Form IRS 1042 T Fill Online, Printable, Fillable 2021

What is the Form IRS 1042 T?

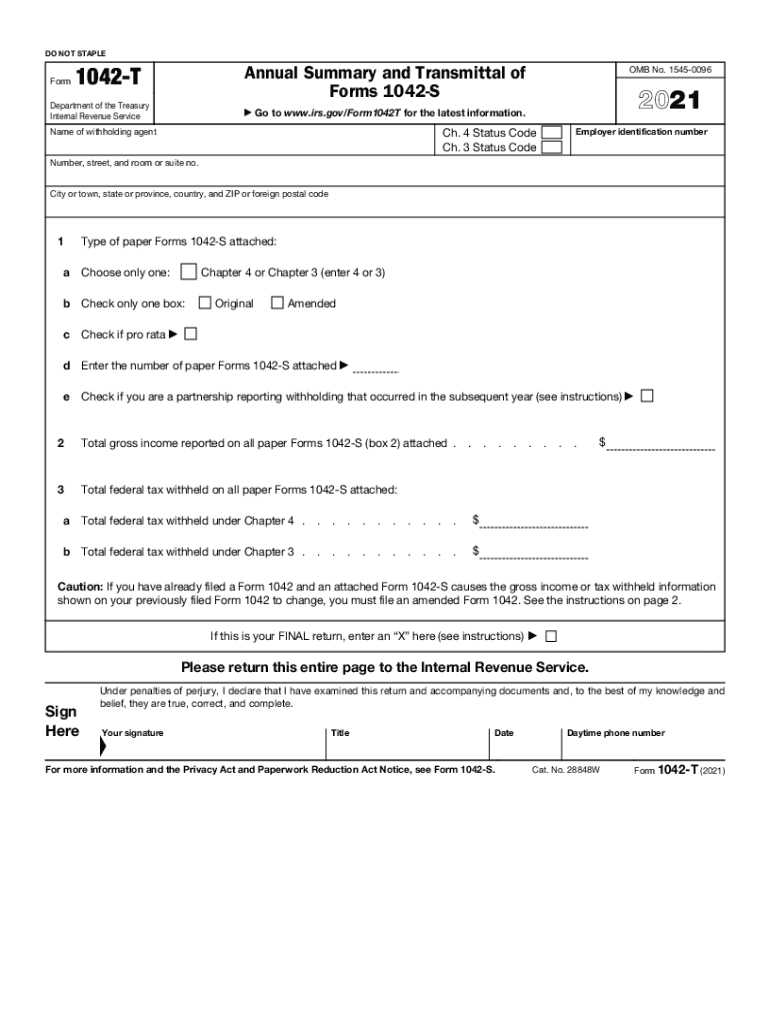

The IRS Form 1042 T is a tax form used primarily for reporting certain types of income paid to foreign individuals and entities. This form is a transmittal form that accompanies other forms, such as Forms 1042-S, which report income subject to withholding. The 1042 T is essential for ensuring that the correct amounts are reported and that withholding tax obligations are met. It is important for businesses and organizations that engage with foreign persons to understand the requirements associated with this form.

Steps to Complete the Form IRS 1042 T

Completing the IRS Form 1042 T involves several key steps. First, gather all necessary documentation, including the Forms 1042-S that report the income and withholding information. Next, enter the required information on the 1042 T, including the name and address of the withholding agent, the total number of Forms 1042-S being submitted, and the total amount of income reported. Ensure that all figures are accurate and reflect the information on the accompanying forms. After completing the form, review it for any errors before submission.

Legal Use of the Form IRS 1042 T

The legal use of Form 1042 T is critical for compliance with U.S. tax laws. This form must be filed accurately to avoid penalties associated with incorrect reporting. The form serves as a declaration that the withholding agent has fulfilled their tax obligations regarding payments made to foreign individuals or entities. It is advisable to retain copies of the submitted form and any related documentation for record-keeping and potential audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 1042 T are crucial to ensure compliance with IRS regulations. Generally, the form must be filed by March 15 of the year following the calendar year in which the income was paid. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for businesses to stay informed about any changes to these deadlines to avoid late filing penalties.

Form Submission Methods

Form 1042 T can be submitted through various methods. The IRS allows for electronic filing, which is often the preferred method for many organizations due to its efficiency and speed. Alternatively, the form can be mailed to the appropriate IRS address, depending on the location of the withholding agent. In-person submissions are typically not available for this form, making electronic and mail submissions the primary options.

Key Elements of the Form IRS 1042 T

Understanding the key elements of Form 1042 T is essential for accurate completion. Key elements include the withholding agent's name and address, the total number of Forms 1042-S being submitted, and the total amount of income reported. Additionally, the form requires a signature from the withholding agent or an authorized representative, affirming that the information provided is true and accurate. Ensuring these elements are correctly filled out can help avoid potential issues with the IRS.

Quick guide on how to complete 2020 form irs 1042 t fill online printable fillable

Effortlessly prepare Form IRS 1042 T Fill Online, Printable, Fillable on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form IRS 1042 T Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS apps and enhance any document-related task today.

The easiest way to edit and electronically sign Form IRS 1042 T Fill Online, Printable, Fillable with ease

- Obtain Form IRS 1042 T Fill Online, Printable, Fillable and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard handwritten signature.

- Review all the details and then click on the Done button to save your edits.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misfiled documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form IRS 1042 T Fill Online, Printable, Fillable and ensure seamless communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form irs 1042 t fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2020 form irs 1042 t fill online printable fillable

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is the 1042 t form and why is it important?

The 1042 t form is crucial for foreign persons receiving income from U.S. sources. It helps ensure compliance with U.S. tax laws by reporting tax withheld on income. Understanding the 1042 t form is vital for both businesses and individuals to avoid potential legal issues.

-

How can airSlate SignNow help with the 1042 t form?

AirSlate SignNow simplifies the process of completing and signing the 1042 t form. With its user-friendly interface, users can easily upload, fill out, and eSign documents securely. This streamlines compliance, allowing businesses to focus more on their core activities.

-

What are the pricing options for using airSlate SignNow with the 1042 t form?

AirSlate SignNow offers competitive pricing plans starting from a basic free trial to advanced subscription options. The cost-effective solution provides businesses with the flexibility to choose a plan that suits their needs, especially for managing documents like the 1042 t form.

-

Are there any features specifically beneficial for managing the 1042 t form?

Yes, airSlate SignNow includes features like customizable templates and secure eSignature options tailored for the 1042 t form. These features enhance efficiency, allowing businesses to manage their tax documents with ease and compliance. Automation tools help reduce errors in data entry too.

-

Can airSlate SignNow integrate with other software for handling 1042 t forms?

Absolutely! AirSlate SignNow provides seamless integrations with various productivity tools and account software that are essential for managing the 1042 t form. This ensures that your document workflow is efficient, enabling tracking and compliance during tax season effortlessly.

-

How secure is airSlate SignNow for signing the 1042 t form?

AirSlate SignNow prioritizes security, ensuring that all transactions, including the signing of the 1042 t form, are encrypted and secure. With advanced authentication methods and strict compliance with legal standards, users can trust that their sensitive information is safe.

-

What benefits does airSlate SignNow offer for remote teams working on 1042 t forms?

For remote teams, airSlate SignNow provides the ability to collaborate on the 1042 t form from anywhere in the world. This fosters teamwork and boosts productivity, allowing members to sign and manage documents in real time. The platform's cloud-based nature ensures accessibility for all team members.

Get more for Form IRS 1042 T Fill Online, Printable, Fillable

- Warranty deed two individuals to one individual georgia form

- 497303654 form

- Quitclaim deed from husband wife and an individual as grantors to husband and wife grantees georgia form

- Warranty deed husband and wife to two individuals georgia form

- Ga affidavit 497303657 form

- Georgia quitclaim deed 497303658 form

- Deed trust grantor form

- Georgia workers compensation form

Find out other Form IRS 1042 T Fill Online, Printable, Fillable

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document