Fill Ioannual Summary and Transmittal of FormsFillable Annual Summary and Transmittal of Forms 1042 S 2022

Understanding Form 1042-T

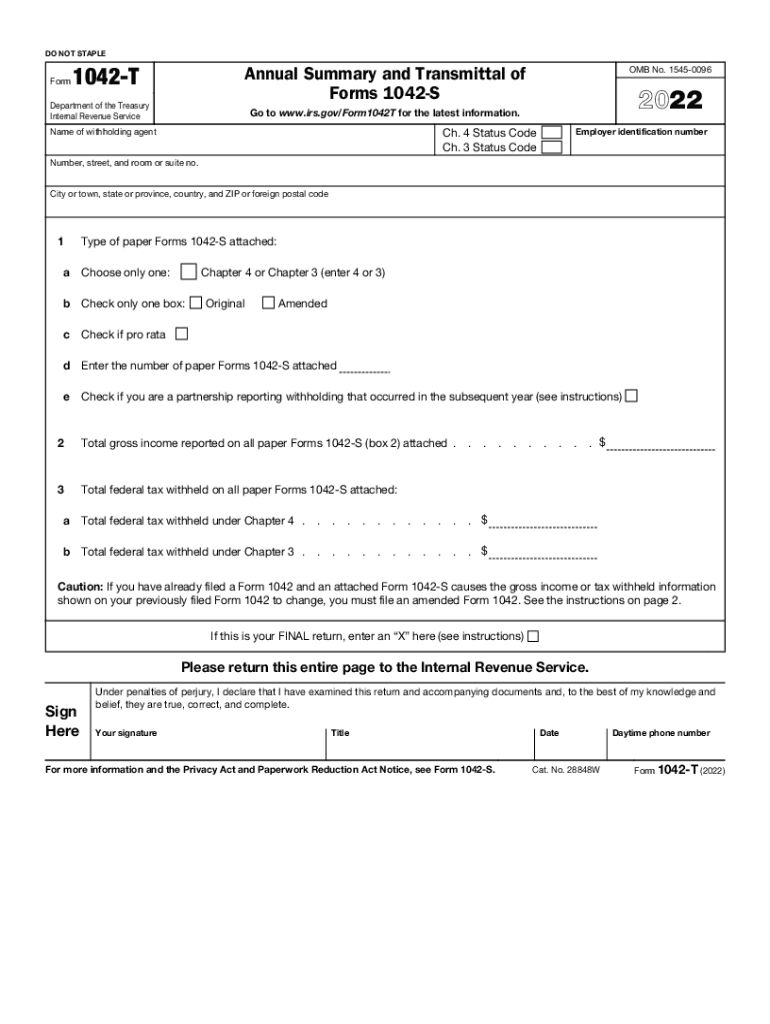

Form 1042-T is a crucial document used for the annual summary and transmittal of Forms 1042-S, which report income subject to withholding for foreign persons. This form is essential for businesses and organizations that make payments to non-resident aliens and foreign entities. It consolidates information from multiple Forms 1042-S into a single document, simplifying the reporting process to the Internal Revenue Service (IRS).

Steps to Complete Form 1042-T

Completing Form 1042-T requires careful attention to detail. Follow these steps to ensure accurate submission:

- Gather all Forms 1042-S that need to be reported.

- Fill in the payer’s information, including name, address, and Employer Identification Number (EIN).

- List the total number of Forms 1042-S being submitted.

- Provide the total amount of income reported on the Forms 1042-S.

- Sign and date the form, certifying that the information is correct.

Filing Deadlines for Form 1042-T

It is essential to be aware of the filing deadlines for Form 1042-T to avoid penalties. Generally, Form 1042-T must be filed with the IRS by March 15 of the year following the calendar year in which the income was paid. If you are submitting Forms 1042-S electronically, ensure that they are also filed by this deadline.

Legal Use of Form 1042-T

Form 1042-T is legally binding when completed correctly. It must comply with IRS regulations regarding foreign income reporting. The form serves as a summary of all Forms 1042-S submitted, ensuring that the IRS receives a comprehensive overview of payments made to foreign persons. Accurate completion and timely submission are crucial to avoid potential legal issues.

IRS Guidelines for Form 1042-T

The IRS provides specific guidelines for filling out Form 1042-T. It is important to refer to the latest IRS instructions to ensure compliance. Key points include:

- Ensure all information is accurate and complete.

- Use the correct tax year for reporting.

- Verify that all Forms 1042-S are attached if submitting by mail.

Digital vs. Paper Submission of Form 1042-T

Form 1042-T can be submitted either digitally or on paper. Electronic submission is often preferred due to its efficiency and the immediate confirmation of receipt. However, if opting for paper submission, ensure that all forms are mailed to the correct address and that sufficient time is allowed for processing.

Quick guide on how to complete fillioannual summary and transmittal of formsfillable annual summary and transmittal of forms 1042 s

Prepare Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S effortlessly on any device

Online document management has gained increased popularity among companies and individuals. It presents a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the accurate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S on any device using airSlate SignNow Android or iOS applications and streamline any document-focused workflow today.

How to edit and eSign Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S with ease

- Find Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S and click on Get Form to begin.

- Make use of the features we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device of your choice. Edit and eSign Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillioannual summary and transmittal of formsfillable annual summary and transmittal of forms 1042 s

Create this form in 5 minutes!

People also ask

-

What is Form 1042 T and who needs it?

Form 1042 T is used for reporting U.S. source income paid to foreign persons. If your business deals with non-resident aliens and foreign entities, you'll need to familiarize yourself with Form 1042 T to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with Form 1042 T?

airSlate SignNow streamlines the process of preparing and eSigning Form 1042 T by providing a user-friendly platform. Our solution enables users to easily fill out the form electronically, ensuring accuracy and efficiency in your tax reporting.

-

Is there a cost associated with using airSlate SignNow for Form 1042 T?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Our solutions provide exceptional value for those needing to process Form 1042 T regularly, making compliance cost-effective.

-

What features does airSlate SignNow offer for Form 1042 T management?

airSlate SignNow includes features such as document templates, e-signature capabilities, and workflow automation tailored for Form 1042 T. These tools allow businesses to reduce errors and speed up the filing process.

-

Can I integrate airSlate SignNow with other software for handling Form 1042 T?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, helping you manage Form 1042 T more efficiently. Enjoy a smooth workflow by connecting tools you already use.

-

What are the benefits of using airSlate SignNow for Form 1042 T submissions?

Using airSlate SignNow for Form 1042 T submissions enhances document security, ensures compliance, and speeds up the signing process. This ultimately saves you time and reduces the likelihood of errors in your filings.

-

How secure is airSlate SignNow when handling Form 1042 T?

AirSlate SignNow prioritizes security, employing industry-standard encryption protocols to protect your data, including Form 1042 T. Your sensitive information is safe throughout the eSigning and submission process.

Get more for Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S

- Nm limited form

- Limited power of attorney where you specify powers with sample powers included new mexico form

- Limited power of attorney for stock transactions and corporate powers new mexico form

- Special durable power of attorney for bank account matters new mexico form

- New mexico business form

- New mexico property management package new mexico form

- New mexico corporation form

- New mexico bylaws form

Find out other Fill ioannual summary and transmittal of formsFillable Annual Summary And Transmittal Of Forms 1042 S

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer