Qualified Subhapter S Subsidiaries Form 8869 2000

What is the Qualified Subhapter S Subsidiaries Form 8869

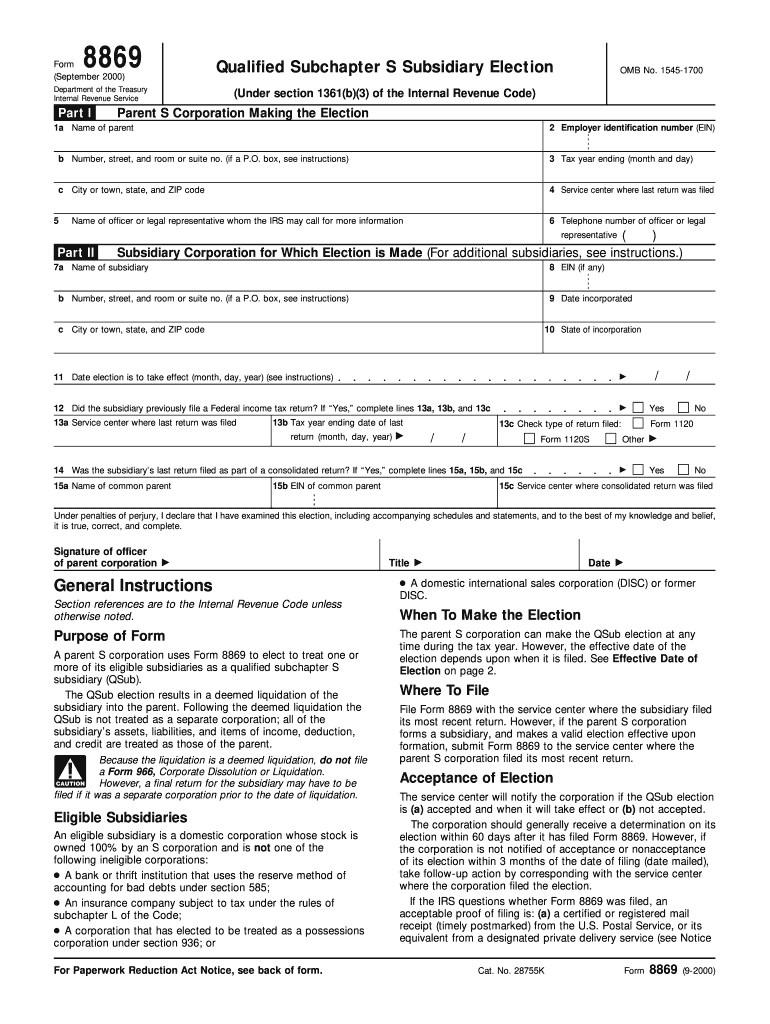

The Qualified Subchapter S Subsidiaries Form 8869 is a tax form used by corporations in the United States to elect to treat certain subsidiaries as Qualified Subchapter S Subsidiaries (QSub). This designation allows the parent S corporation to include the income, deductions, and credits of the subsidiary directly on its own tax return, simplifying the tax process. The form must be filed with the Internal Revenue Service (IRS) to ensure that the subsidiary is recognized as a QSub for tax purposes.

How to use the Qualified Subchapter S Subsidiaries Form 8869

Using the Qualified Subchapter S Subsidiaries Form 8869 involves several steps. First, the parent S corporation must determine if it meets the eligibility criteria to elect QSub status for its subsidiary. Once eligibility is confirmed, the corporation should complete the form accurately, providing necessary information about the parent and subsidiary entities. After filling out the form, it must be submitted to the IRS, typically alongside the parent corporation's tax return. It is crucial to ensure that all information is correct to avoid potential issues with the IRS.

Steps to complete the Qualified Subchapter S Subsidiaries Form 8869

Completing the Qualified Subchapter S Subsidiaries Form 8869 involves the following steps:

- Gather necessary information about the parent S corporation and the subsidiary, including names, addresses, and Employer Identification Numbers (EINs).

- Indicate the election to treat the subsidiary as a QSub by checking the appropriate box on the form.

- Provide details about the ownership structure, confirming that the parent S corporation owns 100% of the subsidiary.

- Sign and date the form, ensuring that it is submitted within the required timeframe to the IRS.

Legal use of the Qualified Subchapter S Subsidiaries Form 8869

The legal use of the Qualified Subchapter S Subsidiaries Form 8869 is essential for compliance with IRS regulations. By filing this form, the parent S corporation formally elects to treat its subsidiary as a QSub, which has implications for tax reporting and liability. The form must be filed within a specified period following the formation of the subsidiary or the beginning of the tax year. Failure to file the form correctly or on time can result in the subsidiary not being recognized as a QSub, leading to potential tax complications.

Filing Deadlines / Important Dates

Filing deadlines for the Qualified Subchapter S Subsidiaries Form 8869 are critical for maintaining compliance. The form must generally be filed by the due date of the parent S corporation's tax return, including extensions. If the parent corporation is filing for a new subsidiary, the election must be made by the due date of the return for the year in which the subsidiary was acquired or formed. It is advisable to keep track of these dates to avoid penalties and ensure proper tax treatment.

Eligibility Criteria

To qualify for the Qualified Subchapter S Subsidiaries Form 8869, certain eligibility criteria must be met. The parent corporation must be an S corporation, and it must own 100% of the subsidiary's stock. The subsidiary must also be a domestic corporation and cannot have any nonresident alien shareholders. Additionally, the subsidiary must not be an ineligible corporation, such as a financial institution or an insurance company. Meeting these criteria is essential for a successful election to QSub status.

Quick guide on how to complete qualified subhapter s subsidiaries form 8869 2000

Complete Qualified Subhapter S Subsidiaries Form 8869 effortlessly on any device

Online document management has become increasingly prevalent among organizations and individuals. It serves as a brilliant eco-friendly alternative to traditional printed and signed forms, allowing you to obtain the necessary document and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Qualified Subhapter S Subsidiaries Form 8869 on any device with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to edit and eSign Qualified Subhapter S Subsidiaries Form 8869 with ease

- Find Qualified Subhapter S Subsidiaries Form 8869 and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Qualified Subhapter S Subsidiaries Form 8869 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct qualified subhapter s subsidiaries form 8869 2000

Create this form in 5 minutes!

How to create an eSignature for the qualified subhapter s subsidiaries form 8869 2000

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Qualified Subhapter S Subsidiaries Form 8869?

The Qualified Subhapter S Subsidiaries Form 8869 is a tax form used by S corporations to elect for their subsidiaries to be treated as qualified subchapter S subsidiaries. This form allows for the consolidation of tax reporting, simplifying the process for businesses. Understanding the implications of using Form 8869 is crucial for compliant financial management.

-

How does airSlate SignNow help with the Qualified Subhapter S Subsidiaries Form 8869?

airSlate SignNow offers an efficient solution for completing and signing the Qualified Subhapter S Subsidiaries Form 8869 electronically. Our platform streamlines the document preparation process, ensuring that forms are filled accurately and signed in a timely manner. This reduces the risk of errors and enhances your workflow efficiency.

-

Is airSlate SignNow a cost-effective option for managing the Qualified Subhapter S Subsidiaries Form 8869?

Yes, airSlate SignNow provides a cost-effective solution for managing the Qualified Subhapter S Subsidiaries Form 8869. With our competitive pricing and robust features, businesses can save on operational costs while ensuring compliance with tax regulations. Our platform offers various plans to suit different business needs.

-

What features does airSlate SignNow offer for the Qualified Subhapter S Subsidiaries Form 8869?

airSlate SignNow includes features such as electronic signatures, secure storage, and customizable templates specifically for the Qualified Subhapter S Subsidiaries Form 8869. These features enhance productivity by making document management simpler and more efficient. Additionally, users can track document statuses and receive notifications.

-

Can I integrate airSlate SignNow with other software for the Qualified Subhapter S Subsidiaries Form 8869?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, providing flexibility when handling the Qualified Subhapter S Subsidiaries Form 8869. This integration capability allows users to enhance their document workflows and ensure smoother data transfer between systems, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for my Qualified Subhapter S Subsidiaries Form 8869?

Utilizing airSlate SignNow for the Qualified Subhapter S Subsidiaries Form 8869 offers numerous benefits including time savings, increased accuracy, and improved compliance. Our platform's intuitive interface enables users to complete documentation quickly while maintaining adherence to IRS regulations. Enhanced collaboration features also facilitate communication within teams.

-

Is customer support available for issues related to the Qualified Subhapter S Subsidiaries Form 8869?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any issues related to the Qualified Subhapter S Subsidiaries Form 8869. Our dedicated support team is available via live chat and email to help you navigate any challenges. We ensure that you have the resources needed for a smooth experience with our platform.

Get more for Qualified Subhapter S Subsidiaries Form 8869

- Enhanced life estate or lady bird deed two individuals husband and wife to two individuals husband and wife florida form

- Quitclaim deed husband wife and an individual to husband and wife florida form

- Warranty deed for form

- Summons form

- Lis pendens 497302865 form

- Quitclaim deed corporation to three individuals florida form

- Deed time share form

- Florida quitclaim deed 497302868 form

Find out other Qualified Subhapter S Subsidiaries Form 8869

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe