Instructions for Form 1098 Instructions for Form 1098, Mortgage Interest Statement 2020-2026

What is the Form?

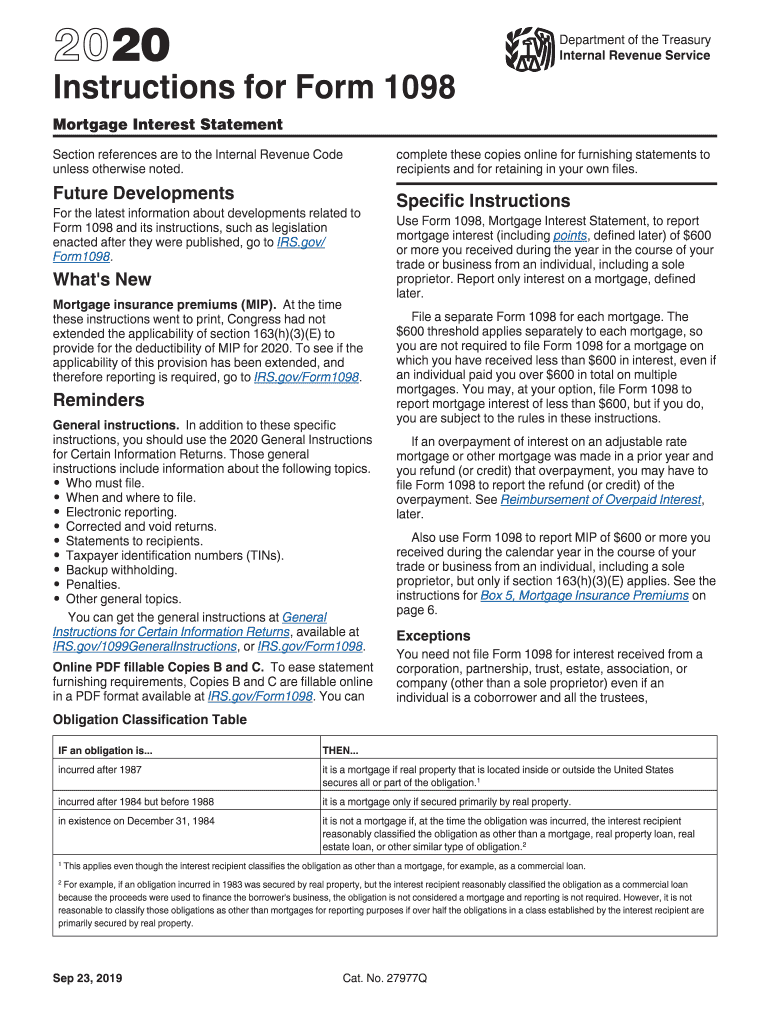

The form, also known as the Mortgage Interest Statement, is a tax document used in the United States. It reports the amount of mortgage interest paid by a borrower during the tax year. Lenders are required to issue this form to borrowers who have paid at least $600 in interest on a mortgage. The information provided on the 1098 form is essential for taxpayers to accurately report their mortgage interest deductions on their federal income tax returns.

Key Elements of the Form

The form includes several critical pieces of information that borrowers need to understand. Key elements include:

- Borrower's Information: This section contains the borrower's name, address, and taxpayer identification number.

- Lender's Information: Details about the lender, including their name, address, and taxpayer identification number, are provided.

- Mortgage Interest Paid: The total amount of interest paid by the borrower during the tax year is clearly stated.

- Points Paid: If applicable, the form will also indicate any points paid on the mortgage, which may be deductible.

- Property Information: The address of the property secured by the mortgage is included.

Steps to Complete the Form

Completing the form involves several straightforward steps:

- Gather Required Information: Collect all necessary documents, including your mortgage statements and any relevant tax documents.

- Fill in Borrower's Information: Enter your name, address, and taxpayer identification number accurately.

- Enter Lender's Information: Provide the lender's details as they appear on the mortgage statement.

- Report Mortgage Interest: Input the total amount of interest paid during the year, as reported by your lender.

- Include Points Paid: If you paid points, ensure they are recorded correctly on the form.

- Review for Accuracy: Double-check all entries for accuracy before submission.

Legal Use of the Form

The form serves a significant legal purpose in the context of U.S. tax law. It provides documentation that supports the mortgage interest deduction claimed by the borrower on their tax return. The IRS requires accurate reporting of this information to ensure compliance with tax regulations. Failure to report the mortgage interest correctly can result in penalties or disallowed deductions during an audit.

Filing Deadlines for the Form

Filing deadlines for the form are crucial to ensure compliance with IRS regulations. Lenders must provide the completed form to borrowers by January thirty-first of the year following the tax year. Borrowers should include the information from the 1098 form when filing their federal income tax returns, which are typically due on April fifteenth. It is essential to adhere to these deadlines to avoid potential penalties.

Obtaining the Form

To obtain the form, borrowers can follow these steps:

- Contact Your Lender: Reach out to your mortgage lender or servicer to request a copy of the form.

- Check Online Portals: Many lenders provide access to tax documents through their online account management systems.

- IRS Website: While the IRS does not provide the form directly, they offer guidance on how to report mortgage interest on your tax return.

Quick guide on how to complete 2020 instructions for form 1098 instructions for form 1098 mortgage interest statement

Complete Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement effortlessly

- Find Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement and click Get Form to begin.

- Make use of the tools we supply to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1098 instructions for form 1098 mortgage interest statement

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1098 instructions for form 1098 mortgage interest statement

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 1098 2018 form, and who needs it?

The 1098 2018 form is a tax form used to report mortgage interest that you paid during the year. Homeowners who paid $600 or more in mortgage interest are typically required to receive this form from their lender. It's essential for accurately filing your taxes.

-

How can airSlate SignNow help with the 1098 2018 form?

airSlate SignNow simplifies the process of managing and eSigning the 1098 2018 form. You can easily upload, send, and sign the required documents securely, ensuring that your tax forms are handled efficiently and without delay.

-

Is there a cost associated with using airSlate SignNow for the 1098 2018 form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. Each plan is cost-effective and designed to provide value when managing essential documents like the 1098 2018 form without incurring unnecessary expenses.

-

What features does airSlate SignNow offer for managing the 1098 2018 form?

airSlate SignNow provides features like customizable templates, secure eSigning, and tracking capabilities, which make it easy to manage the 1098 2018 form. You can streamline your workflow and ensure that all parties have access to the document throughout the signing process.

-

Can I store my completed 1098 2018 form securely with airSlate SignNow?

Absolutely! airSlate SignNow offers secure cloud storage for all your documents, including the completed 1098 2018 form. This ensures that your sensitive information is protected and easily accessible whenever you need it.

-

Does airSlate SignNow integrate with other applications for processing the 1098 2018 form?

Yes, airSlate SignNow integrates seamlessly with popular applications like CRM systems and document management tools. This makes it easier to incorporate the 1098 2018 form into your existing workflows and improves overall efficiency.

-

How can I ensure compliance when using the 1098 2018 form through airSlate SignNow?

airSlate SignNow is designed with compliance in mind, including features that meet industry standards for electronic signatures. By using our platform to manage the 1098 2018 form, you can confidently ensure that your documents are compliant with legal requirements.

Get more for Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement

- Order form for warehouse receipts

- Standard business card layout form

- The craigmore halifax form

- Maintenance request form 244113634

- Odometer disclosure statement atlantic city classic car auction form

- Wwworegongovodotdmvoregon department of transportation vehicle trip permits form

- Daily outdoor safety checklist form

- City of encinitas permits form

Find out other Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed