Form 8879 EO 2013

What is the Form 8879 EO

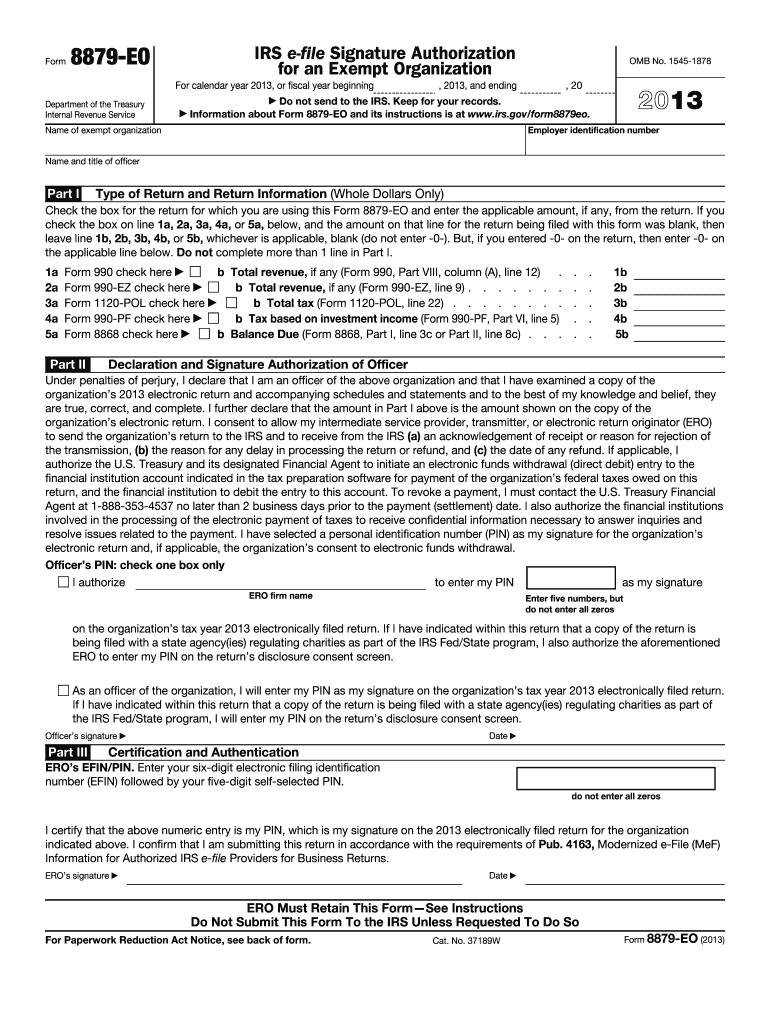

The Form 8879 EO, also known as the IRS e-file Signature Authorization for Exempt Organizations, is a crucial document for tax-exempt organizations. It allows these entities to authorize an electronic return for submission to the IRS. This form is specifically designed for organizations that are filing their tax returns electronically, ensuring that the signature of the authorized individual is captured in compliance with IRS regulations.

How to use the Form 8879 EO

To use the Form 8879 EO, organizations must first complete their electronic tax return. Once the return is prepared, the authorized individual must review the information to ensure its accuracy. The Form 8879 EO is then signed electronically, which allows the organization to submit the tax return electronically to the IRS. This process streamlines the filing procedure and ensures timely submission.

Steps to complete the Form 8879 EO

Completing the Form 8879 EO involves several key steps:

- Gather necessary information, including the organization's details and the preparer's information.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form with the authorized individual to verify accuracy.

- Sign the form electronically, which can be done using a secure eSignature solution.

- Submit the signed form along with the electronic tax return to the IRS.

Legal use of the Form 8879 EO

The legal use of the Form 8879 EO is governed by IRS regulations. It is essential that the form is signed by an individual authorized to act on behalf of the organization, which typically includes officers or directors. The electronic signature must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), ensuring that the form is legally binding.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8879 EO. Organizations must ensure that they are using the most current version of the form and that it is filled out correctly. The IRS also outlines the responsibilities of the authorized individual, including the need to review the tax return thoroughly before signing the form. Adhering to these guidelines is essential to avoid penalties or issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 EO align with the deadlines for the associated tax returns. Generally, tax-exempt organizations must file their returns by the fifteenth day of the fifth month after the end of their tax year. It is crucial to keep track of these dates to ensure timely filing and avoid potential penalties for late submissions.

Quick guide on how to complete 2013 form 8879 eo

Manage Form 8879 EO easily on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources essential to create, modify, and electronically sign your documents efficiently without hold-ups. Handle Form 8879 EO on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and electronically sign Form 8879 EO effortlessly

- Find Form 8879 EO and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that function by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Form 8879 EO to guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 8879 eo

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 8879 eo

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 8879 EO and how does it work?

Form 8879 EO is an IRS form that allows electronic signatures for tax returns submitted by exempt organizations. With airSlate SignNow, you can easily create and send Form 8879 EO for e-signature, streamlining your tax filing process while ensuring compliance with IRS requirements.

-

What are the main features of airSlate SignNow for handling Form 8879 EO?

AirSlate SignNow offers robust features such as customizable templates, secure storage, and real-time tracking for your Form 8879 EO. Users can send documents for signature via email or through a shareable link, making the entire process efficient and user-friendly.

-

How does airSlate SignNow ensure the security of Form 8879 EO?

Security is a top priority at airSlate SignNow. We implement advanced encryption and authentication methods to protect your Form 8879 EO data, ensuring that your sensitive information is secure during the signing process.

-

Is there a free trial available for using airSlate SignNow with Form 8879 EO?

Yes, airSlate SignNow offers a free trial that allows you to explore all features related to Form 8879 EO. This trial is a great opportunity to experience how our solution can streamline document signing before committing to a subscription.

-

What pricing plans are available for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs when dealing with Form 8879 EO. Plans range from individual use to team-oriented features, ensuring both affordability and value for all users.

-

Can I integrate airSlate SignNow with other software when managing Form 8879 EO?

Absolutely! AirSlate SignNow offers various integrations with popular software solutions, like CRM and document management systems, allowing you to efficiently manage Form 8879 EO alongside your other tools. This ensures a seamless workflow across your organization.

-

What benefits can I expect from using airSlate SignNow for Form 8879 EO?

By using airSlate SignNow for Form 8879 EO, you can expect improved efficiency and reduced turnaround times on document management. Our platform enhances collaboration, minimizes paper usage, and simplifies record-keeping, all while maintaining compliance with IRS regulations.

Get more for Form 8879 EO

Find out other Form 8879 EO

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement