Form 1042 T Annual Summary and Transmittal of Forms 1042 S Irs 2011

What is the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs

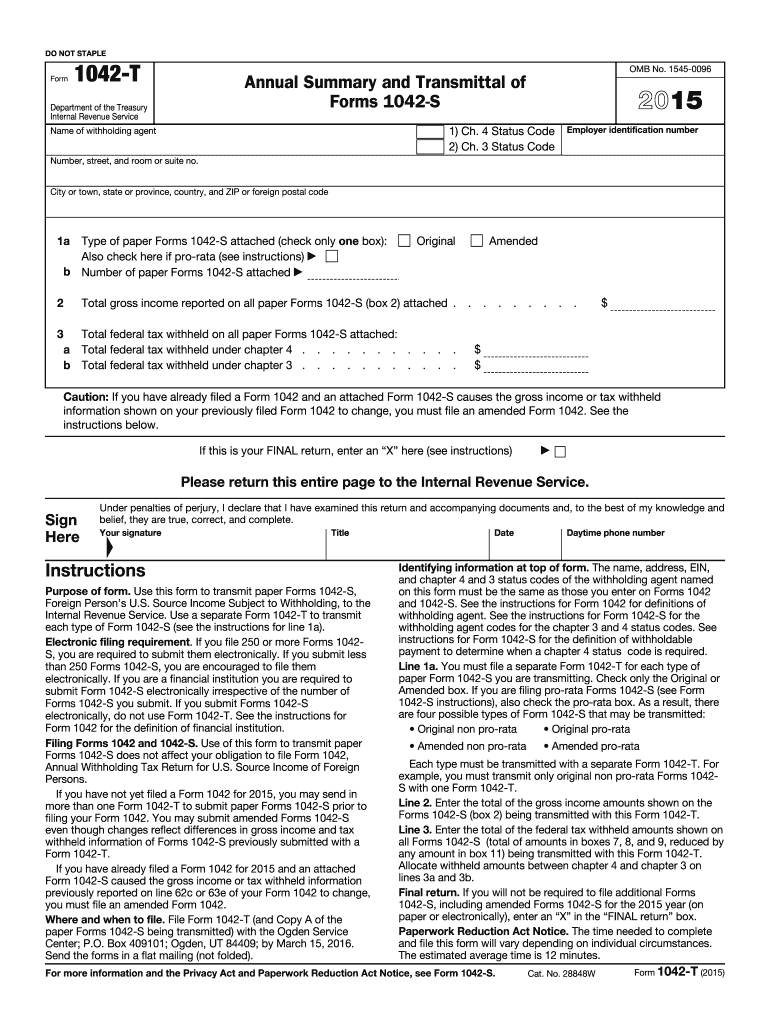

The Form 1042 T Annual Summary and Transmittal of Forms 1042 S is a crucial document used by withholding agents to report income paid to foreign persons. This form summarizes the information contained in the individual Forms 1042 S, which detail the amounts withheld and paid to non-resident aliens and foreign entities. It is essential for compliance with U.S. tax laws and ensures that the IRS receives accurate information regarding the withholding of taxes on payments made to foreign recipients. Understanding this form is vital for any business or individual involved in international transactions.

Steps to Complete the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs

Completing the Form 1042 T involves several key steps:

- Gather all relevant Forms 1042 S that report income paid to foreign persons.

- Ensure that each Form 1042 S is accurately filled out, including the recipient's information and amounts withheld.

- Fill in the Form 1042 T by providing the total number of Forms 1042 S attached and the total amount of income reported.

- Include the withholding agent's information, including name, address, and Employer Identification Number (EIN).

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to adhere to specific deadlines when filing Form 1042 T. Generally, the form must be filed with the IRS by March 15 of the year following the tax year in which the income was paid. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, copies of the Forms 1042 S must be provided to recipients by the same date to ensure compliance and avoid penalties.

Legal Use of the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs

The legal use of Form 1042 T is governed by U.S. tax regulations that require withholding agents to report payments made to foreign persons accurately. This form serves as a declaration of compliance with IRS regulations, ensuring that appropriate taxes have been withheld. Failure to file this form or inaccuracies in the information reported can lead to penalties, including fines and increased scrutiny from the IRS. Therefore, it is essential to understand the legal implications of this form and ensure its proper completion and timely submission.

Required Documents

To successfully complete and file Form 1042 T, the following documents are typically required:

- Completed Forms 1042 S for each foreign recipient.

- The withholding agent's Employer Identification Number (EIN).

- Documentation supporting the amounts withheld and paid, such as payment records and contracts.

- Any additional information that may be necessary to substantiate the claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

Form 1042 T can be submitted to the IRS through various methods. The preferred method is electronic filing, which can be done using IRS-approved software. This method is efficient and helps ensure accuracy. Alternatively, the form can be mailed to the appropriate IRS address based on the location of the withholding agent. In-person submission is generally not available for this form, as it is primarily processed through mail or electronically. It is important to choose the method that best suits your needs while ensuring compliance with IRS submission guidelines.

Quick guide on how to complete 2014 form 1042 t annual summary and transmittal of forms 1042 s irs

Complete Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find and securely store the necessary forms online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any delays. Manage Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and eSign Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs effortlessly

- Find Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or stored files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from a device of your preference. Modify and eSign Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs to ensure outstanding communication throughout your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1042 t annual summary and transmittal of forms 1042 s irs

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1042 t annual summary and transmittal of forms 1042 s irs

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs?

The Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs is a document required by the IRS for reporting income paid to foreign persons. It summarizes all Forms 1042-S that were issued during the tax year. Ensuring accurate completion of this form is crucial for compliance and preventing potential penalties.

-

How can airSlate SignNow help with the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs?

airSlate SignNow provides a seamless process for eSigning and sending the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs. With our user-friendly interface, businesses can easily collect signatures and manage document workflows efficiently, ensuring timely submission to the IRS.

-

What are the pricing options for using airSlate SignNow for the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Each plan includes features to streamline the completion of the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs, including unlimited templates, automated reminders, and integrations with other software, making it a cost-effective solution.

-

Are there specific features in airSlate SignNow for managing Forms 1042 S and the associated Form 1042 T?

Yes, airSlate SignNow provides specific features that cater to the management of Forms 1042 S and the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs. Users can track document progress, set custom workflows, and receive timely notifications, ensuring that all forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software to streamline the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs process?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including accounting platforms and CRMs. This allows you to streamline the process of managing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs, making data entry and document tracking more efficient.

-

How does airSlate SignNow ensure the security of my Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs documents?

Security is a priority at airSlate SignNow. All documents, including the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs, are protected with advanced encryption and secure cloud storage. We ensure that your sensitive information remains confidential and secure throughout the signing process.

-

What if I encounter issues while completing the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs?

Should you encounter any issues while working on the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs, our customer support team is available to assist you. You can signNow out for help via multiple channels, including email and live chat, ensuring you receive prompt assistance when needed.

Get more for Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs

- Warranty deed to separate property of one spouse to both as joint tenants florida form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries florida form

- Warranty deed from limited partnership or llc is the grantor or grantee florida form

- Florida warranty deed 497303458 form

- Warranty deed for three individuals to one individual with retained life estates in two grantors florida form

- Warranty deed from individuals or husband and wife to two 2 individuals as joint tenants with the right of survivorship florida form

- Florida joint tenants form

- Florida warranty deed 497303462 form

Find out other Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online