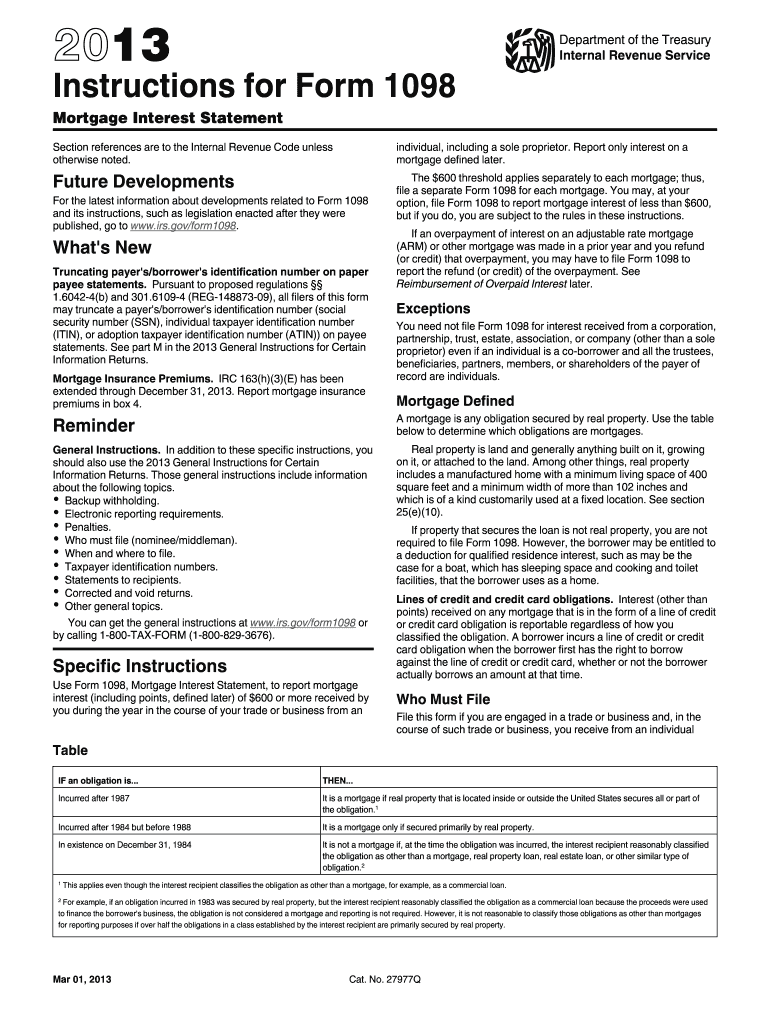

Irs Form 1098 Mortgage Interest Statement 2013

What is the IRS Form 1098 Mortgage Interest Statement

The IRS Form 1098 Mortgage Interest Statement is a tax document that lenders use to report the amount of mortgage interest paid by a borrower during the tax year. This form is essential for homeowners, as it helps them claim deductions on their federal income tax returns. The form includes details such as the borrower's name, the mortgage interest amount, and the property address. Understanding this form is crucial for accurately reporting mortgage interest on tax returns and maximizing potential tax benefits.

How to Use the IRS Form 1098 Mortgage Interest Statement

Using the IRS Form 1098 Mortgage Interest Statement involves several steps. First, you should review the information provided on the form to ensure accuracy. The amount of mortgage interest listed can be deducted from your taxable income, which may reduce your overall tax liability. When filing your tax return, include the total mortgage interest amount from the form on Schedule A if you are itemizing deductions. It is important to keep this form for your records, as the IRS may request it in case of an audit.

Steps to Complete the IRS Form 1098 Mortgage Interest Statement

Completing the IRS Form 1098 involves a few straightforward steps:

- Gather necessary information, including the lender's details and your mortgage account number.

- Enter the total amount of mortgage interest paid during the year.

- Include any points paid on the mortgage, if applicable.

- Provide the property address associated with the mortgage.

- Review all entries for accuracy before submission.

Once completed, the form must be submitted to the IRS and a copy sent to the borrower.

Key Elements of the IRS Form 1098 Mortgage Interest Statement

Several key elements are included in the IRS Form 1098 Mortgage Interest Statement. These elements are crucial for both the lender and the borrower:

- Borrower's Information: Name, address, and taxpayer identification number.

- Lender's Information: Name, address, and taxpayer identification number of the lender.

- Mortgage Interest Paid: Total amount of interest paid by the borrower during the tax year.

- Points Paid: Any points paid at closing that may be deductible.

- Property Address: The physical address of the property for which the mortgage was taken.

Legal Use of the IRS Form 1098 Mortgage Interest Statement

The IRS Form 1098 is legally recognized as a valid document for reporting mortgage interest. It must be filled out accurately to comply with IRS regulations. Borrowers can use the information on this form to substantiate their claims for deductions on their tax returns. Lenders are required by law to issue this form to borrowers who have paid $600 or more in interest during the year, ensuring transparency and compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1098 Mortgage Interest Statement are critical for both lenders and borrowers. Lenders must provide the form to borrowers by January 31 of the year following the tax year in which interest was paid. Additionally, lenders must file the form with the IRS by February 28 if filed on paper or by March 31 if filed electronically. Meeting these deadlines is essential to avoid penalties and ensure that borrowers can accurately report their mortgage interest deductions in a timely manner.

Quick guide on how to complete irs form 1098 mortgage interest statement 2013

Complete Irs Form 1098 Mortgage Interest Statement effortlessly on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, alter, and eSign your documents quickly without delays. Manage Irs Form 1098 Mortgage Interest Statement on any device with airSlate SignNow Android or iOS applications and streamline any document-centered process today.

How to alter and eSign Irs Form 1098 Mortgage Interest Statement with ease

- Find Irs Form 1098 Mortgage Interest Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Form 1098 Mortgage Interest Statement and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1098 mortgage interest statement 2013

Create this form in 5 minutes!

How to create an eSignature for the irs form 1098 mortgage interest statement 2013

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Irs Form 1098 Mortgage Interest Statement?

The Irs Form 1098 Mortgage Interest Statement is a tax document issued by lenders to report the amount of mortgage interest paid by the borrower during the tax year. This form is essential for homeowners to accurately file their tax returns and claim mortgage interest deductions.

-

How can airSlate SignNow help with Irs Form 1098 Mortgage Interest Statement?

airSlate SignNow simplifies the process of managing and eSigning the Irs Form 1098 Mortgage Interest Statement. With our user-friendly platform, you can securely send the form for eSignature, ensuring compliance and efficiency in your document workflows.

-

Is there a cost to use airSlate SignNow for handling the Irs Form 1098 Mortgage Interest Statement?

Yes, airSlate SignNow offers a cost-effective solution with various pricing plans tailored to meet your business needs. Our plans are designed to provide exceptional value, making it easy for users to manage the Irs Form 1098 Mortgage Interest Statement without breaking the bank.

-

What features does airSlate SignNow provide for managing the Irs Form 1098 Mortgage Interest Statement?

airSlate SignNow offers features such as secure eSigning, document tracking, and customizable templates specifically for the Irs Form 1098 Mortgage Interest Statement. These features ensure that you can efficiently manage your documents while maintaining compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other software when handling the Irs Form 1098 Mortgage Interest Statement?

Yes, airSlate SignNow easily integrates with a variety of software applications, enhancing your workflow when dealing with the Irs Form 1098 Mortgage Interest Statement. Our platform can connect with CRM systems, cloud storage, and more, streamlining your document management process.

-

What are the benefits of using airSlate SignNow for the Irs Form 1098 Mortgage Interest Statement?

Using airSlate SignNow for the Irs Form 1098 Mortgage Interest Statement offers numerous benefits, including time savings, enhanced security, and improved collaboration. Our platform allows you to quickly prepare and send documents, ensuring timely responses and eliminating paperwork delays.

-

Is airSlate SignNow secure for handling sensitive documents like the Irs Form 1098 Mortgage Interest Statement?

Absolutely, airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. Your Irs Form 1098 Mortgage Interest Statement and other sensitive documents are protected, giving you peace of mind when sending and signing electronically.

Get more for Irs Form 1098 Mortgage Interest Statement

Find out other Irs Form 1098 Mortgage Interest Statement

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself