About Form 5330, Return of Excise Taxes Related ToInstructions for Form 5330 12Internal RevenueInstructions for Form 5330 12Inte 2022-2026

Understanding Form 5330

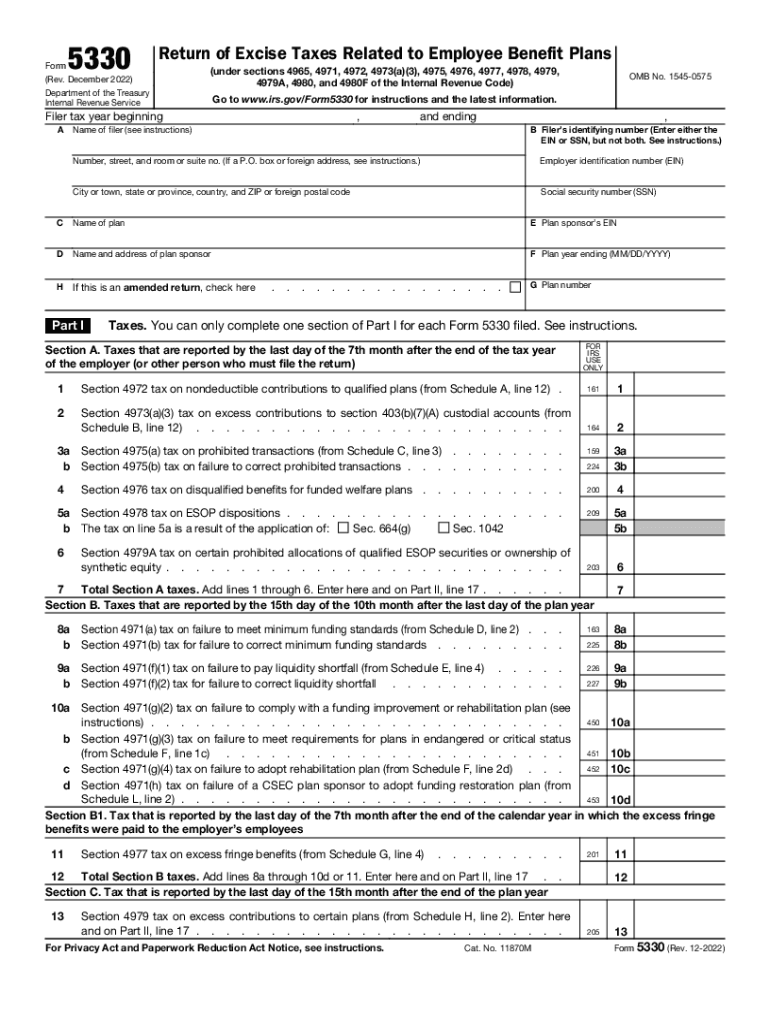

Form 5330, officially known as the Return of Excise Taxes Related to Employee Benefit Plans, is a crucial document for employers managing certain employee benefit plans. This form is primarily used to report and pay excise taxes imposed by the Internal Revenue Service (IRS) for failures related to these plans. Understanding the purpose of Form 5330 helps ensure compliance with federal regulations, avoiding potential penalties and legal issues.

Steps to Complete Form 5330

Completing Form 5330 requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the employee benefit plan, including plan details and any applicable tax liabilities.

- Fill out the form accurately, ensuring all sections are completed. This includes information about the plan sponsor and the specific excise tax being reported.

- Calculate the total excise tax owed based on the reported failures. This calculation is critical to avoid underpayment penalties.

- Review the completed form for accuracy before submission. Mistakes can lead to delays or additional penalties.

- Submit the form by the deadline, which is typically the last day of the seventh month after the end of the plan year.

IRS Guidelines for Form 5330

The IRS provides specific guidelines for completing and submitting Form 5330. These guidelines outline the requirements for reporting excise taxes related to employee benefit plans. Employers should familiarize themselves with the IRS instructions to ensure compliance. Key points include:

- Understanding the types of failures that trigger excise taxes, such as excess contributions or failure to meet minimum distribution requirements.

- Reviewing the applicable tax rates for different types of failures.

- Ensuring timely filing to avoid penalties associated with late submissions.

Filing Deadlines for Form 5330

Adhering to filing deadlines is crucial for compliance with IRS regulations. The deadline for submitting Form 5330 is generally the last day of the seventh month following the end of the plan year. For example, if your plan year ends on December 31, the form must be filed by July 31 of the following year. Late submissions may incur penalties, making timely filing essential.

Penalties for Non-Compliance

Failing to file Form 5330 or submitting it inaccurately can result in significant penalties. The IRS imposes excise taxes for each day the failure continues, which can accumulate quickly. Additionally, employers may face fines for late filings. Understanding these penalties emphasizes the importance of accurate and timely submissions to protect the organization from financial repercussions.

Digital vs. Paper Version of Form 5330

Employers can choose to file Form 5330 either digitally or via paper submission. The digital version offers advantages such as faster processing times and reduced risk of errors. Electronic filing also allows for easier tracking of submissions. However, some employers may prefer paper filing for record-keeping purposes. Regardless of the method chosen, ensuring accuracy and compliance with IRS guidelines is essential.

Quick guide on how to complete about form 5330 return of excise taxes related toinstructions for form 5330 122020internal revenueinstructions for form 5330

Effortlessly Prepare About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the instruments required to create, modify, and electronically sign your documents promptly without delays. Manage About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to Modify and Electronically Sign About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte with Ease

- Acquire About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or mask sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 5330 return of excise taxes related toinstructions for form 5330 122020internal revenueinstructions for form 5330

Create this form in 5 minutes!

How to create an eSignature for the about form 5330 return of excise taxes related toinstructions for form 5330 122020internal revenueinstructions for form 5330

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5330 and why is it important?

Form 5330 is a tax form used by organizations to report certain excise taxes related to employee benefit plans. It is crucial for maintaining compliance with IRS regulations and avoiding potential penalties. By understanding form 5330, businesses can avoid costly mistakes.

-

How can airSlate SignNow assist with form 5330 filing?

airSlate SignNow provides an efficient platform for businesses to upload, eSign, and manage their form 5330 submissions. Our software ensures that documents are securely signed and stored, simplifying the filing process. This makes it easier for organizations to maintain compliance with tax reporting requirements.

-

What features does airSlate SignNow offer for form 5330 preparation?

With airSlate SignNow, users can access features such as customizable templates, electronic signatures, and secure document storage specifically for form 5330 preparation. These tools streamline the process, allowing for faster turnaround times and reducing potential errors. Effortlessly collaborate with your team to ensure accurate filings.

-

Is airSlate SignNow cost-effective for handling form 5330?

Yes, airSlate SignNow is a cost-effective solution for managing form 5330. With flexible pricing plans, businesses can choose the one that fits their needs and budget, minimizing costs associated with paper-based filing. This allows organizations to allocate resources more efficiently.

-

Can airSlate SignNow integrate with other software for form 5330 management?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications, enhancing the management of form 5330 within your existing workflows. This means you can streamline processes, reduce data entry errors, and ensure consistency across all documents.

-

What are the benefits of using airSlate SignNow for form 5330 processing?

Using airSlate SignNow for form 5330 processing offers numerous benefits, including improved efficiency, enhanced security, and reduced turnaround time. Our platform allows for fast electronic signatures and easy document tracking, ensuring that your form 5330 is filed on time without the typical hassles.

-

How secure is airSlate SignNow for handling sensitive form 5330 information?

airSlate SignNow is committed to security and employs advanced encryption methods to protect sensitive form 5330 information. Our platform complies with relevant regulations to ensure that your data is kept safe and confidential. Trust us to safeguard your important documents.

Get more for About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte

Find out other About Form 5330, Return Of Excise Taxes Related ToInstructions For Form 5330 12Internal RevenueInstructions For Form 5330 12Inte

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT