1041 Form 2018

What is the 1041 Form

The 1041 Form, officially known as the U.S. Income Tax Return for Estates and Trusts, is a tax document used by fiduciaries to report income, deductions, gains, and losses of estates and trusts. This form is essential for ensuring that the income generated by these entities is accurately reported to the Internal Revenue Service (IRS). The 1041 Form is particularly relevant for estates and trusts that have generated income during the tax year, and it must be filed annually if the estate or trust has gross income of $600 or more or if it has a beneficiary who is a non-resident alien.

Steps to complete the 1041 Form

Completing the 1041 Form involves several key steps to ensure accuracy and compliance with IRS regulations:

- Gather necessary information: Collect all relevant financial documents, including income statements, deduction records, and any prior year tax returns.

- Fill out the form: Input the estate or trust's income, deductions, and other required information into the appropriate sections of the form.

- Calculate tax liability: Use the IRS tax tables to determine the tax owed based on the income reported.

- Review for accuracy: Double-check all entries for errors and ensure that all required signatures are included.

- File the form: Submit the completed 1041 Form to the IRS by the due date, either electronically or via mail.

Legal use of the 1041 Form

The legal use of the 1041 Form is crucial for compliance with federal tax laws. This form must be filed correctly to avoid penalties and ensure that the estate or trust meets its tax obligations. The IRS requires that all income generated by the estate or trust be reported accurately, and failure to do so can result in significant fines. Additionally, using a reliable eSignature tool can help ensure that the form is signed and submitted securely, maintaining its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 Form are critical for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to stay aware of these dates to avoid late filing penalties.

Who Issues the Form

The 1041 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides the form and accompanying instructions on its official website, ensuring that fiduciaries have access to the necessary resources for accurate filing. It is important to use the most current version of the form to comply with any updates in tax law.

Required Documents

To complete the 1041 Form accurately, several documents are required:

- Income statements: Documentation of all income generated by the estate or trust, including interest, dividends, and rental income.

- Deduction records: Proof of any deductions the estate or trust can claim, such as administrative expenses and charitable contributions.

- Prior year tax returns: If applicable, the previous year's tax return can provide helpful references for completing the current year's form.

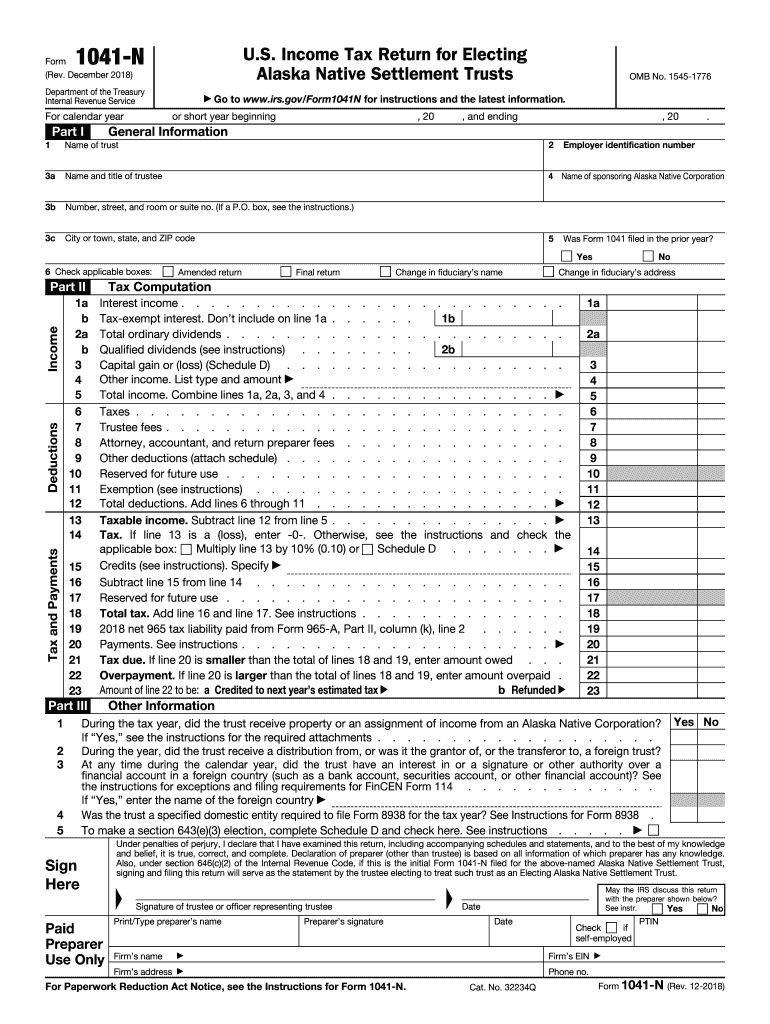

Quick guide on how to complete form 1041 n rev december 2018 us income tax return for electing alaska native settlement trusts

Complete 1041 Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle 1041 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 1041 Form effortlessly

- Obtain 1041 Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 1041 Form and guarantee clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 n rev december 2018 us income tax return for electing alaska native settlement trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev december 2018 us income tax return for electing alaska native settlement trusts

How to generate an eSignature for your Form 1041 N Rev December 2018 Us Income Tax Return For Electing Alaska Native Settlement Trusts online

How to create an eSignature for your Form 1041 N Rev December 2018 Us Income Tax Return For Electing Alaska Native Settlement Trusts in Google Chrome

How to make an eSignature for signing the Form 1041 N Rev December 2018 Us Income Tax Return For Electing Alaska Native Settlement Trusts in Gmail

How to generate an eSignature for the Form 1041 N Rev December 2018 Us Income Tax Return For Electing Alaska Native Settlement Trusts right from your smartphone

How to generate an electronic signature for the Form 1041 N Rev December 2018 Us Income Tax Return For Electing Alaska Native Settlement Trusts on iOS

How to create an eSignature for the Form 1041 N Rev December 2018 Us Income Tax Return For Electing Alaska Native Settlement Trusts on Android

People also ask

-

What is an Alaska 1041 form?

The Alaska 1041 form is a tax document used by partnerships and LLCs in Alaska to report income, deductions, and credits. It is essential for ensuring compliance with state tax regulations. Understanding how to properly fill out the Alaska 1041 can save businesses time and potential penalties.

-

How can airSlate SignNow help with the Alaska 1041 process?

airSlate SignNow streamlines the process of signing and sending the Alaska 1041 form digitally. Our platform allows users to easily eSign documents, ensuring a faster and more efficient filing experience. The convenience of airSlate SignNow means you can manage your Alaska 1041 without hassles.

-

What are the pricing options for using airSlate SignNow for Alaska 1041?

airSlate SignNow offers several pricing plans to cater to different business needs, making the eSigning of the Alaska 1041 cost-effective. Whether you're a small business or a large enterprise, we provide flexible options that fit your budget. You can choose a plan that allows unlimited documents or pay as you go.

-

Are there any integrations available with airSlate SignNow for the Alaska 1041?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for the Alaska 1041. Whether you use CRM systems, cloud storage, or project management tools, our integrations facilitate easy document access and signature requests. This integration capability helps to streamline the tax filing process.

-

What features does airSlate SignNow offer for signing the Alaska 1041?

airSlate SignNow offers robust features such as mobile access, templates for recurring documents, and real-time tracking of your Alaska 1041 forms. Our user-friendly interface makes it easy to prepare and send documents for signature, ensuring you never miss a filing deadline. Security measures further protect your sensitive tax information.

-

How secure is the signing process for Alaska 1041 with airSlate SignNow?

The signing process for the Alaska 1041 with airSlate SignNow is highly secure. We use state-of-the-art encryption and authentication methods to ensure the safety of your documents. Your data privacy is our priority, providing peace of mind when submitting sensitive tax information online.

-

Can airSlate SignNow be used for multiple users in my business when handling the Alaska 1041?

Absolutely! airSlate SignNow supports multiple users, making it ideal for businesses that need collaborative efforts on the Alaska 1041. Teams can efficiently manage document workflows, approve signatures, and effectively share information across departments. This collaborative aspect enhances productivity.

Get more for 1041 Form

- Form contractor waiver lien

- Mwidverificationduke energycom form

- Nonresidential service requestload sheet form duke energy

- Transcript purchase order third circuit instructions form

- Circuit criminal appeal form

- Notice acknowledgment service by mail ao440a federal court forms on hotdocs

- Disability certification form western new england university assets wne

- Ftcc form a 14 revised 03072013 academic agreement review faytechcc

Find out other 1041 Form

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure