Form 945 2015

What is the Form 945

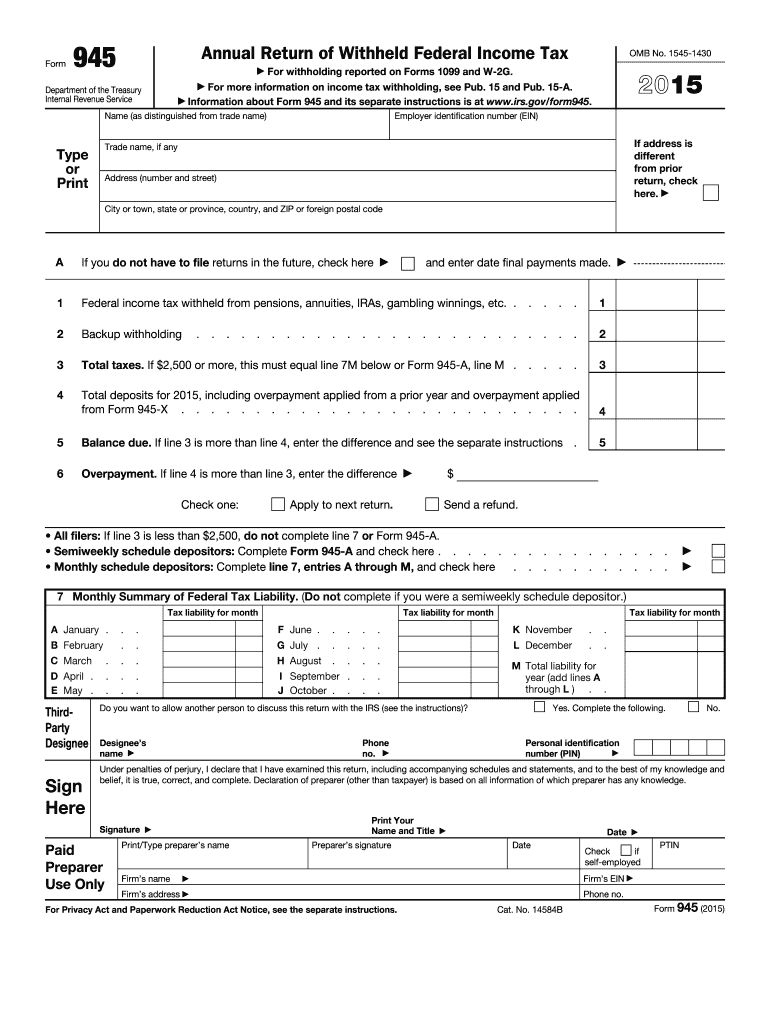

The Form 945 is a tax form used by businesses to report and pay withheld federal income tax from nonpayroll payments. This includes payments made to independent contractors, dividends, and other types of income. The form is essential for ensuring compliance with federal tax regulations, as it allows the Internal Revenue Service (IRS) to track the tax liabilities of businesses. Understanding the purpose and requirements of Form 945 is crucial for any business entity that engages in nonpayroll transactions.

How to use the Form 945

Using Form 945 involves several key steps to ensure accurate reporting and compliance. First, gather all necessary information regarding the payments made during the tax year. This includes the total amount of nonpayroll payments and the corresponding federal income tax withheld. Next, complete the form by providing the required details, including your business name, Employer Identification Number (EIN), and the amounts withheld. Once the form is filled out, it must be submitted to the IRS according to the established deadlines to avoid penalties.

Steps to complete the Form 945

Completing Form 945 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial records related to nonpayroll payments.

- Enter your business information, including name and EIN, in the designated sections.

- Report the total amount of nonpayroll payments made during the year.

- Calculate the federal income tax withheld from these payments and enter the amount on the form.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 945

The legal use of Form 945 is governed by IRS regulations, which outline the requirements for reporting withheld taxes accurately. Businesses must ensure that they correctly withhold the appropriate amount of federal income tax from nonpayroll payments and report this information using the form. Failure to comply with these regulations can result in penalties and interest charges. It is essential to maintain accurate records and file the form on time to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for Form 945 are critical for compliance. The form must be submitted annually, with the due date typically falling on January thirty-first of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, if you are required to make deposits of withheld taxes, ensure that these are made according to the IRS schedule to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 945 can be submitted through various methods, depending on your preference and the requirements of the IRS. Businesses have the option to file the form electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on your location. In-person submissions are generally not available for this form, making electronic filing or mailing the primary options for compliance.

Quick guide on how to complete 2015 form 945

Effortlessly Prepare Form 945 on Any Device

Managing documents online has surged in popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it in the cloud. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Manage Form 945 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and Electronically Sign Form 945 with Ease

- Find Form 945 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 945 to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 945

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 945

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is Form 945 and how is it used in business?

Form 945 is a tax form used by businesses to report withheld federal income tax from nonpayroll payments. It helps employers ensure compliance with IRS regulations. By using airSlate SignNow, businesses can easily eSign and submit Form 945 digitally, simplifying the filing process.

-

How can airSlate SignNow assist with the completion of Form 945?

airSlate SignNow provides a user-friendly platform that allows businesses to fill out and eSign Form 945 online. It includes templates and tools to streamline the documentation process, ensuring that all necessary information is accurately captured and submitted in a timely manner.

-

What are the pricing options for using airSlate SignNow for Form 945?

airSlate SignNow offers various affordable pricing plans to cater to different business needs. Whether you're a small business or a large corporation, you can choose a plan that fits your budget while providing the necessary features to handle Form 945 efficiently.

-

Are there any specific features in airSlate SignNow that specifically aid with Form 945?

Yes, airSlate SignNow includes features such as customizable templates for Form 945, secure storage, and easy sharing options. The platform also allows teams to collaborate on the document in real-time, ensuring accuracy and compliance with IRS requirements.

-

How does airSlate SignNow improve the efficiency of filing Form 945?

By using airSlate SignNow, businesses can signNowly reduce the time spent on preparing and filing Form 945. The platform automates many parts of the document workflow, minimizing errors and ensuring faster turnaround times for necessary approvals and signatures.

-

Is it easy to integrate airSlate SignNow with other software when handling Form 945?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, making it easy to manage Form 945 alongside your existing processes. Whether it's accounting software or CRM tools, integration helps optimize your workflow.

-

What benefits can I expect from using airSlate SignNow for Form 945?

Using airSlate SignNow for Form 945 provides numerous benefits including enhanced compliance, faster processing times, and improved document security. The platform is designed to empower businesses to manage their eSignature and document workflow efficiently.

Get more for Form 945

- Big coulee district assistance application swo nsn form

- Puerto rico application for authority renewal form

- Fire exit drill form texas department of insurance texasgov

- Travel authorization and expense report scsk12 form

- Craft fair vendor application 2018 1 1 form

- Business credit card application bank of utah form

- Wxhs orchestra concert report form davis school district

- Page 1 of 2 condensed position description form

Find out other Form 945

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF