Affiliated Business Arrangement Disclosure Wells Fargo Form 2009-2026

What is the Affiliated Business Arrangement Disclosure Wells Fargo Form

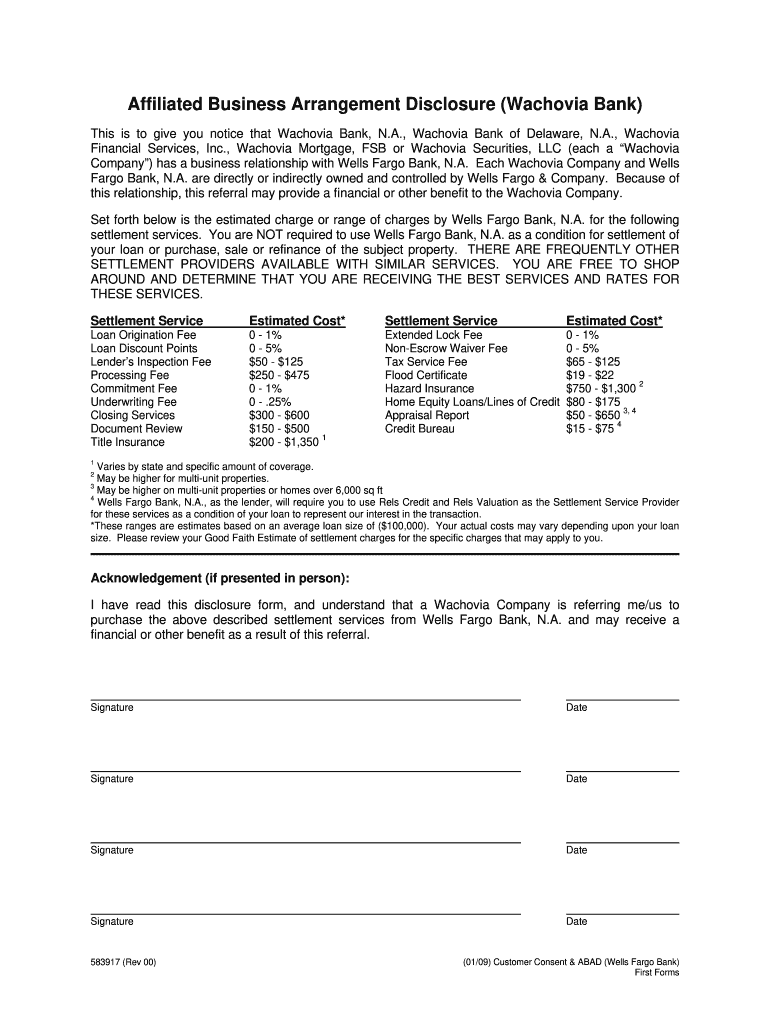

The Affiliated Business Arrangement Disclosure Wells Fargo Form is a crucial document that outlines the relationships between various parties involved in a business transaction. This form is designed to inform clients about any affiliations that may exist between the entities involved, ensuring transparency in the business dealings. It is particularly important in real estate transactions, where affiliated businesses may have financial interests in the services provided. By disclosing these relationships, Wells Fargo aims to maintain compliance with legal standards and protect consumers from potential conflicts of interest.

How to use the Affiliated Business Arrangement Disclosure Wells Fargo Form

Using the Affiliated Business Arrangement Disclosure Wells Fargo Form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant details about the parties involved in the transaction, including their affiliations. Next, fill out the form with precise information, ensuring that all sections are completed. Once the form is filled out, it should be reviewed for accuracy before being submitted. This process helps to ensure that all disclosures are made in accordance with regulatory requirements, fostering trust between the parties involved.

Steps to complete the Affiliated Business Arrangement Disclosure Wells Fargo Form

Completing the Affiliated Business Arrangement Disclosure Wells Fargo Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about all parties involved in the transaction.

- Identify any affiliations that may exist between the parties.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form as per the guidelines provided by Wells Fargo.

Key elements of the Affiliated Business Arrangement Disclosure Wells Fargo Form

The Affiliated Business Arrangement Disclosure Wells Fargo Form includes several key elements that are essential for compliance and clarity. These elements typically consist of:

- Identification of the parties involved in the transaction.

- Details of the affiliated business relationships.

- Disclosure of any potential conflicts of interest.

- Signatures from all parties acknowledging the disclosures made.

Legal use of the Affiliated Business Arrangement Disclosure Wells Fargo Form

The legal use of the Affiliated Business Arrangement Disclosure Wells Fargo Form is governed by various regulations that aim to protect consumers. This form must be completed and submitted in accordance with the Real Estate Settlement Procedures Act (RESPA) and other applicable laws. By using this form, businesses can ensure that they are meeting their legal obligations to disclose affiliations, thereby minimizing the risk of legal repercussions and fostering a transparent business environment.

Disclosure Requirements

Disclosure requirements for the Affiliated Business Arrangement Disclosure Wells Fargo Form are critical to ensure compliance with federal and state regulations. Businesses must disclose any relationships that could influence the transaction, including financial interests, ownership stakes, or any other affiliations that might affect the impartiality of the services provided. Failure to disclose these relationships can result in penalties and undermine the trust between the parties involved.

Quick guide on how to complete affiliated business arrangement disclosure wells fargo form

Prepare Affiliated Business Arrangement Disclosure Wells Fargo Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Affiliated Business Arrangement Disclosure Wells Fargo Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Affiliated Business Arrangement Disclosure Wells Fargo Form with ease

- Obtain Affiliated Business Arrangement Disclosure Wells Fargo Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Affiliated Business Arrangement Disclosure Wells Fargo Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affiliated business arrangement disclosure wells fargo form

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What are Wells Fargo business account disclosures?

Wells Fargo business account disclosures refer to the important information provided by Wells Fargo regarding the terms and conditions of their business accounts. These disclosures offer insights into fees, interest rates, and other account features that businesses should be aware of. Understanding these disclosures is crucial for making informed financial decisions as a business owner.

-

How can I access my Wells Fargo business account disclosures?

You can easily access your Wells Fargo business account disclosures through the Wells Fargo online banking portal or mobile app. Simply log in to your account, navigate to the 'Account Information' section, and look for the disclosures related to your specific business account. This ensures that you have the most up-to-date information regarding your account.

-

What features do Wells Fargo business accounts offer?

Wells Fargo business accounts come with a variety of features including online banking, mobile check deposit, and cash management solutions. These accounts are designed to help businesses manage their finances effectively and securely. Additional features may be detailed in the Wells Fargo business account disclosures, helping you choose the right account for your needs.

-

Are there any fees associated with Wells Fargo business accounts?

Yes, Wells Fargo business accounts may have various fees, such as monthly maintenance fees, transaction fees, and ATM fees. These fees are clearly outlined in the Wells Fargo business account disclosures, ensuring that you are aware of any costs associated with your account. Understanding these fees can help you manage your business banking more efficiently.

-

How do I report an issue with my Wells Fargo business account?

To report an issue with your Wells Fargo business account, you can contact customer service directly via the phone number on your account statement or visit a local branch. It's advisable to have relevant information, including your account details, handy. Your concerns may also be addressed during your review of the Wells Fargo business account disclosures.

-

What is the process for closing a Wells Fargo business account?

To close a Wells Fargo business account, you must ensure all outstanding transactions are cleared and funds are withdrawn. You can initiate the account closure by visiting your local branch or calling customer service. The specific process and any related fees are detailed in the Wells Fargo business account disclosures, providing necessary guidance.

-

Are Wells Fargo business accounts easily integrated with other financial tools?

Yes, Wells Fargo business accounts can be easily integrated with various financial management tools and software. This integration helps streamline your accounting processes and enhances your business's financial efficiency. You may find specific information regarding these integrations in the Wells Fargo business account disclosures.

Get more for Affiliated Business Arrangement Disclosure Wells Fargo Form

- Letter from landlord to tenant as notice of default on commercial lease alaska form

- Residential or rental lease extension agreement alaska form

- Commercial rental lease application questionnaire alaska form

- Apartment lease rental application questionnaire alaska form

- Residential rental lease application alaska form

- Salary verification form for potential lease alaska

- Landlord agreement to allow tenant alterations to premises alaska form

- Notice of default on residential lease alaska form

Find out other Affiliated Business Arrangement Disclosure Wells Fargo Form

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple