Credit for Federal Tax Paid on Fuels IRS Gov 2012

What is the Credit For Federal Tax Paid On Fuels IRS gov

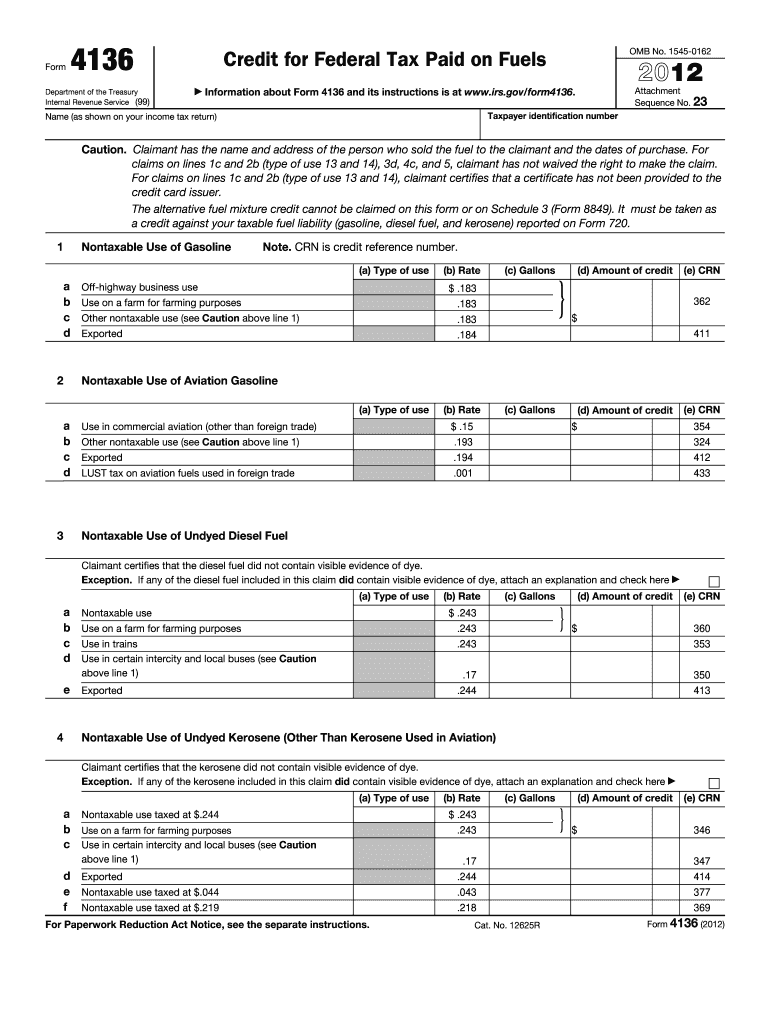

The Credit For Federal Tax Paid On Fuels is a tax credit available to certain taxpayers who pay federal excise taxes on fuels used in various applications. This credit is designed to help offset the costs associated with fuel taxes for businesses and individuals who utilize fuel for specific purposes, such as farming, commercial fishing, or other qualified activities. The IRS provides guidelines on eligibility and the types of fuels that qualify for this credit, making it essential for taxpayers to understand the specifics to benefit fully.

How to use the Credit For Federal Tax Paid On Fuels IRS gov

To utilize the Credit For Federal Tax Paid On Fuels, taxpayers must first determine their eligibility based on the type of fuel used and the purpose for which it is consumed. Eligible taxpayers can claim the credit by completing the appropriate IRS form, typically Form 8849, which is used for claiming refunds of excise taxes. It is important to accurately report the amount of fuel purchased and the federal excise tax paid to ensure the correct credit is applied.

Steps to complete the Credit For Federal Tax Paid On Fuels IRS gov

Completing the Credit For Federal Tax Paid On Fuels involves several key steps:

- Gather documentation of fuel purchases and federal excise taxes paid.

- Determine eligibility based on the type of fuel and its use.

- Complete Form 8849, providing accurate information regarding fuel usage and tax amounts.

- Submit the completed form to the IRS, either electronically or via mail, depending on your preference.

- Keep copies of all submitted documents for your records.

Eligibility Criteria

Eligibility for the Credit For Federal Tax Paid On Fuels is based on several factors, including the type of fuel used and the specific activities for which it is consumed. Generally, taxpayers must demonstrate that the fuel was used in a qualifying manner, such as for farming, commercial fishing, or certain off-highway uses. Additionally, the taxpayer must have paid federal excise taxes on the fuel to qualify for the credit.

Required Documents

To successfully claim the Credit For Federal Tax Paid On Fuels, taxpayers need to gather and submit various documents, including:

- Receipts or invoices for fuel purchases.

- Records of federal excise taxes paid on the fuel.

- Completed Form 8849 with accurate information.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines for claiming the Credit For Federal Tax Paid On Fuels. Generally, claims must be filed within three years from the date the tax was paid. It is advisable to check the IRS website or consult a tax professional for specific deadlines related to the current tax year, as these dates may vary.

Quick guide on how to complete credit for federal tax paid on fuels irsgov

Complete Credit For Federal Tax Paid On Fuels IRS gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Credit For Federal Tax Paid On Fuels IRS gov on any platform using airSlate SignNow's Android or iOS apps and enhance any document-oriented process today.

The best way to modify and eSign Credit For Federal Tax Paid On Fuels IRS gov with ease

- Locate Credit For Federal Tax Paid On Fuels IRS gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Focus on relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Credit For Federal Tax Paid On Fuels IRS gov and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit for federal tax paid on fuels irsgov

Create this form in 5 minutes!

How to create an eSignature for the credit for federal tax paid on fuels irsgov

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the 'Credit For Federal Tax Paid On Fuels IRS gov.'?

The 'Credit For Federal Tax Paid On Fuels IRS gov.' allows taxpayers to receive a credit for certain federal taxes paid on fuels used for business purposes. Understanding this credit can signNowly reduce your taxable income, ultimately saving you money for reinvestment in your business. It’s important to familiarize yourself with the eligibility criteria and documentation requirements to take full advantage of this credit.

-

How can airSlate SignNow help with claiming the Credit For Federal Tax Paid On Fuels IRS gov.?

airSlate SignNow streamlines the process of preparing and submitting documents needed to claim the Credit For Federal Tax Paid On Fuels IRS gov. Our intuitive eSigning platform ensures that all necessary forms are easily filled out and shared securely, allowing you to focus on what matters most—your business. Additionally, our system keeps your documents organized and accessible for any future audits or inquiries.

-

Are there any costs associated with using airSlate SignNow for my tax credits?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs, ensuring you can access the tools necessary for claiming tax credits like the Credit For Federal Tax Paid On Fuels IRS gov. While there is a subscription fee, many users find that the time saved and the potential tax credits gained far outweigh the investment. Consider our free trial to evaluate how it can benefit you.

-

What features does airSlate SignNow provide for tax documentation?

airSlate SignNow offers several features designed to assist with tax documentation, including customizable templates, automated workflows, and secure electronic signatures. These features simplify the process of preparing documents related to the Credit For Federal Tax Paid On Fuels IRS gov., ensuring compliance and accuracy. Our user-friendly interface makes it easy for anyone to utilize these tools effectively.

-

What are the benefits of using airSlate SignNow for federal tax documentation?

By using airSlate SignNow for your federal tax documentation, you can save both time and resources while increasing the accuracy of your submissions. This is particularly advantageous when dealing with credits like the Credit For Federal Tax Paid On Fuels IRS gov., which require precise documentation. Our platform enhances collaboration among team members, ensuring that everyone involved in tax preparation is on the same page.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software applications, making it easier to manage your documents related to the Credit For Federal Tax Paid On Fuels IRS gov. This integration helps centralize your data and enhances your workflow efficiency, allowing you to maintain organized records without switching between multiple platforms.

-

What type of customer support does airSlate SignNow offer?

airSlate SignNow provides comprehensive customer support that is available via email, chat, and phone. Our dedicated support team can assist you with any questions or challenges you may encounter while preparing your documentation for credits like the Credit For Federal Tax Paid On Fuels IRS gov. We also offer a rich library of resources and tutorials to help you maximize our platform's capabilities.

Get more for Credit For Federal Tax Paid On Fuels IRS gov

- Application m 22 rev form

- Illinois enhanced skills driving school application for main license form

- E 45 rev form

- Psiexams contact psi online one stop solution for test takers form

- Service contract provider registration application licensing form

- Ecif pag ibig form

- Pdf alaska department of commerce community and economic form

- Dr 2469 082417 form

Find out other Credit For Federal Tax Paid On Fuels IRS gov

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy