Form 1120 C 2015

What is the Form 1120 C

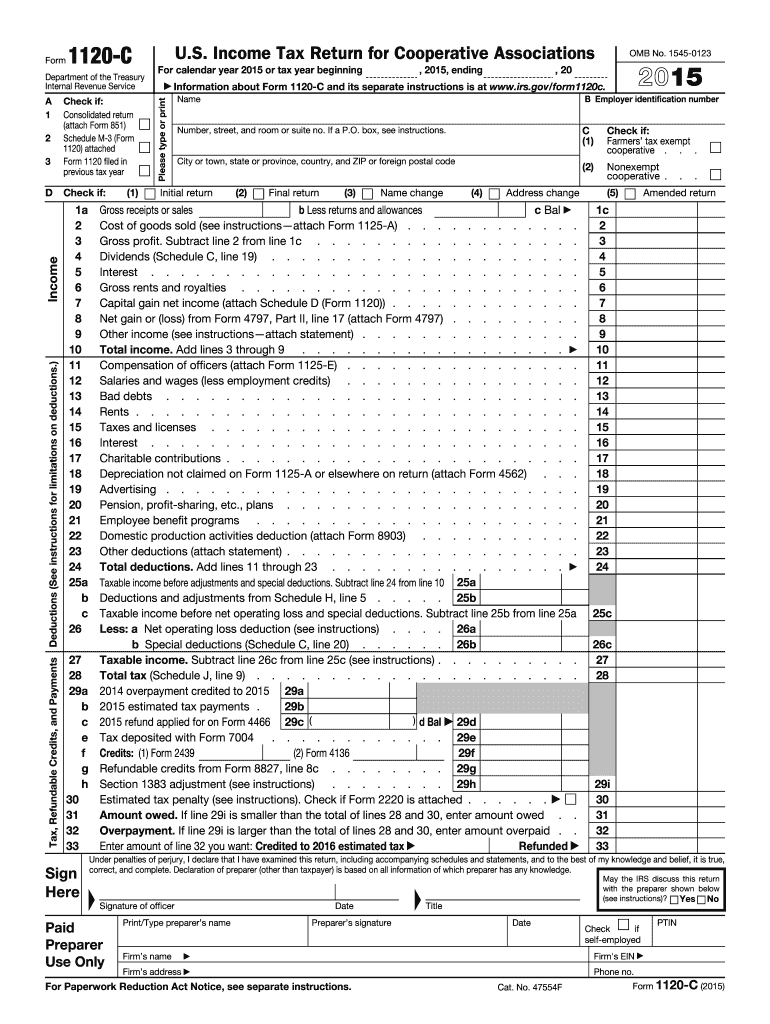

The Form 1120 C is a tax return specifically designed for certain corporations that are classified as a "C Corporation" under the Internal Revenue Code. This form is used to report income, gains, losses, deductions, and credits, as well as to calculate the corporation's tax liability. Unlike other business structures, C Corporations are taxed separately from their owners, which can lead to a different tax treatment. Understanding the Form 1120 C is essential for compliance and accurate reporting of corporate finances.

How to use the Form 1120 C

Using the Form 1120 C involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, fill out the form accurately, detailing all income, deductions, and credits. It is crucial to follow the instructions provided by the IRS to avoid errors. Once completed, the form must be filed with the IRS by the designated deadline, typically the 15th day of the fourth month after the end of the corporation's tax year.

Steps to complete the Form 1120 C

Completing the Form 1120 C requires careful attention to detail. Start by entering the corporation's name, address, and Employer Identification Number (EIN) at the top of the form. Next, report total income on line one, including gross receipts and other income sources. Follow this by detailing deductions, which may include operating expenses, salaries, and cost of goods sold. After calculating taxable income, apply any available credits. Finally, sign and date the form before submission to ensure it is valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 C are critical for compliance. Generally, the form must be filed by the 15th day of the fourth month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If additional time is needed, a six-month extension can be requested using Form 7004. However, it is important to note that this extension only applies to filing the form, not to the payment of any taxes owed.

Legal use of the Form 1120 C

The legal use of the Form 1120 C is governed by IRS regulations. This form must be completed accurately and submitted on time to avoid penalties. Properly filing the Form 1120 C ensures that the corporation is compliant with federal tax laws and can help avoid audits or legal issues. Additionally, maintaining accurate records and documentation related to the information reported on the form is essential for legal protection and transparency.

Key elements of the Form 1120 C

Key elements of the Form 1120 C include sections for reporting income, deductions, and tax credits. The form requires detailed information about the corporation's financial activities, including gross receipts, cost of goods sold, and operating expenses. It also includes sections for calculating the corporation's tax liability and any applicable credits. Understanding these elements is crucial for accurate reporting and compliance with tax obligations.

Quick guide on how to complete 2015 form 1120 c

Complete Form 1120 C effortlessly on any device

Managing online documents has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Handle Form 1120 C on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Form 1120 C effortlessly

- Obtain Form 1120 C and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant portions of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you choose. Adjust and eSign Form 1120 C and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1120 c

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1120 c

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1120 C?

Form 1120 C is the corporate tax return filed by C corporations in the United States. It’s used to report income, gains, losses, deductions, and credits. Businesses that classify as C corporations must file this form annually to comply with IRS requirements.

-

How can airSlate SignNow assist with Form 1120 C?

airSlate SignNow provides an efficient eSigning solution to facilitate the completion and submission of Form 1120 C. Users can easily send the form for electronic signatures, ensuring secure and prompt processing. This not only saves time but also reduces the chances of errors in filing.

-

What features does airSlate SignNow offer for Form 1120 C processing?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage. These tools help streamline the workflow for Form 1120 C, allowing users to manage document approvals efficiently. Additionally, integration options with various business tools enhance functionality.

-

Is airSlate SignNow cost-effective for managing Form 1120 C?

Yes, airSlate SignNow is designed to be a budget-friendly option for businesses needing to handle Form 1120 C and other documents. With competitive pricing plans, companies can enjoy unlimited eSigning and document management features without breaking the bank. This ensures businesses can manage their compliance needs affordably.

-

Can airSlate SignNow integrate with accounting software for Form 1120 C?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, making it easier to manage Form 1120 C. This allows users to directly pull in necessary data and ensure accuracy when preparing documents. Integration simplifies the process of maintaining tax records.

-

What are the benefits of eSigning Form 1120 C with airSlate SignNow?

eSigning Form 1120 C with airSlate SignNow brings several benefits, such as enhanced security and fast turnaround times. The platform ensures that all signatures are legally binding and can be tracked in real-time. Additionally, this method reduces paperwork and promotes a more sustainable practice.

-

How secure is airSlate SignNow for filing Form 1120 C?

airSlate SignNow prioritizes security, implementing advanced encryption protocols to protect documents like the Form 1120 C. Users can have peace of mind knowing their sensitive information is secure during transmission and storage. Regular security audits further ensure compliance with industry standards.

Get more for Form 1120 C

- 2000 form ph bir 1902 fill online printable fillable blank

- 2551q bir formtaxation in the united statesincome tax

- Identity theft victims packet chandler police department form

- Illinois uniform partnership act statement of dissolution

- Never received regular certificate of title form

- Telephone 804 786 2787 fax 804 367 1003 form

- Opting to tax land and buildings form

- Oversize and or over mass form

Find out other Form 1120 C

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online