Tax Form 1098 2018

What is the Tax Form 1098

The Tax Form 1098 is an IRS document used to report mortgage interest paid by individuals during the tax year. This form is primarily issued by lenders to borrowers and serves as a record of interest payments that may be deductible when filing federal income taxes. The information provided on the form can help taxpayers determine their eligibility for mortgage interest deductions, which can significantly impact their overall tax liability.

How to use the Tax Form 1098

To use the Tax Form 1098 effectively, taxpayers should first ensure they receive the form from their mortgage lender. Once received, the form should be reviewed for accuracy, as it contains critical information including the amount of interest paid, the lender's details, and the borrower's identification. Taxpayers can then use the information to complete their federal tax return, specifically Schedule A, where they can claim the mortgage interest deduction if eligible.

Steps to complete the Tax Form 1098

Completing the Tax Form 1098 involves several straightforward steps:

- Gather necessary information, such as your mortgage account number and the total interest paid during the year.

- Review the form for accuracy, ensuring all details match your records.

- Fill out the relevant sections, including your name, address, and Social Security number.

- Submit the form to the IRS along with your tax return, if required.

IRS Guidelines

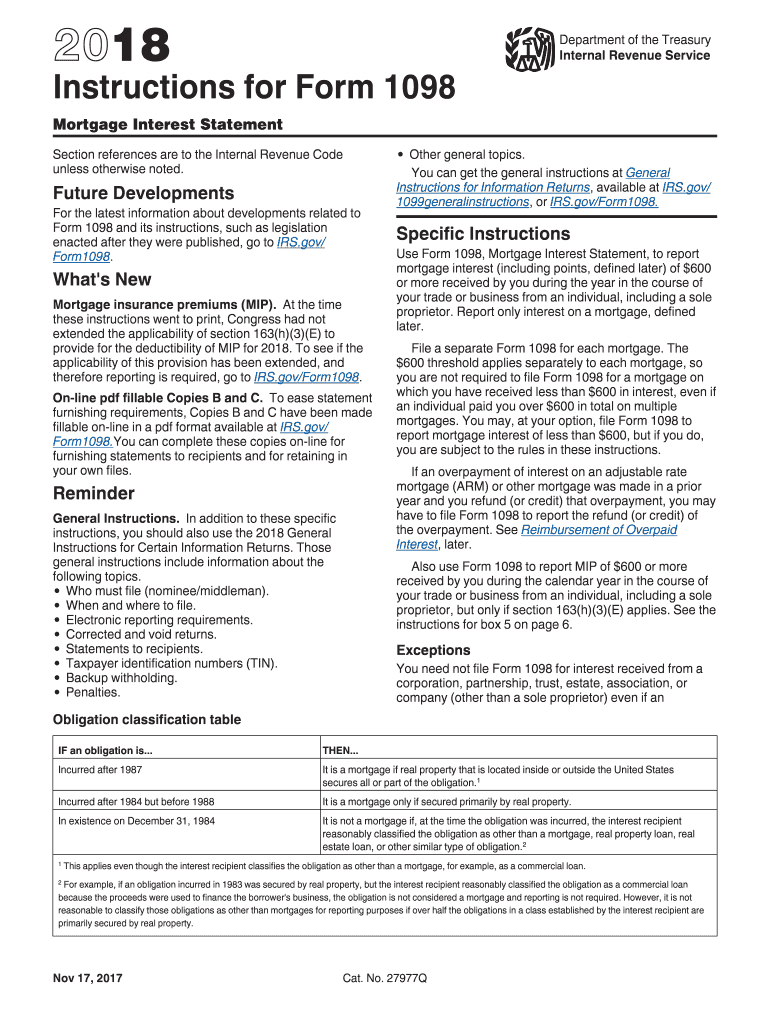

The IRS provides specific guidelines for the use of Tax Form 1098. Taxpayers should refer to the IRS instructions for Form 1098 to understand the requirements for reporting mortgage interest. It is essential to keep records of all interest payments and related documents to substantiate claims made on tax returns. Additionally, the IRS outlines the deadlines for submitting the form and the penalties for incorrect or late submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form 1098 typically align with the annual tax return deadlines. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the interest was paid. Taxpayers should also be aware of the April fifteenth deadline for filing their income tax returns to avoid penalties.

Who Issues the Form

The Tax Form 1098 is issued by mortgage lenders, including banks, credit unions, and other financial institutions. These entities are responsible for reporting the total amount of interest paid by the borrower during the tax year. Borrowers should expect to receive this form by the end of January each year, allowing adequate time to prepare their tax returns.

Quick guide on how to complete 2016 instructions form 1098 2018 2019

Effortlessly Prepare Tax Form 1098 on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to swiftly create, modify, and eSign your documents without delays. Handle Tax Form 1098 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign Tax Form 1098 seamlessly

- Locate Tax Form 1098 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Form 1098 while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 instructions form 1098 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the 2016 instructions form 1098 2018 2019

How to generate an eSignature for the 2016 Instructions Form 1098 2018 2019 in the online mode

How to make an eSignature for the 2016 Instructions Form 1098 2018 2019 in Google Chrome

How to generate an eSignature for putting it on the 2016 Instructions Form 1098 2018 2019 in Gmail

How to create an eSignature for the 2016 Instructions Form 1098 2018 2019 straight from your smart phone

How to make an electronic signature for the 2016 Instructions Form 1098 2018 2019 on iOS

How to generate an eSignature for the 2016 Instructions Form 1098 2018 2019 on Android devices

People also ask

-

What is the Tax Form 1098 and why is it important?

The Tax Form 1098 is used to report mortgage interest payments that homeowners make to lenders. It is important for taxpayers because it can help them claim deductions on their income tax returns. Understanding how to manage your Tax Form 1098 can maximize your tax benefits.

-

How can airSlate SignNow help with Tax Form 1098?

airSlate SignNow simplifies the process of eSigning and sending the Tax Form 1098. With our platform, you can easily prepare, sign, and send this form electronically, ensuring compliance and reducing the time spent on paperwork.

-

What features does airSlate SignNow offer for managing Tax Form 1098?

With airSlate SignNow, you can create templates for the Tax Form 1098, automate workflows, and track the status of your documents. Our user-friendly interface allows for easy editing and collaboration, making tax season less stressful.

-

Is there a cost to use airSlate SignNow for Tax Form 1098?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions are designed to streamline your document management process, including handling the Tax Form 1098 efficiently.

-

Can I integrate airSlate SignNow with other software for Tax Form 1098 management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enabling you to manage your Tax Form 1098 alongside your existing tools. This integration allows for improved workflow and data management.

-

What are the benefits of using airSlate SignNow for Tax Form 1098?

Using airSlate SignNow for your Tax Form 1098 offers numerous benefits, including time savings, enhanced security, and reduced paper usage. Our platform helps ensure that your documents are signed and sent promptly, which can lead to faster tax filing.

-

How secure is airSlate SignNow when handling Tax Form 1098?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your Tax Form 1098 and other sensitive documents. You can trust our platform to keep your data safe and secure.

Get more for Tax Form 1098

Find out other Tax Form 1098

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT