Form 1041 N Rev December IRS Gov Irs 2015

What is the Form 1041 N Rev December

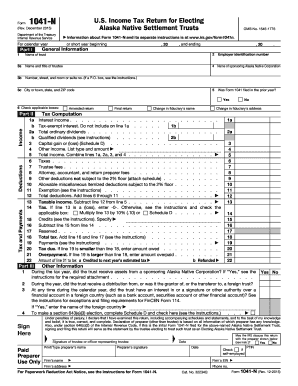

The Form 1041 N Rev December is a tax form used by estates and trusts in the United States to report income, deductions, gains, and losses. This form is specifically designed for entities that are required to file income tax returns under the Internal Revenue Code. It is essential for ensuring compliance with federal tax obligations and provides a structured way to report financial activities of estates and trusts. The form is updated periodically, with the December revision reflecting the latest tax laws and requirements from the IRS.

How to use the Form 1041 N Rev December

Using the Form 1041 N Rev December involves several steps to ensure accurate reporting of income and deductions. First, gather all relevant financial documents related to the estate or trust, including income statements, expense receipts, and prior tax returns. Next, complete the form by entering information about the entity, including its name, address, and taxpayer identification number. Carefully follow the instructions for reporting income, deductions, and credits. Once completed, the form must be filed with the IRS by the designated deadline, ensuring that all information is accurate to avoid penalties.

Steps to complete the Form 1041 N Rev December

Completing the Form 1041 N Rev December involves a systematic approach:

- Gather all necessary financial documents related to the estate or trust.

- Fill out the entity's identifying information, including name and taxpayer identification number.

- Report all sources of income, including interest, dividends, and rental income.

- Detail any deductions the estate or trust is entitled to claim, such as administrative expenses or distributions to beneficiaries.

- Calculate the taxable income and any tax owed.

- Review the completed form for accuracy before submission.

Legal use of the Form 1041 N Rev December

The legal use of the Form 1041 N Rev December is critical for compliance with federal tax laws. This form must be filed by estates and trusts that have gross income of $600 or more or have a beneficiary who is a non-resident alien. Failing to file the form can result in penalties and interest on unpaid taxes. It is important to ensure that all information reported is truthful and complete, as inaccuracies can lead to audits or further legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 N Rev December are crucial to adhere to in order to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates or trusts that operate on a calendar year, this means the form is generally due by April fifteenth. Extensions may be available, but it is essential to file the necessary paperwork to avoid late fees.

Form Submission Methods

The Form 1041 N Rev December can be submitted through various methods, including:

- Online filing through IRS-approved e-filing software.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Choosing the right submission method can help ensure timely processing of the form.

Quick guide on how to complete form 1041 n rev december 2015 irsgov irs

Effortlessly Prepare Form 1041 N Rev December IRS gov Irs on Any Device

Virtual document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage Form 1041 N Rev December IRS gov Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Form 1041 N Rev December IRS gov Irs with ease

- Obtain Form 1041 N Rev December IRS gov Irs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as an ordinary wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 1041 N Rev December IRS gov Irs while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 n rev december 2015 irsgov irs

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev december 2015 irsgov irs

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is Form 1041 N Rev December IRS gov Irs?

Form 1041 N Rev December IRS gov Irs is a tax form used for reporting income of estates and trusts in Nebraska. This form assists in calculating the taxable income for estates and trusts and is an essential part of the tax filing process.

-

How does airSlate SignNow streamline the signing of Form 1041 N Rev December IRS gov Irs?

airSlate SignNow offers an easy-to-use platform that allows users to eSign Form 1041 N Rev December IRS gov Irs quickly and securely. This reduces paperwork, saves time, and ensures a more efficient filing process.

-

What features does airSlate SignNow provide for completing Form 1041 N Rev December IRS gov Irs?

With airSlate SignNow, users can take advantage of features like customizable templates, document collaboration, and automated workflows. These tools make filling out Form 1041 N Rev December IRS gov Irs straightforward and hassle-free.

-

Is there a cost associated with using airSlate SignNow for signing Form 1041 N Rev December IRS gov Irs?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Each plan includes features that make signing Form 1041 N Rev December IRS gov Irs both affordable and efficient.

-

Can airSlate SignNow integrate with other software when working with Form 1041 N Rev December IRS gov Irs?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, allowing users to import data and manage documents related to Form 1041 N Rev December IRS gov Irs more effectively.

-

What are the benefits of using airSlate SignNow for Form 1041 N Rev December IRS gov Irs?

Using airSlate SignNow for Form 1041 N Rev December IRS gov Irs enhances efficiency and accuracy. The platform’s secure eSigning capability ensures that all documents are legally binding, providing peace of mind during the filing process.

-

Is airSlate SignNow secure for signing tax documents like Form 1041 N Rev December IRS gov Irs?

Yes, airSlate SignNow prioritizes the security of your documents. It employs industry-standard encryption and secure authentication processes to protect sensitive information when signing Form 1041 N Rev December IRS gov Irs.

Get more for Form 1041 N Rev December IRS gov Irs

- Contract cost fixed form

- Painting contract for contractor georgia form

- Trim carpenter contract for contractor georgia form

- Fencing contract for contractor georgia form

- Hvac contract for contractor georgia form

- Landscape contract for contractor georgia form

- Commercial contract for contractor georgia form

- Excavator contract for contractor georgia form

Find out other Form 1041 N Rev December IRS gov Irs

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT