Form 1041 N Rev December U S Income Tax Return for Electing Alaska Native Settlement Trusts 2023

What is the Form 1041 N for Electing Alaska Native Settlement Trusts?

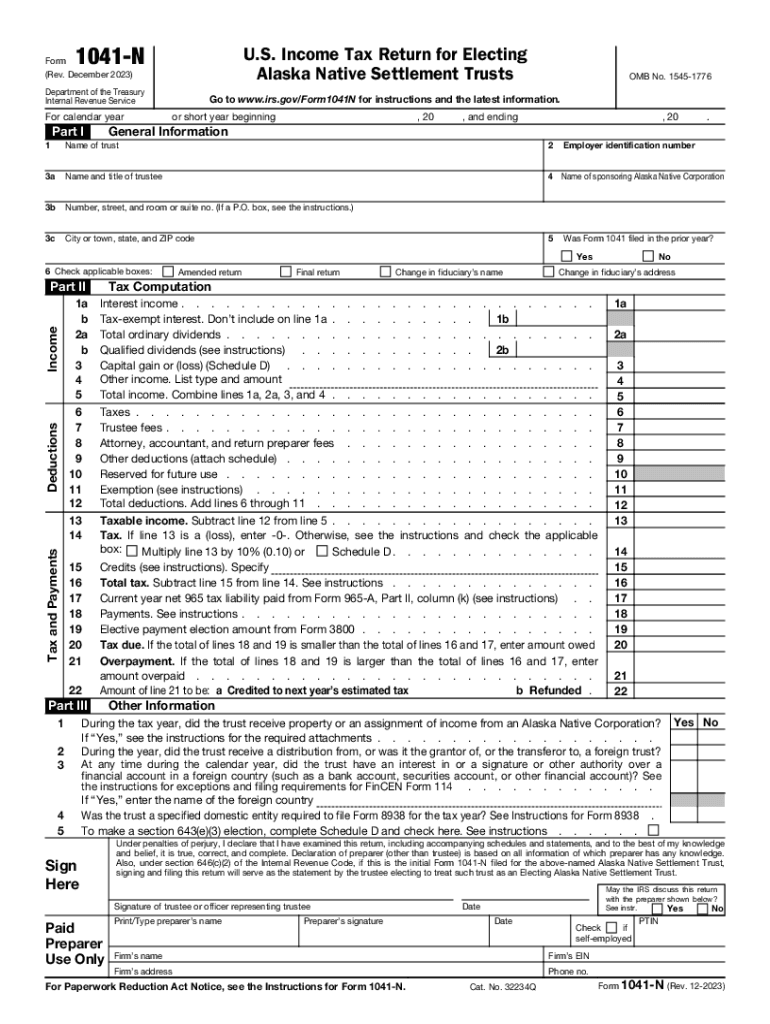

The Form 1041 N, officially known as the U.S. Income Tax Return for Electing Alaska Native Settlement Trusts, is specifically designed for Alaska Native Settlement Trusts to report income, deductions, and credits. This form allows these trusts to elect special tax treatment under the Internal Revenue Code. It is essential for ensuring compliance with federal tax regulations while allowing Alaska Native Settlement Trusts to manage their finances effectively.

How to Use the Form 1041 N for Electing Alaska Native Settlement Trusts

Using Form 1041 N involves several steps. First, gather all necessary financial documentation, including income statements and any relevant deductions. Next, fill out the form accurately, ensuring that all income sources are reported. It's important to include any distributions made to beneficiaries, as these may affect the overall tax liability. After completing the form, it should be reviewed for accuracy before submission to the IRS.

Steps to Complete the Form 1041 N for Electing Alaska Native Settlement Trusts

Completing the Form 1041 N involves a systematic approach:

- Begin with the identification section, providing the trust's name, address, and Employer Identification Number (EIN).

- Report all sources of income, including dividends, interest, and capital gains.

- Detail any deductions the trust is eligible for, such as administrative expenses or distributions to beneficiaries.

- Calculate the taxable income by subtracting deductions from total income.

- Complete the signature section, ensuring that the form is signed by an authorized individual.

Legal Use of the Form 1041 N for Electing Alaska Native Settlement Trusts

The legal use of Form 1041 N is crucial for compliance with U.S. tax laws. This form allows Alaska Native Settlement Trusts to elect special tax treatment, which can provide significant tax benefits. Properly filing this form ensures that the trust meets its legal obligations and avoids potential penalties for non-compliance. It is advisable to consult with a tax professional familiar with the specific requirements for Alaska Native Settlement Trusts.

Filing Deadlines for the Form 1041 N

Filing deadlines for Form 1041 N typically align with the standard tax deadlines for trusts. Generally, the form must be filed by the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is due on April 15. It's important to be aware of these deadlines to avoid late filing penalties.

Required Documents for the Form 1041 N

To complete Form 1041 N, several key documents are required:

- Financial statements detailing all income sources.

- Records of deductions and expenses incurred by the trust.

- Documentation of distributions made to beneficiaries.

- Any prior year tax returns for reference, if applicable.

Quick guide on how to complete form 1041 n rev december u s income tax return for electing alaska native settlement trusts

Complete Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts on any device via airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts with ease

- Obtain Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of the documents or black out sensitive information with specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow manages all your document needs in a few clicks from any device of your choice. Modify and eSign Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 n rev december u s income tax return for electing alaska native settlement trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev december u s income tax return for electing alaska native settlement trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alaska 1041 form and why is it important?

The Alaska 1041 form is a tax return specifically for estates and trusts in Alaska. It's important because it helps ensure compliance with state tax laws, allowing fiduciaries to report income and distributions accurately. Utilizing electronic signing solutions, like airSlate SignNow, can streamline the process of completing and submitting the Alaska 1041.

-

How can airSlate SignNow assist with filing the Alaska 1041?

airSlate SignNow simplifies the eSigning process for the Alaska 1041 form, allowing users to electronically sign documents securely. This solution makes it easier to prepare and send the necessary forms to accountants or beneficiaries. With airSlate SignNow, you can ensure that all signatures are collected efficiently to meet filing deadlines.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. Depending on the features required for handling documents like the Alaska 1041, users can choose from basic to more advanced plans. An affordable pricing strategy ensures all businesses can access the tools necessary for efficient document management.

-

Is airSlate SignNow compliant with Alaska state regulations for the 1041 form?

Yes, airSlate SignNow is designed to comply with state regulations including those relevant to the Alaska 1041 form. Our platform ensures that all electronic signatures and document handling meet legal standards, providing peace of mind to users preparing their tax forms. This compliance is crucial for maintaining the integrity of your documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features like customizable templates, team collaboration tools, and secure cloud storage. These features enhance the efficiency of managing documents, including the Alaska 1041 form, by streamlining workflows and reducing turnaround times. Additionally, tracking capabilities enable users to monitor document progress easily.

-

Are there integrations available with airSlate SignNow for accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing for easy handling of the Alaska 1041 and other tax documents. These integrations facilitate the transfer of information directly into your preferred software, eliminating the need for manual data entry. By leveraging these tools, businesses can improve accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for the Alaska 1041?

Using airSlate SignNow for the Alaska 1041 provides signNow benefits, including time-saving eSigning and improved document security. The platform’s user-friendly interface ensures that even non-technical users can navigate the process with ease. Additionally, the ability to access documents from anywhere enhances convenience for users handling their tax responsibilities.

Get more for Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts

Find out other Form 1041 N Rev December U S Income Tax Return For Electing Alaska Native Settlement Trusts

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed