W 2g Form 2014

What is the W-2G Form

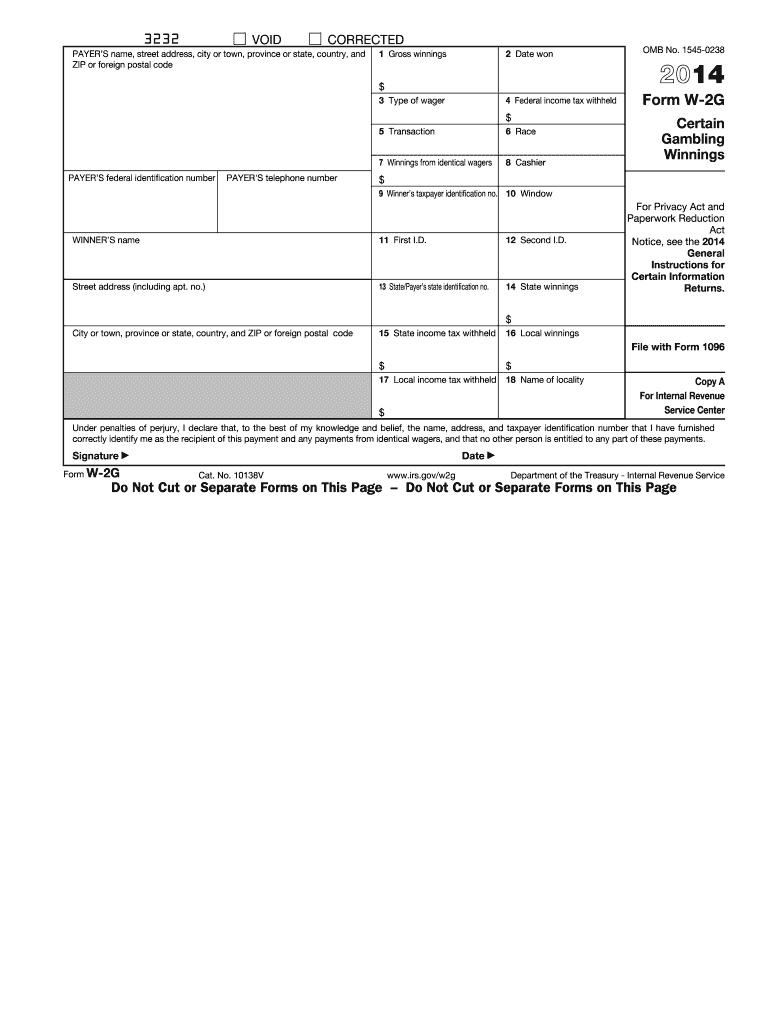

The W-2G Form, officially known as the "Certain Gambling Winnings" form, is a tax document used in the United States to report gambling winnings to the Internal Revenue Service (IRS). This form is typically issued by casinos, racetracks, or other gambling establishments when a player wins a certain amount, which is defined by IRS regulations. The W-2G Form includes details such as the amount won, the type of gambling, and the federal income tax withheld, if any. It is essential for individuals who have received significant gambling winnings to accurately report this income on their tax returns.

How to use the W-2G Form

Using the W-2G Form involves a few straightforward steps. First, ensure that you receive the form from the gambling establishment after your winnings meet the reporting threshold. Next, review the information on the form for accuracy, including your name, Social Security number, and the amount won. When filing your tax return, include the W-2G Form as part of your income documentation. It is crucial to report the winnings as income on your tax return, even if you do not receive a W-2G Form. Keep a copy of the form for your records, as it may be needed for future reference or audits.

Steps to complete the W-2G Form

Completing the W-2G Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the gambling establishment or download it from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the total amount of gambling winnings in the appropriate box on the form.

- If applicable, enter the amount of federal income tax withheld.

- Review the completed form for any errors before submission.

Legal use of the W-2G Form

The W-2G Form has legal significance as it serves as an official record of gambling winnings. According to IRS guidelines, individuals must report all gambling winnings, regardless of whether they receive a W-2G Form. Failure to report this income can lead to penalties and interest on unpaid taxes. The form also provides a basis for claiming losses on your tax return, as you can offset winnings with losses, provided you keep accurate records of your gambling activities.

Filing Deadlines / Important Dates

Filing deadlines for the W-2G Form align with the general tax filing deadlines in the United States. Typically, the form must be submitted along with your annual tax return by April fifteenth of the following year. If you receive a W-2G Form, it is advisable to file your taxes promptly to avoid late fees or penalties. Additionally, the gambling establishment must send out W-2G Forms to recipients by January thirty-first of the year following the winnings.

Who Issues the Form

The W-2G Form is issued by gambling establishments, including casinos, racetracks, and lottery organizations. These entities are required to provide the form to individuals who win amounts that exceed the IRS reporting thresholds. It is important to note that not all gambling winnings will result in a W-2G Form; only those that meet specific criteria, such as a jackpot or substantial payout, will trigger its issuance.

Quick guide on how to complete 2014 w 2g form

Effortlessly Prepare W 2g Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage W 2g Form on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and Electronically Sign W 2g Form with Ease

- Obtain W 2g Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign W 2g Form and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 w 2g form

Create this form in 5 minutes!

How to create an eSignature for the 2014 w 2g form

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is a W 2g Form and why is it important?

The W 2g Form is a tax document used to report winnings from gambling activities. It is important because it helps ensure accurate tax reporting and compliance with IRS regulations. By utilizing the W 2g Form, individuals can properly report their gambling income and any associated withholdings.

-

How does airSlate SignNow make handling the W 2g Form easier?

airSlate SignNow simplifies the process of managing the W 2g Form by allowing you to easily upload, send, and eSign the document digitally. This streamlines the workflow, making it faster and more efficient for both individuals and businesses. The platform also ensures that all electronic signatures are legally binding.

-

Is there a cost to use airSlate SignNow for the W 2g Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for handling documents like the W 2g Form efficiently. Additionally, you can start with a free trial to explore the service before committing to a payment plan.

-

Can I integrate airSlate SignNow with other software for the W 2g Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enabling you to manage your documents including the W 2g Form within your existing workflow. This integrations enhance productivity by allowing you to connect with systems you already use, like CRMs and accounting software.

-

What security measures does airSlate SignNow implement for the W 2g Form?

airSlate SignNow takes document security seriously and employs multiple security measures for documents like the W 2g Form. These include data encryption, secure access controls, and compliance with industry regulations to protect sensitive information. This ensures that your documents remain safe during the signing process.

-

How quickly can I get my W 2g Form signed using airSlate SignNow?

Using airSlate SignNow, the time to get your W 2g Form signed can be reduced signNowly. The platform allows for instant sending and receiving of documents, enabling you to get your forms signed within minutes rather than days. Notifications and reminders ensure that all parties stay informed and prompt.

-

Are there mobile capabilities for managing the W 2g Form with airSlate SignNow?

Yes, airSlate SignNow provides mobile functionalities that allow you to manage your W 2g Form from anywhere. You can easily send, sign, and track documents using the mobile app, offering flexibility for users on the go. This convenience ensures that you can handle your documents efficiently, regardless of your location.

Get more for W 2g Form

- Hqp slf 066 form 2020

- Msvs pag ibig form

- Issuing partner bank form

- Board for contractors dpor virginiagov form

- Inz 1017 visitor visa application ctripinz 1017 visitor visa application ctripvisa application how to apply indian visaindia form

- Application for certification in industrial radiography form

- Examinations forms california department of real estate

- Ppp loan application 2021 la mano nera form

Find out other W 2g Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document