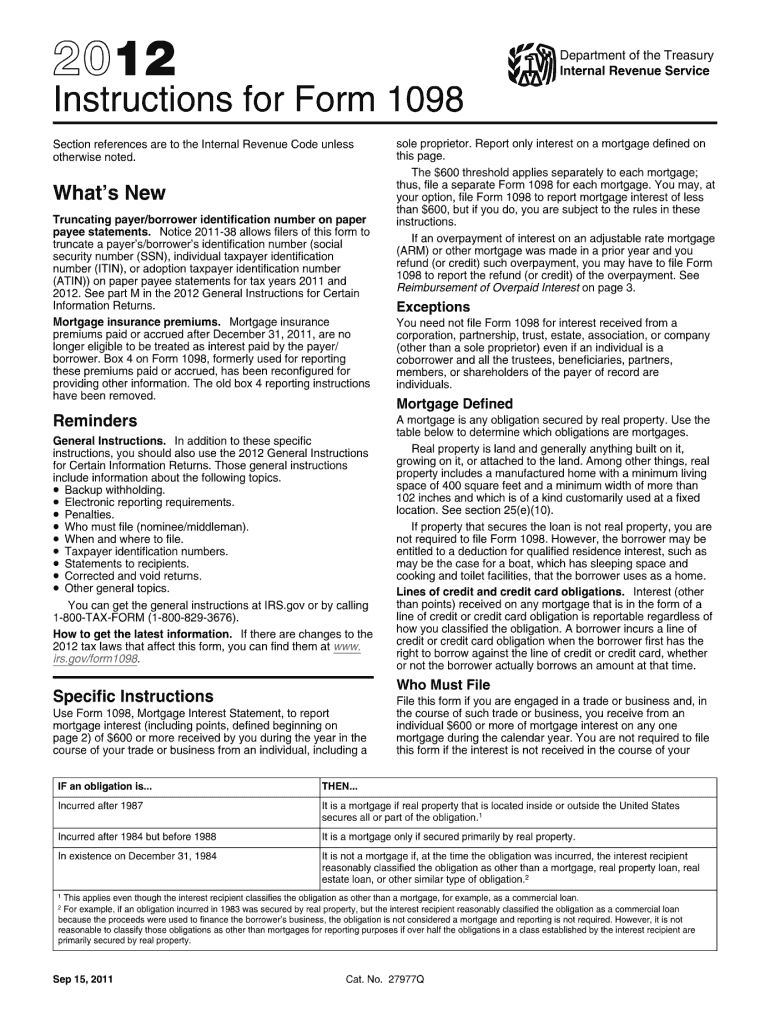

Fillable 1098 Int Form 2012

What is the Fillable 1098 Int Form

The Fillable 1098 Int Form is a tax document used in the United States to report interest paid on qualified student loans. This form is particularly beneficial for borrowers who are eligible to deduct interest payments from their taxable income. It is issued by lenders to borrowers and includes essential information such as the total interest paid during the tax year and the borrower's identification details. Understanding this form is crucial for individuals seeking to maximize their tax deductions related to education expenses.

How to use the Fillable 1098 Int Form

Using the Fillable 1098 Int Form involves several straightforward steps. First, ensure you have received the form from your lender, which should be provided by January thirty-first each year. Once you have the form, review the information for accuracy, including your name, Social Security number, and the total interest amount reported. This information will be used when filing your federal tax return, specifically on Schedule 1, where you can claim the student loan interest deduction. It is essential to keep this form for your records, as you may need it for future reference or audits.

Steps to complete the Fillable 1098 Int Form

Completing the Fillable 1098 Int Form is a simple process. Follow these steps to ensure accuracy:

- Obtain the form from your lender or download it from the IRS website.

- Fill in your personal information, including your name and Social Security number.

- Enter the lender's information, including their name and identification number.

- Input the total interest paid on your student loans as reported by your lender.

- Review the completed form for any errors before submission.

Legal use of the Fillable 1098 Int Form

The Fillable 1098 Int Form serves a legal purpose in the context of U.S. tax regulations. It provides documentation that supports your claim for the student loan interest deduction, which can reduce your taxable income. To ensure the form is legally valid, it must be filled out accurately and submitted in accordance with IRS guidelines. Failure to provide correct information may result in penalties or disallowance of the deduction, making it crucial to handle this form with care.

Filing Deadlines / Important Dates

When dealing with the Fillable 1098 Int Form, it is important to be aware of key deadlines. The form must be issued by lenders to borrowers by January thirty-first each year. Taxpayers typically need to file their federal tax returns by April fifteenth. However, if you require additional time, you can file for an extension, which allows you to submit your return by October fifteenth. Keeping track of these dates helps ensure compliance and maximizes your opportunity to claim deductions.

Who Issues the Form

The Fillable 1098 Int Form is issued by lenders who provide student loans. This includes banks, credit unions, and other financial institutions that have disbursed loans for educational purposes. It is the responsibility of the lender to provide accurate information on the form regarding the interest paid by the borrower during the tax year. If you have multiple loans from different lenders, you may receive several forms, each detailing the interest paid on those specific loans.

Quick guide on how to complete 2011 fillable 1098 int 2012 form

Easily prepare Fillable 1098 Int Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers a fantastic eco-friendly substitute to conventional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly without delays. Handle Fillable 1098 Int Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Fillable 1098 Int Form effortlessly

- Obtain Fillable 1098 Int Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your amendments.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Fillable 1098 Int Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 fillable 1098 int 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 fillable 1098 int 2012 form

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is a Fillable 1098 Int Form?

A Fillable 1098 Int Form is a tax document used to report interest payments that individuals receive during the tax year. With airSlate SignNow, you can easily create and edit this form electronically, streamlining the process.

-

How can I fill out the Fillable 1098 Int Form using airSlate SignNow?

You can fill out the Fillable 1098 Int Form on airSlate SignNow by selecting the form from our extensive template library. Simply input the required information into the fields, save your changes, and prepare it for eSignature.

-

Is there a cost associated with using the Fillable 1098 Int Form on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for businesses and individuals looking to use the Fillable 1098 Int Form. Pricing depends on the plan you choose, which includes various features to manage documents efficiently.

-

What features does airSlate SignNow offer for the Fillable 1098 Int Form?

With airSlate SignNow, the Fillable 1098 Int Form comes with features like easy customization, eSignature capabilities, and cloud storage. These tools simplify the process, enabling users to manage their tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for my Fillable 1098 Int Form?

Yes, airSlate SignNow offers seamless integrations with popular software like CRM systems and cloud storage services. This allows you to manage your Fillable 1098 Int Form alongside your existing workflows, ensuring a smooth process.

-

What are the benefits of using airSlate SignNow for the Fillable 1098 Int Form?

Using airSlate SignNow for your Fillable 1098 Int Form means you benefit from a user-friendly interface, quick turnaround times, and improved accuracy. This can considerably reduce the stress and time associated with filing taxes.

-

Is it secure to use airSlate SignNow for my Fillable 1098 Int Form?

Absolutely! airSlate SignNow employs state-of-the-art security measures to protect your documents, including the Fillable 1098 Int Form. Your data is encrypted, and access is restricted to ensure confidentiality.

Get more for Fillable 1098 Int Form

- Letter from landlord to tenant as notice of default on commercial lease iowa form

- Residential or rental lease extension agreement iowa form

- Commercial rental lease application questionnaire iowa form

- Apartment lease rental application questionnaire iowa form

- Residential rental lease application iowa form

- Salary verification form for potential lease iowa

- Landlord agreement to allow tenant alterations to premises iowa form

- Notice of default on residential lease iowa form

Find out other Fillable 1098 Int Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself