Qualified Subhapter S Subsidiaries Form 8869 2013

What is the Qualified Subhapter S Subsidiaries Form 8869

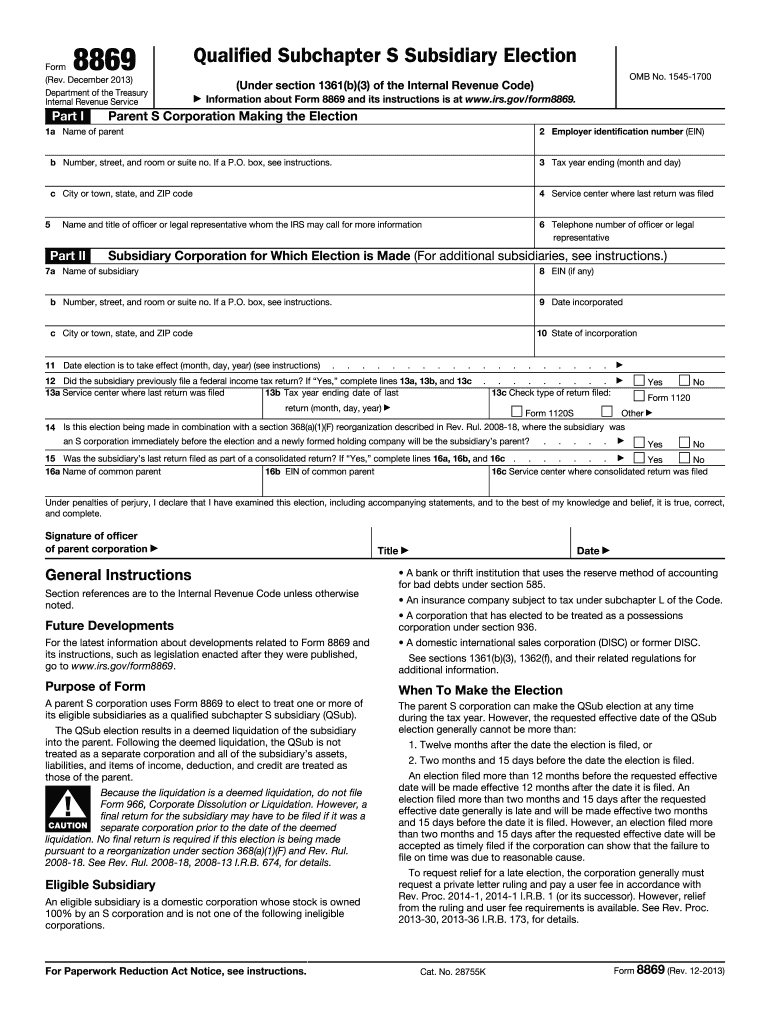

The Qualified Subchapter S Subsidiaries Form 8869 is a tax form used by corporations in the United States that elect to treat certain subsidiaries as qualified subchapter S subsidiaries (QSSS). This designation allows the parent S corporation to include the income, deductions, and credits of the subsidiary on its tax return. By filing Form 8869, the parent corporation can simplify its tax reporting and ensure compliance with IRS regulations regarding QSSS status.

How to use the Qualified Subhapter S Subsidiaries Form 8869

To use Form 8869 effectively, a corporation must first ensure that it meets the eligibility criteria for a QSSS. The form requires detailed information about the parent S corporation and the subsidiary, including their names, addresses, and Employer Identification Numbers (EINs). Once completed, the form must be filed with the IRS to officially elect QSSS status for the subsidiary. It is important to retain a copy of the form for your records, as it may be needed for future tax filings or audits.

Steps to complete the Qualified Subhapter S Subsidiaries Form 8869

Completing Form 8869 involves several key steps:

- Gather necessary information about the parent S corporation and the subsidiary, including names, addresses, and EINs.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS by the appropriate deadline.

Legal use of the Qualified Subhapter S Subsidiaries Form 8869

The legal use of Form 8869 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. Additionally, the parent S corporation must maintain compliance with all relevant tax laws and regulations. Failure to comply can result in penalties and loss of QSSS status, which could have significant tax implications for the corporation.

Key elements of the Qualified Subhapter S Subsidiaries Form 8869

Key elements of Form 8869 include:

- Identification of the parent S corporation and the subsidiary.

- Election statement indicating the intent to treat the subsidiary as a QSSS.

- Signature of an authorized representative of the parent corporation.

- Filing date and any applicable extensions.

Filing Deadlines / Important Dates

Filing deadlines for Form 8869 are critical to maintaining QSSS status. The form must be filed with the IRS by the 15th day of the third month following the end of the tax year for which the election is being made. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations should also be aware of any extensions that may apply to their specific situation.

Quick guide on how to complete qualified subhapter s subsidiaries form 8869 2013

Prepare Qualified Subhapter S Subsidiaries Form 8869 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Qualified Subhapter S Subsidiaries Form 8869 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Qualified Subhapter S Subsidiaries Form 8869 without any hassle

- Find Qualified Subhapter S Subsidiaries Form 8869 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Qualified Subhapter S Subsidiaries Form 8869 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct qualified subhapter s subsidiaries form 8869 2013

Create this form in 5 minutes!

How to create an eSignature for the qualified subhapter s subsidiaries form 8869 2013

How to generate an electronic signature for the Qualified Subhapter S Subsidiaries Form 8869 2013 in the online mode

How to create an electronic signature for the Qualified Subhapter S Subsidiaries Form 8869 2013 in Chrome

How to make an electronic signature for signing the Qualified Subhapter S Subsidiaries Form 8869 2013 in Gmail

How to create an eSignature for the Qualified Subhapter S Subsidiaries Form 8869 2013 from your mobile device

How to make an electronic signature for the Qualified Subhapter S Subsidiaries Form 8869 2013 on iOS

How to create an electronic signature for the Qualified Subhapter S Subsidiaries Form 8869 2013 on Android OS

People also ask

-

What is the Qualified Subhapter S Subsidiaries Form 8869?

The Qualified Subhapter S Subsidiaries Form 8869 is a tax form used by S corporations to elect to treat eligible subsidiaries as Qualified Subchapter S subsidiaries. This form allows businesses to simplify their tax reporting and ensure compliance with IRS regulations. By utilizing Form 8869, companies can streamline their tax obligations.

-

How can airSlate SignNow help with the Qualified Subhapter S Subsidiaries Form 8869?

airSlate SignNow provides an efficient platform for managing and electronically signing the Qualified Subchapter S Subsidiaries Form 8869. By using our intuitive eSigning solution, businesses can ensure their forms are completed accurately and submitted on time. We empower you to focus on your business while we handle the paperwork.

-

Are there any costs associated with using airSlate SignNow for Form 8869?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs, including features to assist with the Qualified Subhapter S Subsidiaries Form 8869. Our plans are designed to be cost-effective while providing essential tools for document management and eSigning. You can choose a plan that fits your budget and requirements.

-

What features of airSlate SignNow assist with Form 8869?

airSlate SignNow includes features such as document templates, real-time collaboration, and mobile access when dealing with the Qualified Subhapter S Subsidiaries Form 8869. These tools enhance your ability to create and manage documents easily, ensuring that everything is in order for submission. Our user-friendly interface streamlines the entire process.

-

Can airSlate SignNow integrate with my existing systems for Form 8869?

Yes, airSlate SignNow offers various integrations with popular business applications, making it easy to incorporate the Qualified Subhapter S Subsidiaries Form 8869 into your current workflow. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect seamlessly. This ensures a smooth experience when handling your documents.

-

What benefits does airSlate SignNow provide for managing Form 8869?

Using airSlate SignNow for the Qualified Subhapter S Subsidiaries Form 8869 brings numerous benefits, including time savings, improved accuracy, and enhanced security. Our digital signing and document management tools reduce the risk of errors while making it easier to organize and access important forms. This allows you to focus on growing your business.

-

Is airSlate SignNow secure for handling sensitive information in Form 8869?

Absolutely, airSlate SignNow takes security very seriously. We implement advanced encryption and security protocols to protect sensitive information contained in the Qualified Subhapter S Subsidiaries Form 8869. Your data is secure with us, ensuring that you can manage your documents with confidence.

Get more for Qualified Subhapter S Subsidiaries Form 8869

Find out other Qualified Subhapter S Subsidiaries Form 8869

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation