Form 5330 1998

What is the Form 5330

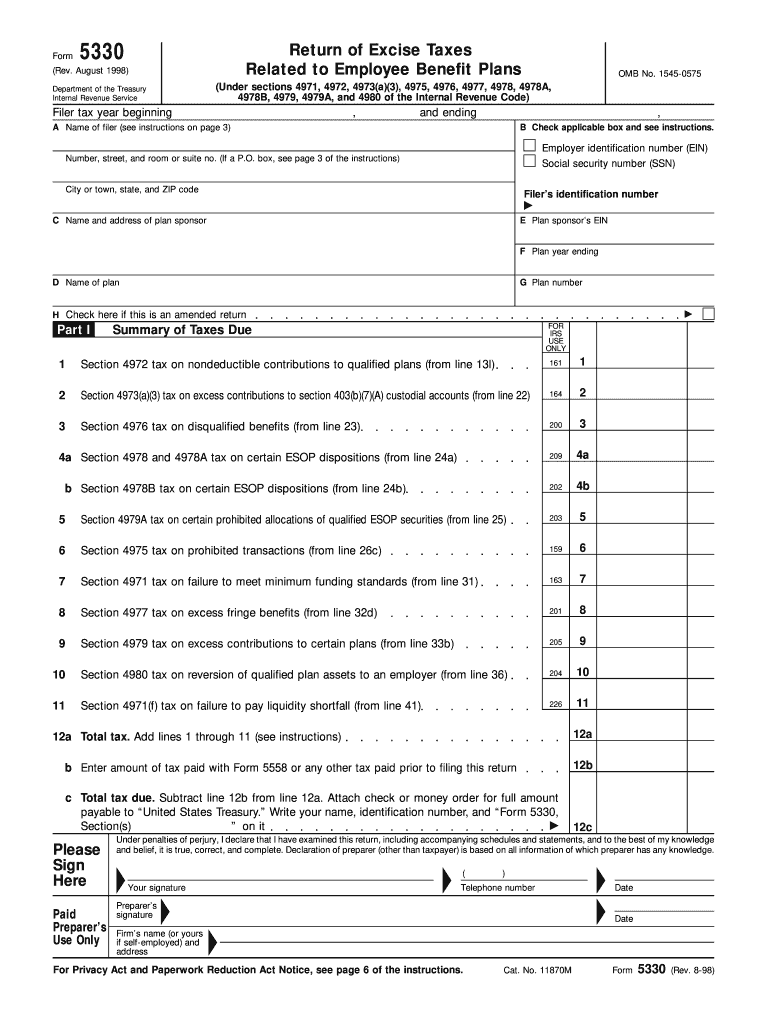

The Form 5330 is a tax form used by employers to report and pay excise taxes related to certain employee benefit plans, specifically for failures related to the Internal Revenue Code. This form is essential for ensuring compliance with tax regulations concerning retirement plans and other employee benefits. It is typically filed by plan administrators or employers who have identified issues such as excess contributions or prohibited transactions within their plans.

How to use the Form 5330

To effectively use the Form 5330, it is important to first identify the specific issue that requires reporting. Common scenarios include excess contributions to retirement plans or failures to meet minimum distribution requirements. Once the issue is identified, gather all necessary information, including details about the plan, the nature of the failure, and the amount of excise tax owed. The form must be completed accurately to avoid penalties, and it should be filed with the IRS by the specified deadline.

Steps to complete the Form 5330

Completing the Form 5330 involves several key steps:

- Gather relevant information about the employee benefit plan.

- Identify the specific failure that necessitates the filing of the form.

- Calculate the excise tax owed based on the nature of the failure.

- Complete the form, ensuring all sections are filled out accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the due date.

Filing Deadlines / Important Dates

The filing deadline for Form 5330 is typically the last day of the seventh month after the end of the plan year in which the failure occurred. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to adhere to these deadlines to avoid incurring additional penalties or interest on unpaid excise taxes.

Penalties for Non-Compliance

Failing to file Form 5330 or submitting it late can result in significant penalties. The IRS imposes a penalty of five percent of the unpaid excise tax for each month the form is late, up to a maximum of 25 percent. Additionally, if the failure is not corrected, further penalties may apply. It is essential to address any issues promptly and file the form accurately to minimize potential penalties.

Legal use of the Form 5330

The Form 5330 is legally binding when completed and submitted according to IRS guidelines. Electronic signatures are accepted, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Using a reliable electronic signature solution ensures that the form is executed legally and securely, maintaining compliance with applicable laws.

Quick guide on how to complete form 5330

Complete Form 5330 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the desired form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Form 5330 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

Steps to edit and eSign Form 5330 with ease

- Find Form 5330 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 5330 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5330

Create this form in 5 minutes!

How to create an eSignature for the form 5330

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is Form 5330 and why is it important?

Form 5330 is a tax return form used to report certain events related to tax-favored retirement plans. It's essential for complying with IRS regulations and avoiding penalties. Utilizing airSlate SignNow can streamline the process of completing and eSigning Form 5330, making it easier for businesses to stay compliant.

-

How can airSlate SignNow help with Form 5330?

airSlate SignNow offers a user-friendly platform that simplifies the eSigning of Form 5330. With features like template creation and automated workflows, you can efficiently manage the signing process. This helps to ensure that Form 5330 is filled out accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for Form 5330?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for single users and teams. By signing up for a plan, you gain access to all features necessary for efficiently managing Form 5330. Visit our pricing page to find the best plan for your requirements.

-

Can I integrate airSlate SignNow with other software for Form 5330 submissions?

Yes, airSlate SignNow integrates seamlessly with various software applications, including CRM and accounting systems. These integrations can streamline the process of filling out and submitting Form 5330, making your workflow more efficient. Check our integration list to see compatible platforms.

-

What security measures does airSlate SignNow implement for Form 5330?

airSlate SignNow prioritizes the security of your documents, including Form 5330, by employing advanced encryption methods and secure data storage. We comply with industry standards to protect sensitive information throughout the eSigning process. Rest assured, your Form 5330 is safe with us.

-

Is airSlate SignNow compliant with regulations for eSigning Form 5330?

Absolutely! airSlate SignNow complies with all relevant eSignature laws, including the ESIGN Act and UETA, making it a legitimate option for signing Form 5330 electronically. This ensures that your electronically signed documents hold up in legal scenarios.

-

What features does airSlate SignNow offer for filling out Form 5330?

airSlate SignNow provides intuitive features such as fillable fields, checkboxes, and electronic signatures specifically designed for Form 5330. These tools help simplify the completion process and reduce errors, allowing for a smoother filing experience. Discover how these features can enhance your document management.

Get more for Form 5330

- Warranty deed for separate or joint property to joint tenancy idaho form

- Warranty deed to separate property of one spouse to both spouses as joint tenants idaho form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries idaho form

- Warranty deed from limited partnership or llc is the grantor or grantee idaho form

- Special warranty deed idaho form

- Idaho ucc3 financing statement amendment addendum idaho form

- Legal last will and testament form for single person with no children idaho

- Legal last will and testament form for a single person with minor children idaho

Find out other Form 5330

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document