About Form 5330, Return of Excise Taxes Related to 2021

Understanding Form 5330

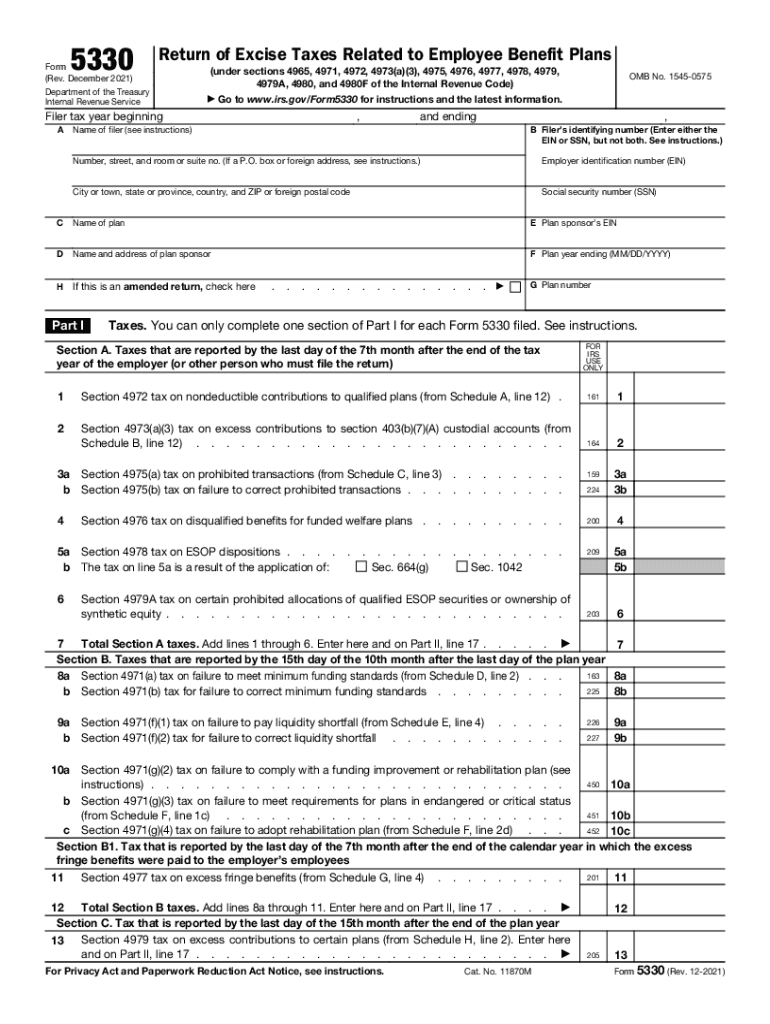

The IRS Form 5330, officially known as the Return of Excise Taxes Related To Employee Benefit Plans, is a crucial document for plan administrators and employers. This form is primarily used to report and pay excise taxes associated with certain employee benefit plans, including those that do not comply with the Internal Revenue Code. It is essential for ensuring that plans meet federal requirements and for avoiding penalties.

Steps to Complete Form 5330

Completing Form 5330 involves several key steps:

- Gather necessary information about the employee benefit plan, including plan details and any applicable excise taxes.

- Fill out the form accurately, ensuring that all required fields are completed, including the identification of the plan and the specific excise tax being reported.

- Calculate the total excise tax owed, applying the correct rates as outlined by the IRS.

- Review the form for accuracy and completeness to prevent delays or issues with processing.

- Submit the form by the due date, ensuring that payment is made for any taxes owed.

Filing Deadlines for Form 5330

Form 5330 has specific filing deadlines that must be adhered to in order to avoid penalties. Generally, the form is due on the last day of the seventh month after the end of the plan year. For example, if the plan year ends on December 31, the form is due by July 31 of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents for Filing Form 5330

When filing Form 5330, certain documents may be required to support the information provided. These may include:

- Plan documents that outline the structure and benefits of the employee benefit plan.

- Records of any prior excise tax payments made for the plan.

- Documentation of compliance efforts and any corrections made to the plan.

Penalties for Non-Compliance with Form 5330

Failure to file Form 5330 on time or inaccuracies in the form can result in significant penalties. The IRS may impose a penalty for late filing, which can accumulate daily until the form is submitted. Additionally, failing to pay the excise tax owed can lead to further financial penalties and interest charges. It is crucial to ensure timely and accurate filing to avoid these consequences.

Digital vs. Paper Version of Form 5330

Form 5330 can be completed and submitted in both digital and paper formats. The digital version offers advantages such as easier calculations and the ability to save progress. However, some may prefer the paper version for its tangible nature. Regardless of the method chosen, it is important to ensure that the form is completed accurately and submitted by the deadline to maintain compliance.

Quick guide on how to complete about form 5330 return of excise taxes related to

Complete About Form 5330, Return Of Excise Taxes Related To effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage About Form 5330, Return Of Excise Taxes Related To on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign About Form 5330, Return Of Excise Taxes Related To with ease

- Obtain About Form 5330, Return Of Excise Taxes Related To and then click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a customary wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign About Form 5330, Return Of Excise Taxes Related To and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 5330 return of excise taxes related to

Create this form in 5 minutes!

How to create an eSignature for the about form 5330 return of excise taxes related to

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What are the form 5330 instructions?

The form 5330 instructions provide detailed guidance on how to complete the IRS Form 5330, which is used to report excise taxes related to employee benefit plans. These instructions outline the information required, filing deadlines, and penalties for late submissions. Understanding these instructions is crucial for compliance with IRS regulations.

-

How can airSlate SignNow help with form 5330 instructions?

airSlate SignNow simplifies the process of filling out form 5330 by allowing you to create and edit documents easily. With its intuitive interface, you can follow the form 5330 instructions step-by-step, ensuring accuracy and compliance. Plus, you can eSign and share the completed forms securely.

-

Are there any costs associated with using airSlate SignNow for form 5330 instructions?

airSlate SignNow offers a cost-effective solution for managing form 5330 instructions. Pricing plans are designed to cater to businesses of all sizes, providing affordable options for document management and eSigning. You can choose a plan that fits your budget and needs.

-

What features does airSlate SignNow offer that support form 5330 instructions?

airSlate SignNow includes features like customizable templates, document editing, eSigning, and real-time collaboration. These features make it easier to adhere to form 5330 instructions while increasing efficiency. Users can also track document status to ensure timely submission.

-

Can I integrate airSlate SignNow with other applications for form 5330 instructions?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Microsoft Office, and many more. These integrations enhance the workflow associated with form 5330 instructions by allowing seamless access to documents and enhancing collaboration across platforms.

-

What are the benefits of using airSlate SignNow for preparing form 5330 instructions?

Using airSlate SignNow for preparing form 5330 instructions streamlines document management and reduces the risk of errors. The platform’s user-friendly design enhances ease of use, making it less time-consuming to prepare necessary forms. Additionally, its eSignature feature speeds up the approval process.

-

Will airSlate SignNow provide updates on form 5330 instructions?

airSlate SignNow is committed to keeping users informed about updates related to form 5330 instructions. You will receive notifications about any changes in IRS filing requirements or deadlines, ensuring that you remain compliant without missing crucial updates.

Get more for About Form 5330, Return Of Excise Taxes Related To

- Plaintiffs petition form

- Answer to plaintiffs petition for divorce louisiana form

- Louisiana answer interrogatories form

- Louisiana answer petition 497308624 form

- Louisiana interdiction 497308625 form

- Allegations petition form

- Answer to intrafamily adoption louisiana form

- Amending petition 497308628 form

Find out other About Form 5330, Return Of Excise Taxes Related To

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement