Form 1041 N Rev December Irs 2016

What is the Form 1041 N Rev December IRS

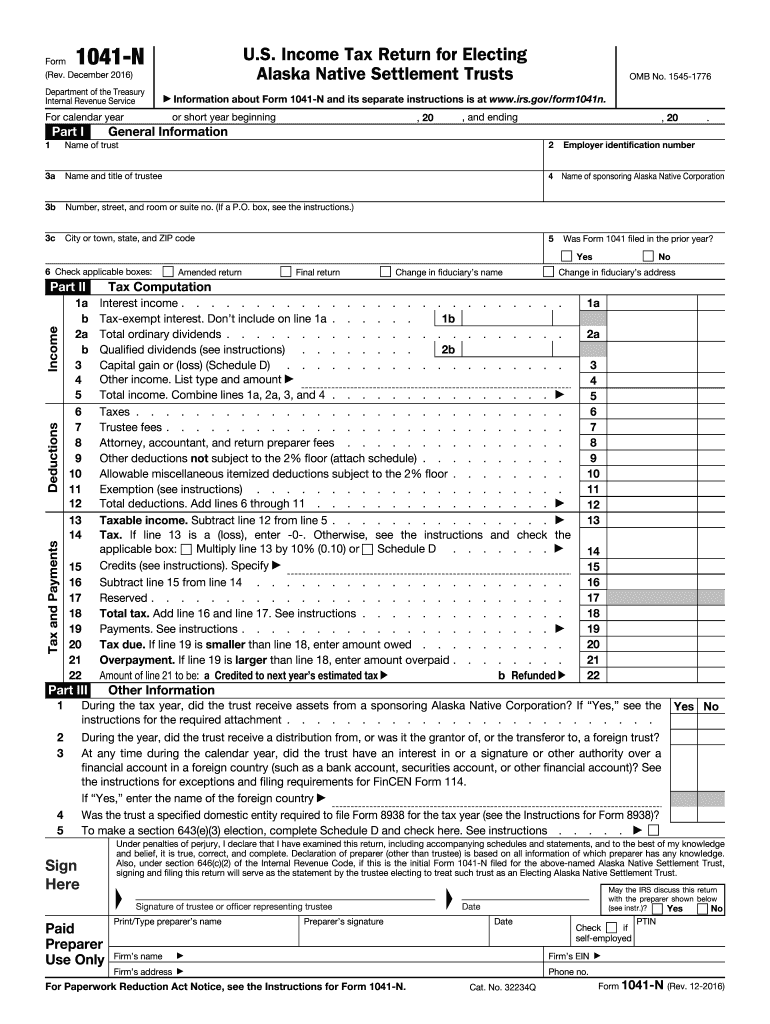

The Form 1041 N Rev December IRS is a tax form used by estates and trusts to report income, deductions, and tax liability to the Internal Revenue Service (IRS). This form is specifically designed for entities that are required to file income tax returns under U.S. federal law. It is crucial for ensuring that estates and trusts comply with tax regulations and fulfill their obligations accurately. Understanding this form is essential for fiduciaries managing estates and trusts, as it helps in the proper reporting of income generated by the estate or trust during the tax year.

How to use the Form 1041 N Rev December IRS

Using the Form 1041 N Rev December IRS involves several key steps that ensure accurate completion and submission. First, gather all necessary financial information related to the estate or trust, including income sources, deductions, and expenses. Next, fill out the form by entering the required information in the appropriate sections, such as income, deductions, and tax computation. It is important to review the instructions provided by the IRS to ensure compliance with all regulations. Once completed, the form must be signed by the fiduciary before submission to the IRS.

Steps to complete the Form 1041 N Rev December IRS

Completing the Form 1041 N Rev December IRS requires careful attention to detail. Follow these steps for successful completion:

- Gather financial documents, including income statements and receipts for deductions.

- Begin filling out the form by entering the name and identification number of the estate or trust.

- Report all sources of income, including interest, dividends, and rental income.

- List allowable deductions, such as administrative expenses and charitable contributions.

- Calculate the total income and deductions to determine the taxable income.

- Complete the tax computation section to determine the tax liability.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 N Rev December IRS are critical for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is essential to be aware of these dates to avoid penalties and ensure timely filing.

Legal use of the Form 1041 N Rev December IRS

The legal use of the Form 1041 N Rev December IRS is governed by federal tax laws. This form must be used by fiduciaries to report income and deductions accurately. Failure to use the form correctly can result in penalties and interest on unpaid taxes. Additionally, the form must be signed by the fiduciary, affirming that the information provided is true and complete. Understanding the legal implications of this form is vital for fiduciaries to protect themselves and the estate or trust they manage.

Key elements of the Form 1041 N Rev December IRS

The Form 1041 N Rev December IRS includes several key elements that are essential for accurate reporting. These elements consist of:

- Identification information for the estate or trust, including name and taxpayer identification number.

- Income reporting sections for various types of income, such as interest and dividends.

- Deductions for allowable expenses related to the administration of the estate or trust.

- Tax computation section to calculate the total tax liability.

- Signature section for the fiduciary to validate the form.

Quick guide on how to complete form 1041 n rev december 2016 irs

Complete Form 1041 N Rev December Irs effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 1041 N Rev December Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to adjust and electronically sign Form 1041 N Rev December Irs with ease

- Locate Form 1041 N Rev December Irs and then click Get Form to commence.

- Utilize the features we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to secure your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, and mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Alter and electronically sign Form 1041 N Rev December Irs to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 n rev december 2016 irs

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev december 2016 irs

How to create an electronic signature for the Form 1041 N Rev December 2016 Irs online

How to generate an eSignature for the Form 1041 N Rev December 2016 Irs in Google Chrome

How to generate an eSignature for signing the Form 1041 N Rev December 2016 Irs in Gmail

How to generate an electronic signature for the Form 1041 N Rev December 2016 Irs from your mobile device

How to make an electronic signature for the Form 1041 N Rev December 2016 Irs on iOS devices

How to make an electronic signature for the Form 1041 N Rev December 2016 Irs on Android

People also ask

-

What is Form 1041 N Rev December Irs?

Form 1041 N Rev December Irs is the federal tax return for estates and trusts. This form is essential for reporting income, deductions, and credits of a trust or estate. Using airSlate SignNow, you can easily send and eSign this important tax document, ensuring compliance with IRS requirements.

-

How can I file Form 1041 N Rev December Irs using airSlate SignNow?

With airSlate SignNow, you can seamlessly prepare and eSign Form 1041 N Rev December Irs by uploading your document and inviting others to sign. The platform provides user-friendly tools to fill out fields efficiently and securely send the document to relevant parties for eSignatures. This simplifies the filing process signNowly.

-

What are the pricing options for using airSlate SignNow to handle Form 1041 N Rev December Irs?

airSlate SignNow offers a variety of pricing plans to suit different business needs, starting from a free trial that allows you to explore its features. Paid plans unlock advanced functionalities ideal for handling documents like Form 1041 N Rev December Irs. Choose a plan that matches your volume and feature requirements.

-

Are there any additional features for managing Form 1041 N Rev December Irs on airSlate SignNow?

Yes, airSlate SignNow includes several features tailored for managing Form 1041 N Rev December Irs, such as customizable templates and audit trails. These tools provide greater control over the document workflow, ensuring that all changes are recorded for compliance purposes and enhancing collaboration among parties involved.

-

Can I integrate airSlate SignNow with other applications for processing Form 1041 N Rev December Irs?

Certainly! airSlate SignNow offers integrations with numerous applications such as Google Drive, Dropbox, and various accounting software. This enhances your ability to process Form 1041 N Rev December Irs by allowing easy import/export of documents and data, maximizing efficiency in your workflow.

-

How secure is my data when using airSlate SignNow for Form 1041 N Rev December Irs?

Data security is a top priority at airSlate SignNow. When working on Form 1041 N Rev December Irs, your information is protected with robust encryption and secure cloud storage. Additionally, the platform complies with industry standards, ensuring that your sensitive information remains safe and confidential.

-

What are the benefits of eSigning Form 1041 N Rev December Irs with airSlate SignNow?

eSigning Form 1041 N Rev December Irs with airSlate SignNow streamlines the process by eliminating the need for printing, signing, and scanning. This not only saves time but also enhances accuracy by allowing for real-time collaboration and instant notifications once the document is signed. Such efficiency is vital during tax season.

Get more for Form 1041 N Rev December Irs

Find out other Form 1041 N Rev December Irs

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document