1099 Sa Form 2012

What is the 1099 Sa Form

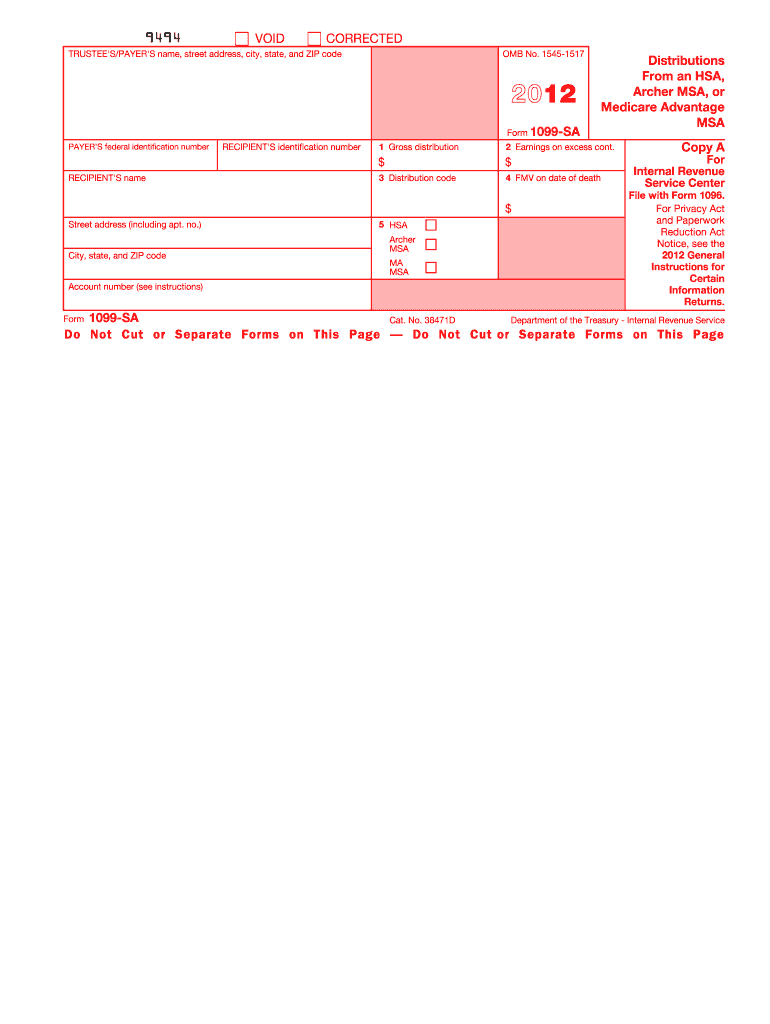

The 1099 Sa Form is a tax document used in the United States to report distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), and Medicare Advantage MSAs. This form is essential for individuals who have taken distributions from these accounts, as it provides the Internal Revenue Service (IRS) with necessary information about the amounts withdrawn and the purposes of those withdrawals. Accurate completion of the 1099 Sa Form ensures that taxpayers can properly report their income and avoid potential penalties.

How to use the 1099 Sa Form

Using the 1099 Sa Form involves several key steps. First, the account holder must receive the form from their HSA or MSA administrator, typically by January 31 of the year following the tax year in which distributions were made. Once received, individuals should review the form for accuracy, ensuring that all reported amounts align with their records. The information on the 1099 Sa Form must then be reported on the taxpayer's federal income tax return, specifically on Form 8889 for HSAs. This process helps to determine any taxable income and potential deductions related to medical expenses.

Steps to complete the 1099 Sa Form

Completing the 1099 Sa Form requires attention to detail and accuracy. Follow these steps:

- Gather all relevant documentation, including records of HSA or MSA contributions and distributions.

- Obtain the 1099 Sa Form from your financial institution or HSA administrator.

- Verify that the amounts listed on the form match your records of distributions.

- Complete the appropriate sections of the form, ensuring that all information is accurate and complete.

- Submit the form to the IRS along with your tax return, ensuring it is done by the filing deadline.

Legal use of the 1099 Sa Form

The legal use of the 1099 Sa Form is crucial for compliance with federal tax regulations. This form must be accurately filled out and submitted to the IRS to report any distributions from HSAs or MSAs. Failure to report these distributions can result in penalties, including additional taxes on the amounts withdrawn. It is important for taxpayers to understand that the IRS uses this information to track compliance with tax laws related to health savings accounts and to ensure that funds are used for qualified medical expenses.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Sa Form are essential for timely tax reporting. Generally, the form must be sent to the IRS by February 28 if filed by paper, or by March 31 if filed electronically. Taxpayers should also be aware that they must receive their copy of the 1099 Sa Form from their HSA or MSA administrator by January 31. Adhering to these deadlines helps avoid late fees and ensures compliance with IRS regulations.

Who Issues the Form

The 1099 Sa Form is issued by financial institutions, HSA administrators, or MSA custodians that manage health savings accounts. These entities are responsible for providing the form to account holders who have taken distributions during the tax year. It is essential for taxpayers to ensure they receive this form, as it contains critical information required for accurate tax reporting.

Quick guide on how to complete 2012 1099 sa form

Complete 1099 Sa Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing for easy access to the correct form and secure online storage. airSlate SignNow equips you with all the essentials to create, edit, and eSign your documents swiftly without hold-ups. Handle 1099 Sa Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to adjust and eSign 1099 Sa Form effortlessly

- Obtain 1099 Sa Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign 1099 Sa Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1099 sa form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1099 sa form

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is a 1099 Sa Form and who needs it?

The 1099 Sa Form is a tax document that reports distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), and other tax-exempt accounts. Individuals who have received distributions from these accounts during the tax year are required to fill out this form. By ensuring you correctly fill out the 1099 Sa Form, you can accurately report your expenses and avoid potential tax penalties.

-

How can airSlate SignNow help with the 1099 Sa Form?

airSlate SignNow streamlines the process of sending and eSigning documents, including the 1099 Sa Form. With its user-friendly interface, you can easily prepare and send your 1099 Sa Form to recipients for their signatures, ensuring compliance and accuracy. This efficiency helps reduce the time spent on administrative tasks, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for 1099 Sa Form processing?

Yes, there is pricing associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. You can choose from various plans based on your document signing needs, allowing you to manage your budget effectively while processing your 1099 Sa Form. Investing in airSlate SignNow can save you time and administrative costs in the long run.

-

What features does airSlate SignNow offer for handling the 1099 Sa Form?

airSlate SignNow offers numerous features that simplify the management of the 1099 Sa Form, including eSigning, template creation, and automated workflows. You can create templates for recurrent forms, ensuring consistency and accuracy in your submissions. Additionally, cloud storage provides easy access to your documents anytime and from anywhere.

-

Can airSlate SignNow integrate with other accounting software for 1099 Sa Form submissions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software solutions, allowing for a smooth workflow when preparing your 1099 Sa Form. This integration ensures that data is easily shareable across platforms, minimizing manual entry and reducing the potential for errors. It helps maintain a cohesive system for managing your financial documents.

-

What are the benefits of using airSlate SignNow for my 1099 Sa Form needs?

Using airSlate SignNow for your 1099 Sa Form needs provides numerous benefits including enhanced security, streamlined processes, and faster turnaround times. It ensures that sensitive information is protected during the signing process while also saving you time in document preparation and submission. This efficiency allows you to concentrate on what matters most—growing your business.

-

How does the eSigning process work for the 1099 Sa Form with airSlate SignNow?

The eSigning process for the 1099 Sa Form with airSlate SignNow is straightforward. You simply upload the form, add the necessary signature fields, and send it to the intended recipients via email. Once signed, both parties receive a copy of the completed 1099 Sa Form, with legally binding signatures, making tax reporting hassle-free.

Get more for 1099 Sa Form

Find out other 1099 Sa Form

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement