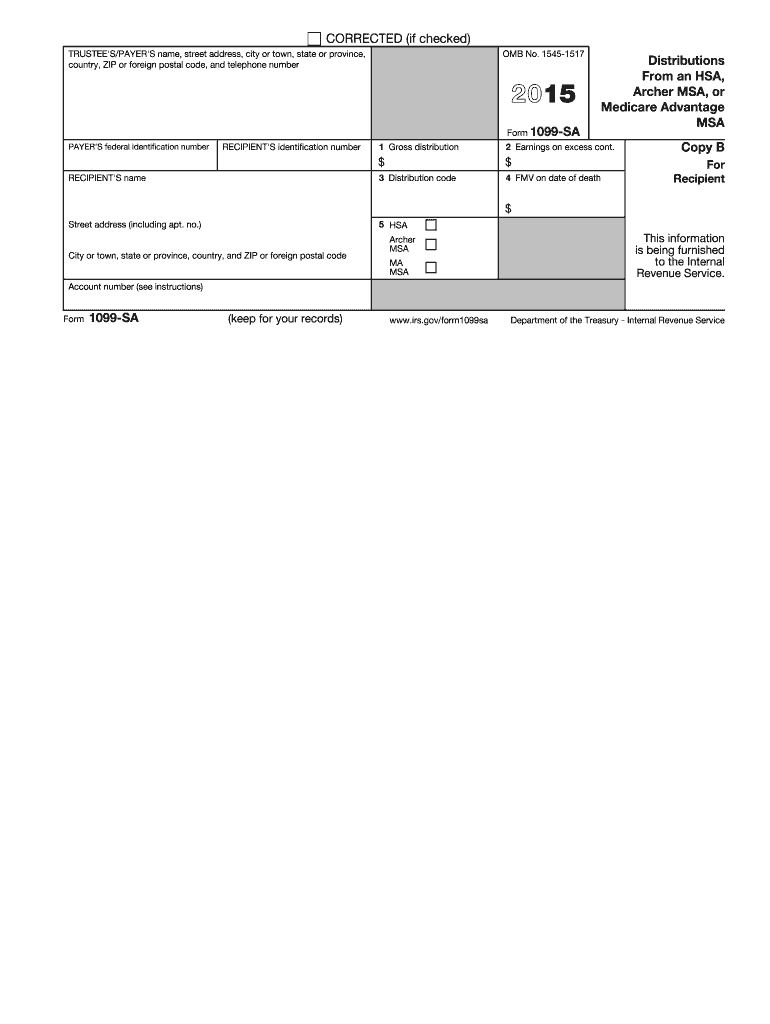

1099 Sa Form 2015

What is the 1099 SA Form

The 1099 SA Form is a tax document used in the United States to report distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), and Medicare Advantage MSAs. This form is essential for individuals who have withdrawn funds from these accounts, as it helps the Internal Revenue Service (IRS) track the use of tax-advantaged savings for medical expenses. The information reported on the 1099 SA Form includes the total distributions made during the tax year, which must be accurately reported on the taxpayer's income tax return.

How to use the 1099 SA Form

Using the 1099 SA Form involves a few key steps. First, individuals should receive this form from their HSA or MSA trustee or custodian by the end of January following the tax year. Once received, taxpayers should review the information for accuracy. If the amounts are correct, the total distributions reported on the form must be included on the individual's tax return. If there are discrepancies, it is important to contact the issuer to resolve any issues before filing taxes.

Steps to complete the 1099 SA Form

Completing the 1099 SA Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information regarding HSA or MSA distributions for the tax year.

- Obtain the 1099 SA Form from your financial institution.

- Verify that the amounts reported match your records of distributions.

- Complete your tax return, ensuring that you include the total distributions from the 1099 SA Form in the appropriate section.

- Keep a copy of the 1099 SA Form for your records in case of future audits.

Legal use of the 1099 SA Form

The legal use of the 1099 SA Form is crucial for compliance with IRS regulations. Taxpayers must accurately report the distributions to avoid penalties and ensure that they are not taxed on funds used for qualified medical expenses. The IRS requires that all distributions be reported, and failure to do so can result in additional taxes or fines. It is important to understand the implications of the information reported on this form to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 SA Form are critical for taxpayers. The form must be provided to individuals by January thirty-first of the year following the tax year. Additionally, taxpayers should ensure that their tax returns, which include the information from the 1099 SA Form, are filed by the April fifteenth deadline. Missing these deadlines can result in penalties, so it is important to stay organized and adhere to these timelines.

Who Issues the Form

The 1099 SA Form is issued by the financial institution or entity that manages the Health Savings Account (HSA) or Medical Savings Account (MSA). This could include banks, credit unions, or other financial service providers. It is the responsibility of these institutions to ensure that the form is accurately completed and sent to account holders by the required deadline. Taxpayers should be aware of who their account custodian is to ensure they receive the form on time.

Quick guide on how to complete 2015 1099 sa form

Prepare 1099 Sa Form effortlessly on any device

The management of online documents has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage 1099 Sa Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 1099 Sa Form effortlessly

- Find 1099 Sa Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validation as a conventional wet ink signature.

- Confirm the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign 1099 Sa Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 sa form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 sa form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a 1099 Sa Form and why is it important?

The 1099 Sa Form is a tax form used to report distributions from Health Savings Accounts (HSAs) and Archer Medical Savings Accounts (MSAs). Understanding this form is crucial for accurate tax reporting and compliance. Using airSlate SignNow, you can securely eSign and send your 1099 Sa Form, ensuring timely submission.

-

How can airSlate SignNow help with the 1099 Sa Form process?

airSlate SignNow streamlines the process of creating, sending, and eSigning your 1099 Sa Form. Our platform provides an easy-to-use interface that simplifies document management while ensuring compliance with IRS regulations. With our solution, you can efficiently handle your 1099 Sa Form without any hassle.

-

What features does airSlate SignNow offer for managing the 1099 Sa Form?

Our platform offers features like customizable templates, secure eSigning, and automated workflows for your 1099 Sa Form. You can easily create a 1099 Sa Form template, fill it out, and send it for signature to multiple recipients. These features save you time and reduce errors in your tax documentation.

-

Is airSlate SignNow cost-effective for managing 1099 Sa Forms?

Yes, airSlate SignNow is a cost-effective solution for managing your 1099 Sa Form. We offer flexible pricing plans to suit businesses of all sizes, ensuring that you can handle your tax documents without breaking the bank. Our affordable plans include all the features necessary for efficient document management.

-

Can I integrate airSlate SignNow with other tools for processing the 1099 Sa Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management tools, allowing you to manage your 1099 Sa Form alongside other financial documents. This integration helps streamline your workflow, improving efficiency in your tax filing process.

-

How secure is the information on my 1099 Sa Form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. We use advanced encryption and compliance with industry standards to protect the information on your 1099 Sa Form. You can trust that your sensitive tax information is secure while using our platform.

-

Can I track the status of my 1099 Sa Form after sending it for eSignature?

Yes, with airSlate SignNow, you can easily track the status of your 1099 Sa Form after it has been sent for eSignature. Our platform provides real-time updates, allowing you to see when the document has been viewed and signed, ensuring you never miss an important deadline.

Get more for 1099 Sa Form

Find out other 1099 Sa Form

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document