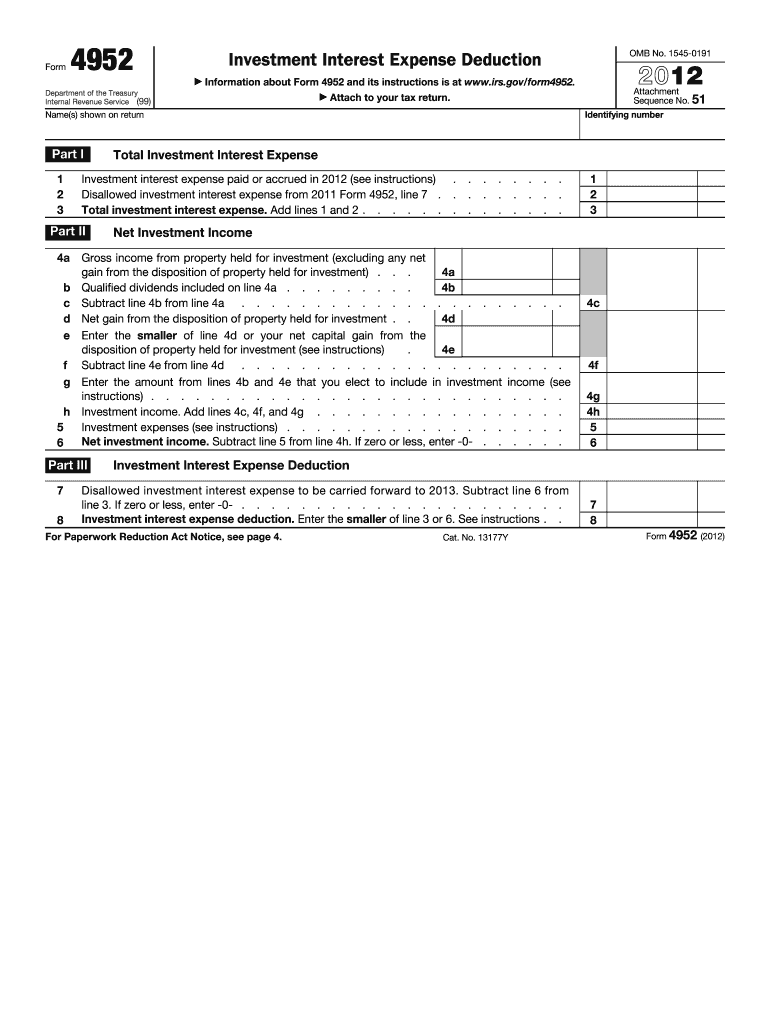

The Form 4952 is a tax form used by U.S. taxpayers to calculate the investment interest expense deduction. This deduction allows individuals to deduct interest paid on loans used to purchase investments, such as stocks or bonds. The form is submitted alongside the IRS Form 1040 during tax filing. Understanding this form is crucial for taxpayers who wish to maximize their deductions and minimize their taxable income.

How to use the Form 4952, Investment Interest Expense Deduction 1040 com

Using Form 4952 involves several steps. Taxpayers must first gather relevant information regarding their investment interest expenses, including the total amount of interest paid and the types of investments involved. The form guides users through calculating the allowable deduction based on the investment income. Proper completion ensures that taxpayers can claim the deduction accurately and avoid potential issues with the IRS.

Steps to complete the Form 4952, Investment Interest Expense Deduction 1040 com

Completing Form 4952 requires careful attention to detail. Here are the general steps:

- Gather all necessary documentation regarding investment interest expenses.

- Fill out the taxpayer information section accurately.

- Calculate the total investment interest expense and any carryover from previous years.

- Determine the amount of investment income to ensure the deduction does not exceed this limit.

- Complete the form by entering the calculated deduction amount.

Legal use of the Form 4952, Investment Interest Expense Deduction 1040 com

The legal use of Form 4952 is governed by IRS regulations. Taxpayers must ensure that all information provided is accurate and reflects their actual financial situation. Misrepresentation or errors can lead to penalties or audits. Using a reliable digital solution for completing and submitting the form can help ensure compliance with legal requirements, as these platforms often include features that enhance accuracy and security.

IRS Guidelines

The IRS provides specific guidelines for completing Form 4952. Taxpayers should refer to the IRS instructions for the form, which detail eligibility criteria, allowable expenses, and calculation methods. Staying informed about these guidelines helps taxpayers avoid common mistakes and ensures that they can effectively utilize the investment interest expense deduction.

Filing Deadlines / Important Dates

Filing deadlines for Form 4952 align with the general tax filing deadlines for Form 1040. Typically, taxpayers must submit their returns by April 15 unless an extension is filed. It is essential to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates ensures that taxpayers can take full advantage of available deductions.

Quick guide on how to complete form 4952 investment interest expense deduction 1040com

Easily Prepare Form 4952, Investment Interest Expense Deduction 1040 com on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can find the appropriate template and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 4952, Investment Interest Expense Deduction 1040 com on any platform with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to Edit and eSign Form 4952, Investment Interest Expense Deduction 1040 com Effortlessly

- Find Form 4952, Investment Interest Expense Deduction 1040 com and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that reason.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 4952, Investment Interest Expense Deduction 1040 com and ensure excellent communication during every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4952 investment interest expense deduction 1040com

Create this form in 5 minutes!

How to create an eSignature for the form 4952 investment interest expense deduction 1040com

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is Form 4952, Investment Interest Expense Deduction 1040 com?

Form 4952, Investment Interest Expense Deduction 1040 com, is a tax form used to calculate the amount of investment interest expense you can deduct on your tax return. This form helps taxpayers track the interest paid on debts that financed investments. Using airSlate SignNow, you can easily manage and eSign your Form 4952, ensuring a smooth filing process.

-

How much does it cost to use airSlate SignNow for filing Form 4952?

airSlate SignNow offers flexible pricing plans that cater to individual and business needs, making it a cost-effective choice for managing Form 4952, Investment Interest Expense Deduction 1040 com. Visit our pricing page to explore different options and choose the one that fits your requirements best.

-

What are the key features of airSlate SignNow for Form 4952 management?

airSlate SignNow features user-friendly document management tools, including eSigning, secure storage, and easy sharing options for Form 4952, Investment Interest Expense Deduction 1040 com. These features streamline the process of completing and submitting your tax forms, saving you time and effort.

-

Is airSlate SignNow secure for handling tax documents like Form 4952?

Yes, airSlate SignNow prioritizes your data security. When managing sensitive tax documents like Form 4952, Investment Interest Expense Deduction 1040 com, we utilize advanced encryption and security protocols to ensure that your information is always protected.

-

Can I integrate airSlate SignNow with other applications when handling Form 4952?

Absolutely! airSlate SignNow supports integration with a wide range of applications, enhancing your workflow when dealing with Form 4952, Investment Interest Expense Deduction 1040 com. This allows for seamless processing, tracking, and managing of your documents across different platforms.

-

How can airSlate SignNow benefit small businesses preparing Form 4952?

For small businesses preparing Form 4952, Investment Interest Expense Deduction 1040 com, airSlate SignNow offers a practical solution to streamline document handling and eSigning. This not only improves efficiency but also saves costs and reduces the risk of errors in tax filing.

-

Does airSlate SignNow offer customer support for Form 4952 queries?

Yes, airSlate SignNow provides comprehensive customer support for all users, including assistance with Form 4952, Investment Interest Expense Deduction 1040 com. Our support team is available to help you navigate any questions or issues you may encounter.

Get more for Form 4952, Investment Interest Expense Deduction 1040 com

- Pain assessment questionnaire form

- Sutter referral form

- Client intake 08142014 form

- Family practice new intake form

- Cancer rehabilitation new patient intake form

- Authorization for release of information and payment

- Superfund community involvement toolkit epa form

- Sobriety works prop 47 cafes project peer navigator form

Find out other Form 4952, Investment Interest Expense Deduction 1040 com

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple