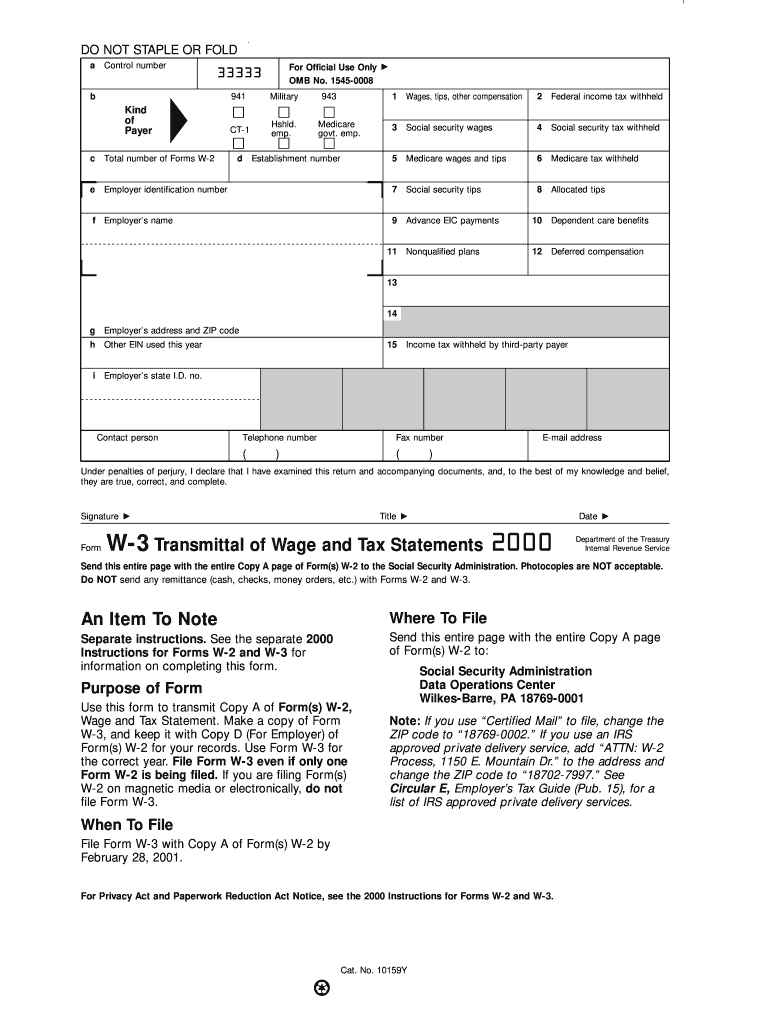

Income Tax Withheld by Third Party Payer Irs 2000

What is the Income Tax Withheld By Third Party Payer IRS

The Income Tax Withheld By Third Party Payer IRS form is a document used to report income tax that has been withheld by a third party on behalf of an individual taxpayer. This form is essential for ensuring that the correct amount of income tax is reported to the Internal Revenue Service (IRS). Typically, third-party payers include employers, financial institutions, or other entities that disburse payments to individuals. The withheld amounts are then credited against the taxpayer's total tax liability for the year.

Steps to Complete the Income Tax Withheld By Third Party Payer IRS

Completing the Income Tax Withheld By Third Party Payer IRS form involves several key steps:

- Gather necessary information, including your Social Security number, the payer's details, and the amount withheld.

- Obtain the correct form from the IRS website or your tax preparer.

- Fill in your personal information accurately, ensuring all details match your official documents.

- Report the income amounts and the tax withheld as specified on the form.

- Review the completed form for accuracy before submission.

How to Use the Income Tax Withheld By Third Party Payer IRS

Using the Income Tax Withheld By Third Party Payer IRS form is straightforward. Once you have completed the form, it is typically submitted along with your annual tax return. This form helps the IRS track the taxes you have already paid through withholding. It is crucial to include this form to avoid discrepancies during tax processing and to ensure you receive any potential refund for overpayment of taxes.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Income Tax Withheld By Third Party Payer IRS form. These guidelines include:

- Filing deadlines, which usually align with the annual tax return due date.

- Requirements for accurate reporting of withheld amounts.

- Instructions on how to correct any errors found after submission.

Legal Use of the Income Tax Withheld By Third Party Payer IRS

The legal use of the Income Tax Withheld By Third Party Payer IRS form is crucial for compliance with federal tax laws. This form serves as proof of the income tax that has been withheld, which can protect taxpayers from penalties associated with underreporting income. It is important to ensure that the form is filled out correctly and submitted timely to maintain legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Withheld By Third Party Payer IRS form generally coincide with the annual tax return deadlines. For most taxpayers, this is April 15 of the following year. However, it is essential to check for any extensions or changes in deadlines that may occur due to specific circumstances, such as natural disasters or legislative changes.

Quick guide on how to complete income tax withheld by third party payer irs

Complete Income Tax Withheld By Third party Payer Irs effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Income Tax Withheld By Third party Payer Irs on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Income Tax Withheld By Third party Payer Irs with ease

- Obtain Income Tax Withheld By Third party Payer Irs and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Choose how you would like to send your form, either via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Income Tax Withheld By Third party Payer Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax withheld by third party payer irs

Create this form in 5 minutes!

How to create an eSignature for the income tax withheld by third party payer irs

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is Income Tax Withheld By Third party Payer Irs?

Income Tax Withheld By Third party Payer Irs refers to the tax amount that is deducted by a third-party payer before the income is disbursed to you. This amount is then remitted to the IRS on your behalf. Understanding this can help you better manage your finances and prepare for tax season.

-

How does airSlate SignNow help with Income Tax Withheld By Third party Payer Irs documentation?

airSlate SignNow provides a seamless solution for sending and eSigning documents related to Income Tax Withheld By Third party Payer Irs. Our platform makes it easy to gather required signatures and manage your tax documents efficiently, ensuring you comply with IRS regulations.

-

Are there any costs associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers a range of pricing plans designed to meet different business needs. Each plan includes features that facilitate the management of documents related to Income Tax Withheld By Third party Payer Irs, providing great value for your investment.

-

Can I integrate airSlate SignNow with other accounting software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing your ability to manage Income Tax Withheld By Third party Payer Irs documentation alongside your financial data. This integration streamlines workflows and improves overall efficiency.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow includes features like templates, electronic signatures, and automated workflows tailored for tax documents, including those related to Income Tax Withheld By Third party Payer Irs. These features help businesses save time and reduce errors in document management.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and compliance measures to protect all sensitive information, including documents related to Income Tax Withheld By Third party Payer Irs. You can trust us to keep your data safe and secure.

-

What benefits can I expect from eSigning documents related to Income Tax Withheld By Third party Payer Irs?

By using airSlate SignNow to eSign documents related to Income Tax Withheld By Third party Payer Irs, you can expedite approval processes, eliminate paperwork, and store your documents securely online. This ensures that you always have access to your important tax documents when needed.

Get more for Income Tax Withheld By Third party Payer Irs

- Insulation contract for contractor hawaii form

- Paving contract for contractor hawaii form

- Site work contract for contractor hawaii form

- Siding contract for contractor hawaii form

- Refrigeration contract for contractor hawaii form

- Drainage contract for contractor hawaii form

- Foundation contract for contractor hawaii form

- Plumbing contract for contractor hawaii form

Find out other Income Tax Withheld By Third party Payer Irs

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will