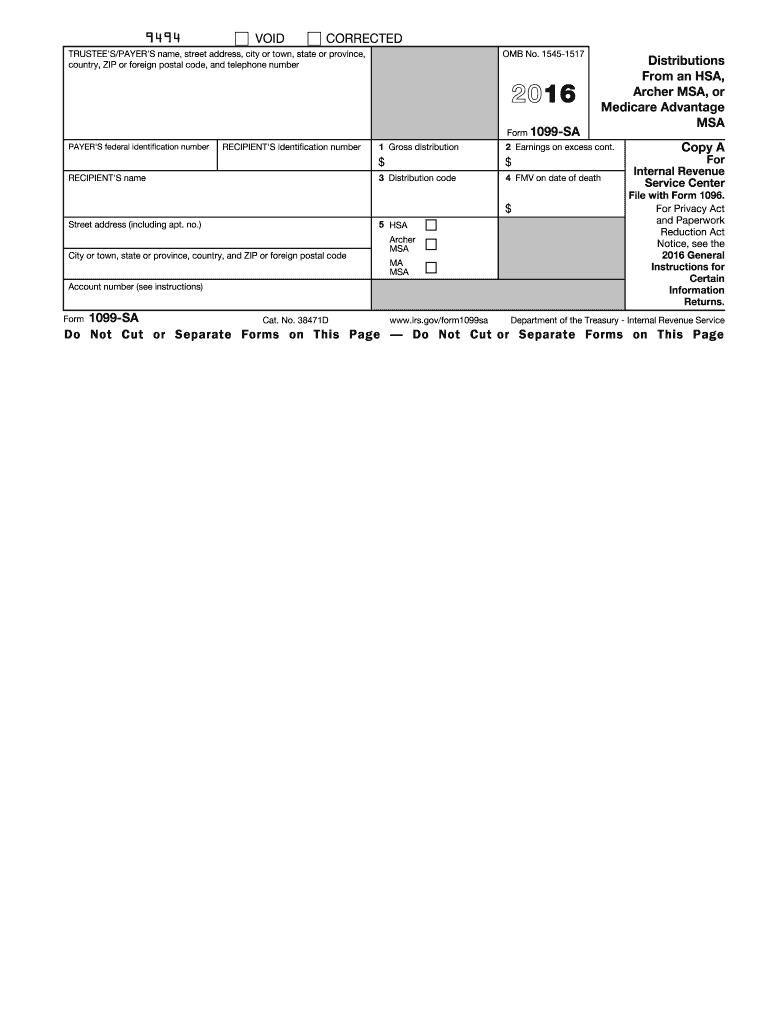

1099 Sapdffillercom Form 2016

What is the 1099 Sapdffillercom Form

The 1099 Sapdffillercom Form is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is essential for businesses and individuals who have made payments to independent contractors or received certain types of income. The IRS requires this form to ensure that all income is accurately reported and taxed accordingly. It is crucial for both the payer and the payee to understand the implications of this form to maintain compliance with tax regulations.

How to use the 1099 Sapdffillercom Form

Using the 1099 Sapdffillercom Form involves several steps to ensure accurate reporting of income. First, gather all necessary information about the recipient, including their name, address, and taxpayer identification number (TIN). Next, fill out the form with the total amount paid during the tax year. It is important to ensure that all entries are correct to avoid penalties. Once completed, the form should be sent to the IRS and a copy provided to the recipient by the deadline. This process helps maintain clear records for tax purposes.

Steps to complete the 1099 Sapdffillercom Form

Completing the 1099 Sapdffillercom Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Fill in the payer's information, including name, address, and TIN.

- Enter the recipient's details, ensuring accuracy in their name, address, and TIN.

- Report the total payments made to the recipient in the appropriate box.

- Check for any additional information that may need to be included, such as state tax withheld.

- Review the form for any errors before submission.

Legal use of the 1099 Sapdffillercom Form

The legal use of the 1099 Sapdffillercom Form is governed by IRS regulations. This form is legally binding when filled out correctly and submitted on time. It is used to report income that is taxable, and failure to file or incorrect reporting can lead to penalties. Both the payer and recipient must keep copies of the form for their records. Understanding the legal implications ensures compliance and helps avoid potential audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Sapdffillercom Form are critical to avoid penalties. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the payments were made. If filing electronically, the deadline may extend to March second. It is essential to check for any specific state deadlines as they may differ from federal requirements. Keeping track of these dates helps ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 1099 Sapdffillercom Form can be submitted through various methods. It can be filed online using IRS e-file services, which is often the quickest and most efficient way. Alternatively, the form can be mailed to the IRS, ensuring that it is postmarked by the filing deadline. In-person submission is generally not available for this form, but businesses may consult tax professionals for assistance. Choosing the right submission method can streamline the filing process and reduce errors.

Quick guide on how to complete 1099 sapdffillercom 2016 form

Uncover the easiest method to complete and endorse your 1099 Sapdffillercom Form

Are you still spending time generating your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior approach to complete and endorse your 1099 Sapdffillercom Form and related forms for public services. Our intelligent electronic signature service equips you with everything necessary to handle documents swiftly and in accordance with official standards - robust PDF editing, managing, securing, signing, and sharing functionalities all accessible within a user-friendly interface.

Only a few steps are required to complete to fill out and endorse your 1099 Sapdffillercom Form:

- Incorporate the fillable template into the editor using the Get Form button.

- Review what information you need to provide in your 1099 Sapdffillercom Form.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your information.

- Refresh the content with Text boxes or Images from the upper toolbar.

- Emphasize what truly counts or Conceal fields that are no longer relevant.

- Select Sign to generate a legally binding electronic signature using any method you prefer.

- Include the Date adjacent to your signature and finalize your work with the Done button.

Store your completed 1099 Sapdffillercom Form in the Documents folder of your profile, download it, or export it to your selected cloud storage. Our service also offers versatile form sharing. There’s no necessity to print your forms when you need to submit them to the relevant public office - send them via email, fax, or by arranging a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 1099 sapdffillercom 2016 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

Do you need to fill I-9 form for 1099 contract?

There's no such thing as a “1099 employee.” You are either an employee or you are not. The IRS rules are here Independent Contractor Self Employed or Employee and ICE uses a similar process to determine who is an employee and who is not.While it is illegal to retain a contractor whom you know to be working illegally, you are not required to connect Form I-9 from your independent contractors. You may do so if you wish.Who Needs Form I-9? Explains who must provide Form I-9.

-

I just received a 1099-K form from Coinbase? How do I fill my taxes?

1099-Ks from Coinbase, Gemini, and other exchanges only show your CUMULATIVE transaction value. That’s why the amount may seem HUGE if you swing traded your entire balance multiple times.However you only need to pay taxes on your capital gains/losses, so that amount is likely less than the 1099K’s amount. You need to file a Schedule D 1040 with a 8949.I recommend checking out Crypto tax sites like TokenTax that calculate all of that for you — Here is an article about 1099Ks from them - Coinbase Pro sent me a 1099-K. What do I do now? | TokenTax Blog

Create this form in 5 minutes!

How to create an eSignature for the 1099 sapdffillercom 2016 form

How to make an eSignature for the 1099 Sapdffillercom 2016 Form in the online mode

How to create an eSignature for the 1099 Sapdffillercom 2016 Form in Chrome

How to make an electronic signature for putting it on the 1099 Sapdffillercom 2016 Form in Gmail

How to make an electronic signature for the 1099 Sapdffillercom 2016 Form straight from your mobile device

How to generate an electronic signature for the 1099 Sapdffillercom 2016 Form on iOS

How to make an eSignature for the 1099 Sapdffillercom 2016 Form on Android

People also ask

-

What is the 1099 SasignNowcom Form and why is it important?

The 1099 SasignNowcom Form is a critical document used for reporting income received by independent contractors and freelancers. It is essential for tax purposes as it helps the IRS track earnings that are not subjected to withholding. Properly completing and submitting this form ensures compliance with tax regulations and avoids potential penalties.

-

How can airSlate SignNow help me with the 1099 SasignNowcom Form?

airSlate SignNow simplifies the process of preparing the 1099 SasignNowcom Form by providing an intuitive platform for eSigning and sending documents. Our user-friendly interface allows you to easily fill out, sign, and send your 1099 forms securely and efficiently. This streamlines your administrative tasks and ensures timely submissions.

-

Are there any costs associated with using airSlate SignNow for the 1099 SasignNowcom Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our plans provide access to features that facilitate the creation and management of the 1099 SasignNowcom Form, ensuring you have a cost-effective solution for your document signing needs. Check our website for detailed pricing information.

-

What features of airSlate SignNow make it suitable for managing the 1099 SasignNowcom Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows, all of which are beneficial for managing the 1099 SasignNowcom Form. These tools enhance efficiency and reduce the likelihood of errors, ensuring that your forms are completed accurately and on time. Additionally, we provide document tracking to keep you updated on the signing status.

-

Can I integrate airSlate SignNow with other software for my 1099 SasignNowcom Form?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enabling you to streamline your workflow for the 1099 SasignNowcom Form. Whether you're using accounting software or project management tools, our integrations help you maintain consistency and efficiency across your operations.

-

Is airSlate SignNow secure for handling my 1099 SasignNowcom Form?

Yes, airSlate SignNow prioritizes security and compliance, utilizing industry-standard encryption to protect your documents, including the 1099 SasignNowcom Form. We adhere to strict security protocols to ensure that your sensitive information remains confidential and secure during the eSigning process.

-

How do I get started with airSlate SignNow for my 1099 SasignNowcom Form?

Getting started with airSlate SignNow is easy! Simply visit our website to sign up for an account, and you can begin creating and managing your 1099 SasignNowcom Form right away. Our platform provides tutorials and customer support to assist you throughout the process.

Get more for 1099 Sapdffillercom Form

Find out other 1099 Sapdffillercom Form

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe