Irs Form 8879 Eopdffillercom 2017

What is the Irs Form 8879 Eopdffillercom

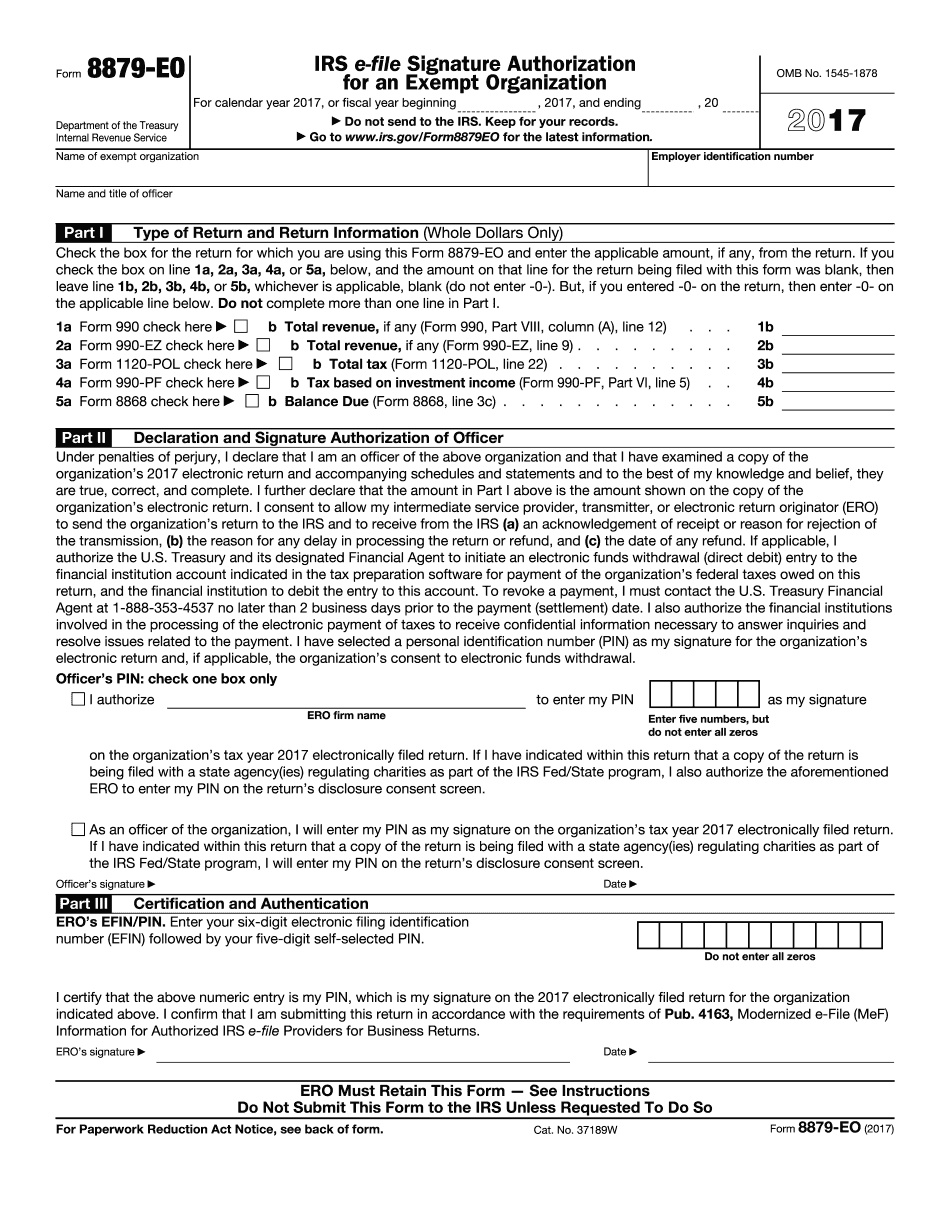

The IRS Form 8879, also known as the e-File Signature Authorization, is a crucial document for taxpayers who choose to electronically file their federal tax returns. This form allows taxpayers to authorize an electronic return originator (ERO) to file their tax returns on their behalf. It serves as a signature for the tax return, ensuring that the submitted information is accurate and complete. The form is particularly relevant for individuals and businesses that prefer the convenience of e-filing while maintaining compliance with IRS regulations.

How to use the Irs Form 8879 Eopdffillercom

Using the IRS Form 8879 involves several key steps. First, ensure that you have completed your federal tax return accurately. Next, provide the necessary information on Form 8879, which includes your name, Social Security number, and the ERO's information. Once the form is filled out, review it carefully to confirm that all details are correct. After verification, you will sign the form electronically, granting the ERO permission to file your tax return. It is essential to keep a copy of the signed form for your records, as it serves as proof of your authorization.

Steps to complete the Irs Form 8879 Eopdffillercom

Completing the IRS Form 8879 involves a straightforward process:

- Gather your completed federal tax return and any necessary supporting documents.

- Fill out the required fields on Form 8879, including your personal information and the ERO's details.

- Review the form for accuracy, ensuring all information matches your tax return.

- Sign the form electronically, which acts as your authorization for the ERO to file your return.

- Retain a copy of the signed form for your records, as it may be needed for future reference.

Legal use of the Irs Form 8879 Eopdffillercom

The legal use of IRS Form 8879 is essential for ensuring compliance with federal tax regulations. By signing this form, you are confirming that the information provided in your tax return is accurate and complete. This authorization is legally binding, meaning that you are responsible for the contents of the return filed under your name. It is important to use the most current version of the form and to follow all IRS guidelines to avoid any issues with your tax filing.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 8879 align with the overall tax filing deadlines set by the IRS. Typically, individual tax returns are due by April 15 each year, unless extended due to weekends or holidays. If you are filing for an extension, you must submit Form 4868 by the original due date. It is crucial to keep track of these dates to ensure timely submission of your tax return and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 8879 can be submitted electronically through your ERO when you e-file your tax return. This method is the most efficient and secure way to submit the form. Alternatively, if you are not using an ERO, you may need to print the form and submit it by mail along with your tax return. However, e-filing is generally recommended due to its speed and reduced risk of errors. Always check the IRS guidelines for the most current submission methods available.

Quick guide on how to complete irs form 8879 eopdffillercom 2017

Discover the simplest method to complete and endorse your Irs Form 8879 Eopdffillercom

Are you still spending valuable time creating your official documents on paper instead of handling them online? airSlate SignNow offers an improved approach to complete and endorse your Irs Form 8879 Eopdffillercom and other forms for public services. Our advanced eSignature solution equips you with everything required to process paperwork efficiently and in line with official standards - powerful PDF editing, managing, safeguarding, signing, and sharing functionalities all available through an intuitive interface.

Only a few steps are needed to finish completing and endorsing your Irs Form 8879 Eopdffillercom:

- Upload the editable template to the editor using the Get Form button.

- Review the details you need to include in your Irs Form 8879 Eopdffillercom.

- Navigate through the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Press Sign to generate a legally enforceable eSignature using your preferred method.

- Include the Date next to your signature and finalize your task with the Done button.

Store your completed Irs Form 8879 Eopdffillercom in the Documents directory of your profile, download it, or transfer it to your chosen cloud storage. Our service also features versatile form sharing options. There's no need to print your templates when you need to forward them to the appropriate public office - simply send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 8879 eopdffillercom 2017

Create this form in 5 minutes!

How to create an eSignature for the irs form 8879 eopdffillercom 2017

How to make an eSignature for the Irs Form 8879 Eopdffillercom 2017 in the online mode

How to create an eSignature for the Irs Form 8879 Eopdffillercom 2017 in Google Chrome

How to make an eSignature for putting it on the Irs Form 8879 Eopdffillercom 2017 in Gmail

How to generate an eSignature for the Irs Form 8879 Eopdffillercom 2017 from your smart phone

How to generate an eSignature for the Irs Form 8879 Eopdffillercom 2017 on iOS

How to generate an eSignature for the Irs Form 8879 Eopdffillercom 2017 on Android

People also ask

-

What is IRS Form 8879 EosignNowcom?

IRS Form 8879 EosignNowcom is an electronic signature authorization form that allows taxpayers to e-file their federal tax returns. This form is essential for providing the IRS with consent for electronic filing while ensuring that you maintain compliance with tax regulations. Using airSlate SignNow, you can easily fill out and sign this form online, streamlining your tax filing process.

-

How can airSlate SignNow help me with IRS Form 8879 EosignNowcom?

airSlate SignNow simplifies the process of completing IRS Form 8879 EosignNowcom by providing an intuitive platform for e-signing documents. You can fill out the form digitally, add your electronic signature, and send it directly to your tax preparer or the IRS. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8879 EosignNowcom?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including a free trial to get you started. You can choose a plan that fits your budget, allowing you to efficiently handle IRS Form 8879 EosignNowcom and other documents without breaking the bank. The cost is competitive, especially considering the time and effort saved.

-

What features does airSlate SignNow offer for IRS Form 8879 EosignNowcom?

airSlate SignNow provides a range of features specifically designed for IRS Form 8879 EosignNowcom, including easy document uploads, customizable templates, and secure cloud storage. Additionally, it supports multiple signing options and real-time document tracking, ensuring that you have complete control over your tax filing process.

-

Can I integrate airSlate SignNow with other applications for IRS Form 8879 EosignNowcom?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems, enhancing the user experience for IRS Form 8879 EosignNowcom. These integrations allow you to access your documents from multiple platforms and streamline your workflow, making it easier to manage your tax documents.

-

What are the benefits of using airSlate SignNow for IRS Form 8879 EosignNowcom?

Using airSlate SignNow for IRS Form 8879 EosignNowcom offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are safely stored and that your electronic signatures are legally binding, giving you peace of mind during tax season.

-

Is airSlate SignNow secure for handling IRS Form 8879 EosignNowcom?

Absolutely, airSlate SignNow prioritizes security and compliance for handling IRS Form 8879 EosignNowcom. The platform employs advanced encryption protocols and complies with industry standards to protect your personal information and ensure that your electronic signatures are valid and secure.

Get more for Irs Form 8879 Eopdffillercom

- Hamk entrance exam questions form

- Alabama supplement exp 102011 form

- Rfp invitation sample form

- Uft career training program form

- Schedule k 1 form 1120 s shareholders share of

- Dr 1317 child care contribution tax credit certificate form

- State separation agreement template form

- Statement agreement template form

Find out other Irs Form 8879 Eopdffillercom

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile