204 Payee 2012-2026

What is the 204 Payee

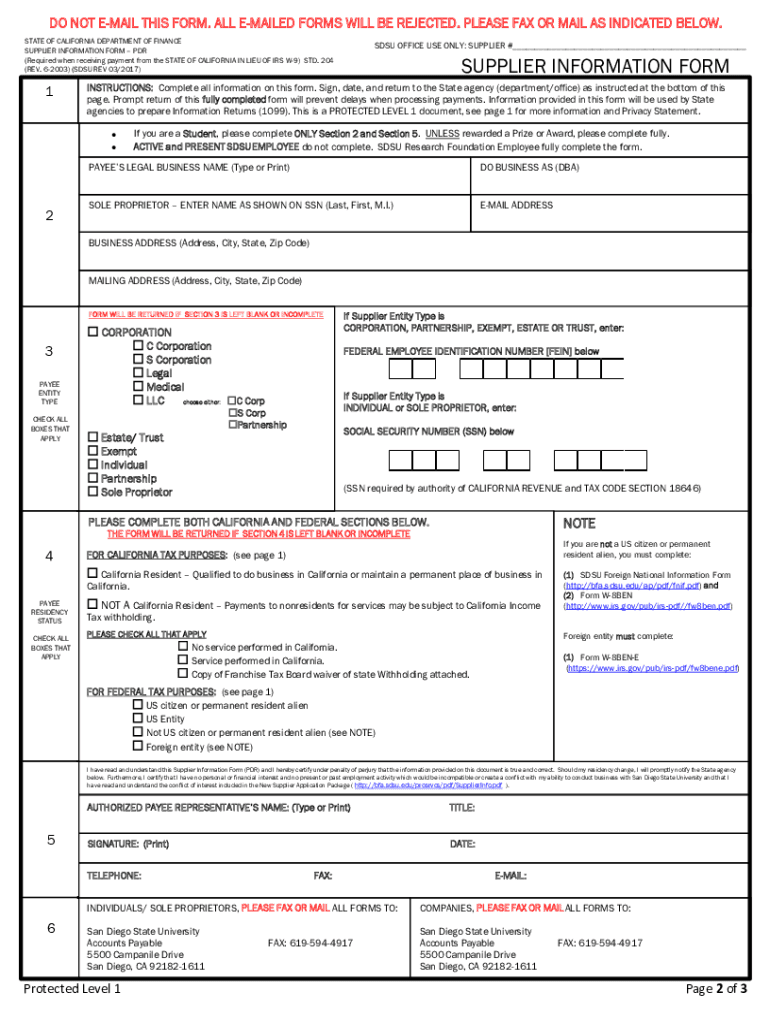

The 204 Payee, also known as the STD 204 form, is a crucial document used for reporting payee data in California. This form is primarily utilized by businesses to provide information about individuals or entities that receive payments. The data collected helps ensure compliance with state tax regulations and facilitates accurate reporting. Understanding the purpose and function of the 204 Payee is essential for businesses that engage in transactions requiring tax reporting.

Steps to Complete the 204 Payee

Completing the 204 Payee form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the payee, including their name, address, and taxpayer identification number. Next, fill out the form by entering the required details in the designated fields. It is important to double-check the information for any errors before submission. Finally, submit the completed form to the appropriate state agency, either online or by mail, depending on your preference and the agency's requirements.

Legal Use of the 204 Payee

The legal use of the 204 Payee form is governed by California state laws regarding tax reporting and compliance. Businesses must ensure that the information provided on the form is accurate and complete to avoid penalties. The form serves as a declaration of payments made to vendors or contractors, which is essential for tax purposes. By adhering to legal requirements when using the 204 Payee, businesses can maintain compliance and avoid potential legal issues.

Key Elements of the 204 Payee

Several key elements must be included when filling out the 204 Payee form. These elements typically consist of the payee's name, address, taxpayer identification number, and the type of payments received. Additionally, the form may require information about the nature of the business relationship between the payer and the payee. Ensuring that all relevant details are accurately captured is vital for the form's validity and for meeting reporting obligations.

Form Submission Methods

The 204 Payee form can be submitted through various methods, allowing for flexibility based on business needs. Businesses may choose to submit the form online via the California state tax website, which often provides a streamlined process. Alternatively, the form can be mailed directly to the appropriate state agency. In-person submissions may also be possible, depending on local regulations. Understanding these submission methods can help ensure timely and efficient processing of the form.

Examples of Using the 204 Payee

There are several scenarios in which the 204 Payee form is utilized. For instance, a business hiring a contractor for a project may need to complete the form to report payments made to that contractor. Similarly, companies that engage freelance workers or vendors must use the 204 Payee to document these transactions for tax purposes. By recognizing these examples, businesses can better understand when and why to utilize the 204 Payee form.

Quick guide on how to complete payee data record std 204 fillable form

Manage 204 Payee everywhere, at any moment

Your routine business operations may require extra attention when managing state-specific business documents. Reclaim your working hours and reduce the paper-related expenses tied to document-based procedures with airSlate SignNow. airSlate SignNow provides you with a wide range of pre-crafted business documents, including 204 Payee, which you can utilize and distribute to your business associates. Manage your 204 Payee effortlessly with powerful editing and eSignature features and send it directly to your recipients.

How to obtain 204 Payee in just a few clicks:

- Select a document relevant to your state.

- Hit Learn More to examine the file and verify it is suitable.

- Choose Get Form to start working on it.

- 204 Payee will automatically appear in the editor. No additional steps are required.

- Utilize airSlate SignNow’s sophisticated editing features to complete or modify the document.

- Select the Sign feature to create your signature and electronically sign your document.

- When you’re ready, click Done, save the changes, and access your document.

- Share the form via email or SMS, or use a link-to-fill option with your partners, or allow them to download the document.

airSlate SignNow signNowly saves your time handling 204 Payee and empowers you to find essential documents in one location. An extensive collection of forms is organized and crafted to encompass crucial organizational operations necessary for your business. The advanced editor reduces the likelihood of errors, as you can swiftly amend mistakes and review your documents on any device prior to submission. Start your free trial today to explore all the benefits of airSlate SignNow for your everyday business workflows.

Create this form in 5 minutes or less

FAQs

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

What’s the title of a person who can take a complex Excel spreadsheet and turn it into a user friendly, intuitive form that’s easy to fill out? How can I hire someone with those skills? It contains , financial, quoting & engineering data.

Look for an SaaS developer, someone with JavaScript, PHP, and MySQL skills to create Cloud-hosted browser-based forms and reports who also has a modicum of financial analysis background.Dumping obsolete Excel client server architecture as soon as you can will be the best thing you can do to bring your operation into the 21st Century.

Create this form in 5 minutes!

How to create an eSignature for the payee data record std 204 fillable form

How to create an eSignature for the Payee Data Record Std 204 Fillable Form in the online mode

How to create an electronic signature for the Payee Data Record Std 204 Fillable Form in Google Chrome

How to generate an eSignature for signing the Payee Data Record Std 204 Fillable Form in Gmail

How to make an eSignature for the Payee Data Record Std 204 Fillable Form right from your mobile device

How to create an eSignature for the Payee Data Record Std 204 Fillable Form on iOS

How to make an eSignature for the Payee Data Record Std 204 Fillable Form on Android OS

People also ask

-

What is a 204 Payee in the context of airSlate SignNow?

A 204 Payee refers to an entity or individual designated to receive payments for services rendered, which can be efficiently managed using airSlate SignNow. Our platform allows you to create, send, and eSign documents related to 204 Payee transactions securely and quickly.

-

How does airSlate SignNow support 204 Payee transactions?

airSlate SignNow provides a streamlined process for handling 204 Payee agreements, allowing you to create templates specifically designed for these transactions. With our eSigning feature, you can ensure that all necessary parties can approve and sign documents promptly, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow for 204 Payee agreements?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those managing 204 Payee agreements. Depending on your volume of transactions and required features, you can choose from our basic to advanced plans, all designed to provide cost-effective solutions.

-

Can I integrate airSlate SignNow with other software for managing 204 Payee contracts?

Yes, airSlate SignNow seamlessly integrates with various software tools, making it easy to manage 204 Payee contracts alongside your existing systems. Whether you use CRM, accounting, or project management tools, our integrations enhance the efficiency of your workflow.

-

What features does airSlate SignNow offer for managing 204 Payee documents?

airSlate SignNow includes a variety of features tailored for 204 Payee document management, such as customizable templates, automated workflows, and secure cloud storage. These features help streamline the signing process, ensuring you can handle documents quickly and securely.

-

How secure is airSlate SignNow for handling sensitive 204 Payee information?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to protect sensitive 204 Payee information, ensuring that your documents are safe and confidential throughout the signing process.

-

Is it easy to send documents for eSignature related to a 204 Payee using airSlate SignNow?

Absolutely! Sending documents for eSignature related to a 204 Payee using airSlate SignNow is straightforward. Our user-friendly interface allows you to upload documents, add signers, and send them out for signatures in just a few clicks.

Get more for 204 Payee

Find out other 204 Payee

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form