Form 1042 T Annual Summary and Transmittal of Forms 1042 S 2024

What is the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

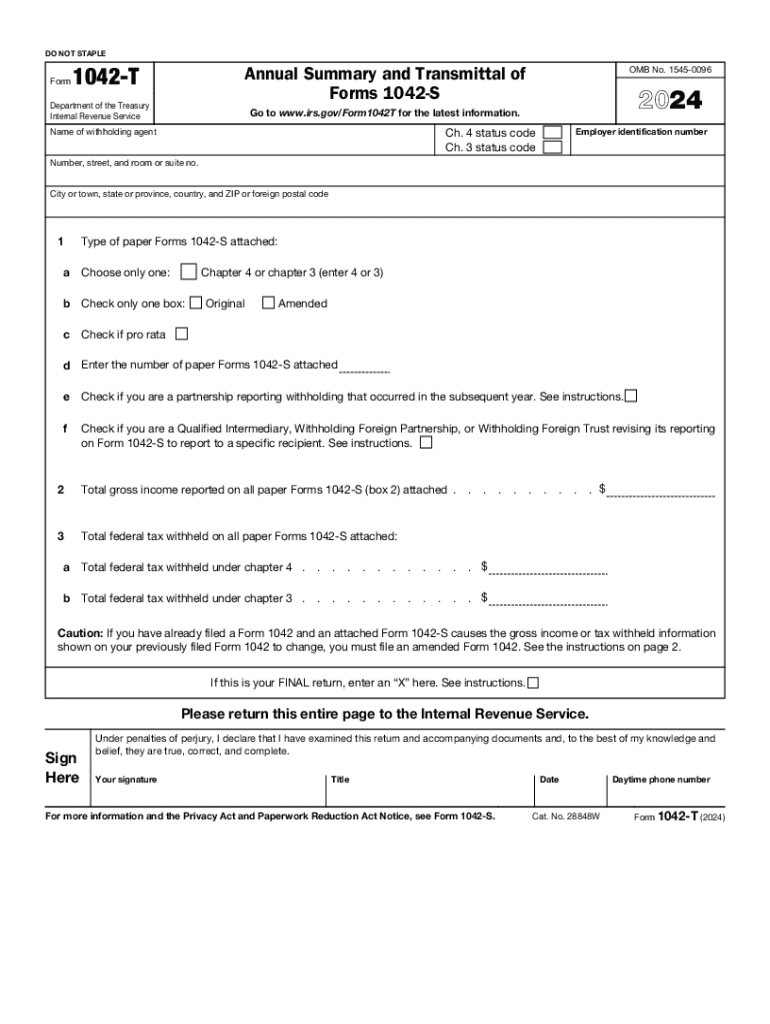

The Form 1042 T Annual Summary and Transmittal of Forms 1042 S is a crucial document used by withholding agents to report income paid to foreign persons. This form summarizes the information contained in the individual Forms 1042 S, which detail the amounts withheld from payments made to non-resident aliens and foreign entities. The primary purpose of Form 1042 T is to transmit these forms to the Internal Revenue Service (IRS) while ensuring compliance with U.S. tax regulations.

How to use the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

To effectively use the Form 1042 T, withholding agents must complete it accurately to summarize the information from all Forms 1042 S issued during the tax year. This includes reporting total payments made, total tax withheld, and the number of Forms 1042 S attached. The completed Form 1042 T serves as a cover sheet when submitting the Forms 1042 S to the IRS, ensuring that all necessary information is organized and presented clearly.

Steps to complete the Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

Completing the Form 1042 T involves several key steps:

- Gather all Forms 1042 S issued during the year.

- Fill in the withholding agent's name, address, and Employer Identification Number (EIN).

- Provide the total amount of payments made to foreign persons and the total amount of tax withheld.

- Indicate the number of Forms 1042 S included with the submission.

- Sign and date the form, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

It is essential to adhere to the IRS deadlines for submitting Form 1042 T. Typically, the form must be filed by March 15 of the year following the tax year being reported. If you are submitting Forms 1042 S along with Form 1042 T, ensure that all documents are sent together by this deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 1042 T or to provide accurate information can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to file altogether. These penalties can escalate depending on the duration of the delay and the amount of tax owed, making timely and accurate submission critical for withholding agents.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 1042 T. These guidelines include detailed instructions on the information required, formatting standards, and submission methods. It is important to review these guidelines thoroughly to ensure compliance and to avoid errors that could lead to penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 1042 t annual summary and transmittal of forms 1042 s

Create this form in 5 minutes!

How to create an eSignature for the form 1042 t annual summary and transmittal of forms 1042 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 1042 instructions 2021 for filing taxes?

The 1042 instructions 2021 provide guidance on how to report income paid to foreign persons and the withholding tax obligations. It's essential to follow these instructions carefully to ensure compliance with IRS regulations. Understanding these instructions can help you avoid penalties and ensure accurate reporting.

-

How can airSlate SignNow assist with 1042 instructions 2021?

airSlate SignNow simplifies the process of signing and sending documents related to the 1042 instructions 2021. Our platform allows you to easily manage and eSign tax documents, ensuring that you meet all necessary deadlines. This streamlines your workflow and helps maintain compliance with tax regulations.

-

What features does airSlate SignNow offer for handling 1042 forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing 1042 forms. These tools help ensure that your documents are completed accurately and efficiently. Additionally, our platform provides a user-friendly interface that simplifies the entire process.

-

Is airSlate SignNow cost-effective for managing 1042 instructions 2021?

Yes, airSlate SignNow is a cost-effective solution for managing the 1042 instructions 2021. Our pricing plans are designed to accommodate businesses of all sizes, providing excellent value for the features offered. By using our platform, you can save time and resources while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with other software for 1042 instructions 2021?

Absolutely! airSlate SignNow offers integrations with various software applications that can help streamline your workflow related to the 1042 instructions 2021. This includes accounting software and CRM systems, allowing for seamless data transfer and improved efficiency in managing your tax documents.

-

What are the benefits of using airSlate SignNow for 1042 instructions 2021?

Using airSlate SignNow for the 1042 instructions 2021 provides numerous benefits, including enhanced security, ease of use, and improved document management. Our platform ensures that your sensitive information is protected while making it easy to track and manage your tax documents. This leads to a more organized and efficient process.

-

How does airSlate SignNow ensure compliance with 1042 instructions 2021?

airSlate SignNow helps ensure compliance with the 1042 instructions 2021 by providing tools that facilitate accurate document preparation and submission. Our platform includes features that guide users through the necessary steps, reducing the risk of errors. This proactive approach helps you stay compliant with IRS regulations.

Get more for Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

Find out other Form 1042 T Annual Summary And Transmittal Of Forms 1042 S

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now