Fillable Form 5330 2013

What is the Fillable Form 5530

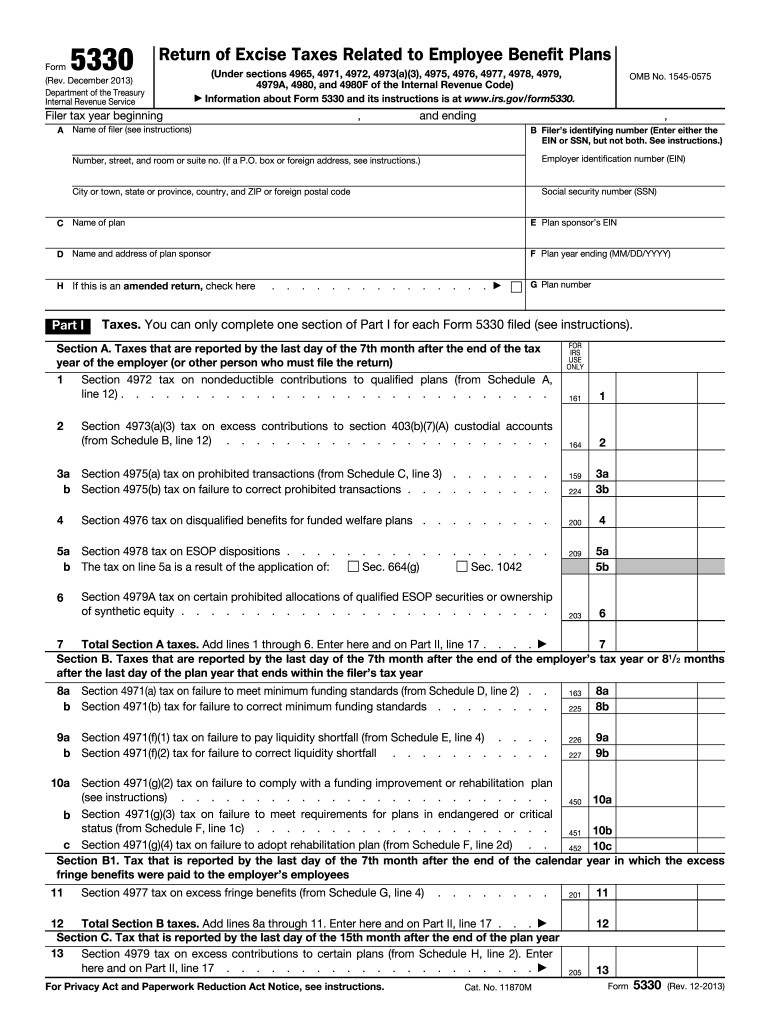

The Fillable Form 5530 is a tax form utilized by certain organizations to report excise taxes related to employee benefit plans. This form is particularly relevant for employers who sponsor self-insured health plans and need to comply with IRS regulations. By completing this form, organizations disclose information about their health coverage and any applicable excise taxes that may be owed. Understanding the purpose of Form 5530 is essential for ensuring compliance with federal tax laws and avoiding potential penalties.

How to Obtain the Fillable Form 5530

To obtain the Fillable Form 5530, individuals and organizations can visit the official IRS website. The form is available for download in a fillable PDF format, allowing users to complete it electronically. Additionally, tax professionals and accountants often have access to the form through tax preparation software. It is important to ensure that you are using the most current version of the form, as updates may occur annually or in response to changes in tax law.

Steps to Complete the Fillable Form 5530

Completing the Fillable Form 5530 involves several key steps:

- Gather necessary information, including details about the health plan and any applicable excise taxes.

- Access the fillable form from the IRS website and open it using a compatible PDF reader.

- Fill in the required fields, ensuring accuracy and completeness.

- Review the form for any errors or omissions before finalizing it.

- Save the completed form for your records and submission.

Following these steps will help ensure that the form is filled out correctly and submitted in accordance with IRS guidelines.

Legal Use of the Fillable Form 5530

The legal use of the Fillable Form 5530 is governed by IRS regulations that require accurate reporting of excise taxes related to employee benefit plans. Organizations must ensure that the information provided on the form is truthful and complete, as inaccuracies can lead to penalties or audits. The form serves as a legal document that may be reviewed by the IRS, making it crucial for organizations to adhere to compliance standards when filling it out.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Form 5530 are typically aligned with the tax year. Organizations must submit the form by the due date specified by the IRS, which is generally the last day of the seventh month following the end of the tax year. It is advisable to check the IRS website for any updates or changes to filing deadlines, as these can vary based on legislative changes or specific circumstances affecting the organization.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Form 5530 can be submitted through various methods, depending on the preferences of the organization and IRS guidelines. The primary submission methods include:

- Online: Some organizations may have the option to file electronically through approved e-filing systems.

- Mail: The completed form can be printed and mailed to the address specified by the IRS for tax submissions.

- In-Person: While less common, some organizations may choose to deliver the form in person to their local IRS office.

Choosing the appropriate submission method is important for ensuring timely and accurate filing of the form.

Quick guide on how to complete fillable form 5330

Accomplish Fillable Form 5330 effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Handle Fillable Form 5330 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to alter and eSign Fillable Form 5330 with ease

- Locate Fillable Form 5330 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Fillable Form 5330 and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form 5330

Create this form in 5 minutes!

How to create an eSignature for the fillable form 5330

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is form 5530 and how is it used?

Form 5530 is a document used by employers to report certain health benefit plans. It provides essential data that the IRS uses to ensure compliance with various regulations. Using airSlate SignNow, you can easily send and eSign your form 5530, streamlining the submission process.

-

How does airSlate SignNow simplify the process of submitting form 5530?

airSlate SignNow offers a user-friendly interface that allows you to fill out and eSign form 5530 in just a few clicks. With automated reminders and secure storage, you can ensure timely submission without hassle. This makes managing your compliance documents much more efficient.

-

Is there a cost associated with using airSlate SignNow for form 5530?

Yes, there are various pricing plans for airSlate SignNow depending on the features you need. However, the solution is often more cost-effective compared to traditional methods of sending and signing documents. Feel free to check out our pricing page for specific plans related to handling form 5530.

-

What features of airSlate SignNow are beneficial for handling form 5530?

airSlate SignNow provides features like templates, document tracking, and team collaboration, making it easier to prepare and manage form 5530. Additionally, you can set up custom workflows to streamline the signing process, which helps in reducing errors and improving efficiency.

-

Can I integrate airSlate SignNow with other software for managing form 5530?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications such as CRMs and project management tools. This means you can easily incorporate form 5530 into your existing workflow, enhancing productivity and maintaining organization.

-

What are the security measures in place when using airSlate SignNow for form 5530?

airSlate SignNow employs advanced security protocols, including encryption and secure access, to protect your data when handling form 5530. This ensures that your sensitive information remains confidential and compliant with applicable regulations.

-

Can multiple users collaborate on form 5530 with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate effectively on form 5530. You can share documents in real-time, making it easier for teams to review, edit, and sign without any physical barriers. This collaborative approach enhances efficiency and accountability.

Get more for Fillable Form 5330

Find out other Fillable Form 5330

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now