Form 5330 Fillable Form 2003

What is the Form 5330 Fillable Form

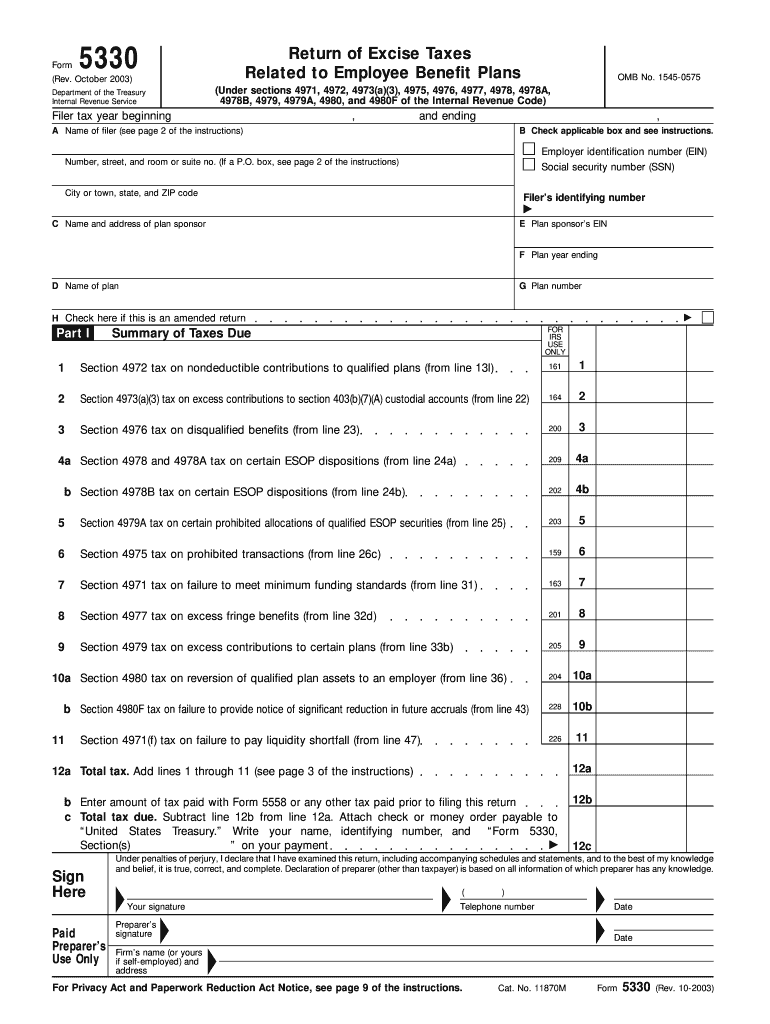

The Form 5330 Fillable Form is a crucial document used by employers and plan administrators to report certain events related to employee benefit plans. Specifically, it is utilized to report excise taxes on prohibited transactions and failures to meet minimum funding standards. This form is essential for ensuring compliance with the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code (IRC). By accurately completing this form, organizations can avoid potential penalties and ensure that their retirement plans remain in good standing.

How to use the Form 5330 Fillable Form

Using the Form 5330 Fillable Form involves several key steps. First, ensure that you have the latest version of the form, which can be filled out electronically. Begin by entering the required information, such as the plan name, employer identification number (EIN), and the type of excise tax being reported. It is important to follow the instructions provided in the form carefully to ensure all sections are completed accurately. Once the form is filled out, it can be e-signed and submitted electronically, streamlining the process and reducing the need for paper documentation.

Steps to complete the Form 5330 Fillable Form

Completing the Form 5330 Fillable Form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Download the latest version of the Form 5330 Fillable Form.

- Gather necessary information, including plan details and tax information.

- Fill out each section of the form, ensuring all required fields are completed.

- Review the form for accuracy, checking for any errors or omissions.

- Sign the form electronically to validate it.

- Submit the completed form electronically or by mail, as appropriate.

Legal use of the Form 5330 Fillable Form

The legal use of the Form 5330 Fillable Form is governed by federal regulations, including ERISA and the IRC. This form must be filed to report specific excise taxes, and failure to do so can result in significant penalties. To ensure legal compliance, it is crucial to understand the requirements for filing and the implications of any reported transactions. The form serves as a formal declaration to the IRS, and accurate completion is vital for maintaining the legality of employee benefit plans.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5330 Fillable Form are critical to avoid penalties. Generally, the form must be filed by the 15th day of the fifth month following the end of the plan year in which the excise tax liability was incurred. For example, if the plan year ends on December 31, the form is due by May 15 of the following year. It is advisable to mark these dates on your calendar and ensure timely submission to maintain compliance and avoid unnecessary fees.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 5330 Fillable Form can lead to severe penalties. The IRS may impose excise taxes for late filings or inaccuracies, which can accumulate quickly. Additionally, failure to report prohibited transactions may result in further legal consequences for the plan administrator or employer. It is essential to understand these penalties and prioritize accurate and timely submission of the form to safeguard against financial repercussions.

Quick guide on how to complete form 5330 fillable form 2003

Complete Form 5330 Fillable Form effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Form 5330 Fillable Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to amend and eSign Form 5330 Fillable Form with ease

- Obtain Form 5330 Fillable Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing out new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 5330 Fillable Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5330 fillable form 2003

Create this form in 5 minutes!

How to create an eSignature for the form 5330 fillable form 2003

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Form 5330 Fillable Form?

The Form 5330 Fillable Form is a document used to report certain events related to underfunded retirement plans to the IRS. This form allows users to easily input their information and submit it electronically. The fillable format simplifies the process, making it easier for businesses to comply with IRS regulations.

-

How can I fill out the Form 5330 Fillable Form?

Filling out the Form 5330 Fillable Form is straightforward with airSlate SignNow. You can select the form from our library, fill in the required fields, and make edits as needed. Once complete, the form can be saved and sent for eSignatures, ensuring a seamless submission process.

-

Is there a cost associated with the Form 5330 Fillable Form?

airSlate SignNow offers competitive pricing for its services, including access to the Form 5330 Fillable Form. We provide various plans to cater to businesses of all sizes, with no hidden fees. This cost-effective solution empowers you to manage your document needs without breaking the bank.

-

What are the benefits of using the Form 5330 Fillable Form?

Using the Form 5330 Fillable Form offers numerous benefits, including convenience, accuracy, and compliance. The fillable format helps reduce errors, and the eSigning feature accelerates the review process. This ensures that your submissions are both timely and legally compliant with IRS requirements.

-

Can I integrate the Form 5330 Fillable Form with other tools?

Yes, airSlate SignNow allows seamless integration with various productivity and business tools. This means you can connect the Form 5330 Fillable Form with your existing software solutions, enhancing your workflow and improving efficiency. Integrations include CRM systems, cloud storage, and more.

-

How secure is the Form 5330 Fillable Form when using airSlate SignNow?

Security is a priority for airSlate SignNow, especially when handling the Form 5330 Fillable Form. We employ advanced encryption and authentication protocols to safeguard your data and documents. This ensures that your sensitive information remains protected throughout the eSigning process.

-

Is the Form 5330 Fillable Form suitable for small businesses?

Absolutely! The Form 5330 Fillable Form is designed to be user-friendly and accessible for businesses of all sizes, including small businesses. airSlate SignNow’s cost-effective solutions make it easier for small enterprises to handle their document needs without extensive resources.

Get more for Form 5330 Fillable Form

- Illinois entry appearance form

- Notice to lessor exercising option to purchase illinois form

- Assignment of lease and rent from borrower to lender illinois form

- Illinois assignment 497306272 form

- Abandoned personal property 497306273 form

- Guaranty or guarantee of payment of rent illinois form

- Letter from landlord to tenant as notice of default on commercial lease illinois form

- Residential or rental lease extension agreement illinois form

Find out other Form 5330 Fillable Form

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast