Form 941C 1994

What is the Form 941C

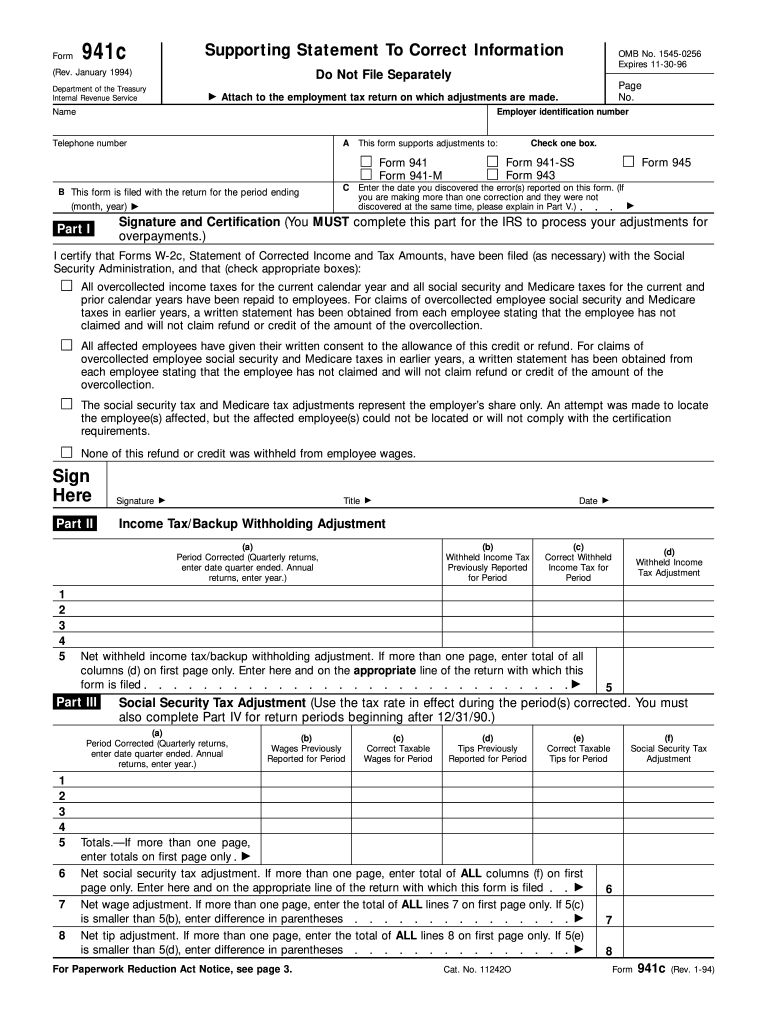

The Form 941C is a tax form used by employers in the United States to correct errors made on previously filed Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring that the IRS has accurate records of an employer's tax obligations. It allows businesses to amend their previous filings and rectify any discrepancies in reported amounts, ensuring compliance with federal tax laws.

How to use the Form 941C

Using the Form 941C involves a straightforward process. Employers should first review their previously submitted Form 941 to identify any errors. Once identified, they can fill out the Form 941C, indicating the corrections needed. It is crucial to provide clear explanations for each correction to avoid confusion. After completing the form, employers must submit it to the IRS, either electronically or by mail, depending on their filing preferences.

Steps to complete the Form 941C

Completing the Form 941C requires careful attention to detail. Follow these steps for accurate completion:

- Review the original Form 941 for errors.

- Obtain a copy of the Form 941C from the IRS website or other reliable sources.

- Fill in the employer information at the top of the form.

- Indicate the specific line items that need correction and provide the correct amounts.

- Explain the reason for each correction in the designated section.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS.

Legal use of the Form 941C

The Form 941C is legally binding when completed and submitted according to IRS guidelines. It must be filled out accurately to ensure compliance with tax regulations. Employers should maintain records of all submitted forms, including the Form 941C, to provide evidence of corrections made. This documentation is essential in case of audits or inquiries from the IRS regarding tax filings.

Filing Deadlines / Important Dates

Timely filing of the Form 941C is crucial to avoid penalties. Generally, the form should be submitted as soon as an error is discovered. However, it is important to adhere to the IRS deadlines for filing Form 941. Employers should be aware of the quarterly deadlines for Form 941 submissions, as corrections should be made within the appropriate tax period to ensure compliance and avoid additional interest or penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941C. The preferred method is electronic filing, which can be done through authorized e-file providers. This method is faster and allows for immediate confirmation of receipt. Alternatively, employers can mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not recommended, but employers can visit local IRS offices for assistance if needed.

Quick guide on how to complete form 941c

Effortlessly prepare Form 941C on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and store it securely online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Handle Form 941C on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 941C effortlessly

- Locate Form 941C and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, whether via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 941C and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941c

Create this form in 5 minutes!

How to create an eSignature for the form 941c

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is Form 941C and how does it relate to airSlate SignNow?

Form 941C is a document used to correct errors on previously filed Form 941. airSlate SignNow simplifies the process of completing and eSigning Form 941C, making it easy for businesses to manage their payroll tax responsibilities efficiently.

-

How can airSlate SignNow help with filing Form 941C?

With airSlate SignNow, businesses can create, edit, and eSign Form 941C seamlessly. Our platform provides templates and guidance, ensuring that users can fill out the form accurately and submit it on time, reducing the risk of errors or delays.

-

Is there a cost associated with using airSlate SignNow for Form 941C?

Yes, airSlate SignNow offers various pricing plans to meet different business needs. Our cost-effective solutions ensure that you only pay for the features you require, helping you manage your Form 941C filings without breaking the bank.

-

What features does airSlate SignNow offer for handling Form 941C?

airSlate SignNow includes features like customizable templates, secure eSigning, and document management tools tailored specifically for Form 941C. These features streamline the filing process, making it convenient for users to manage their tax forms digitally.

-

Are there any integrations available with airSlate SignNow for Form 941C?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, allowing easy import and export of data related to Form 941C. This integration helps ensure accurate information on your tax forms and enhances overall workflow efficiency.

-

Can I track the status of my Form 941C using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form 941C submissions in real-time. Knowing where your document stands helps you maintain compliance with deadlines and follow up as necessary.

-

Is airSlate SignNow secure for eSigning Form 941C?

Yes, security is a top priority for airSlate SignNow. Our platform uses advanced encryption and authentication methods to ensure that your eSigned Form 941C is safe and secure, protecting sensitive information throughout the process.

Get more for Form 941C

- Trustee trustees form

- Final waiver form 497306014

- Quitclaim deed from corporation to corporation illinois form

- Warranty deed from corporation to corporation illinois form

- Illinois day notice template form

- Quitclaim deed from corporation to two individuals illinois form

- Warranty deed from corporation to two individuals illinois form

- Illinois modification form

Find out other Form 941C

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors