Form 8869 Rev December Qualified Subchapter S Subsidiary Election 2020-2026

Understanding the Form 8869 for Qualified Subchapter S Subsidiary Election

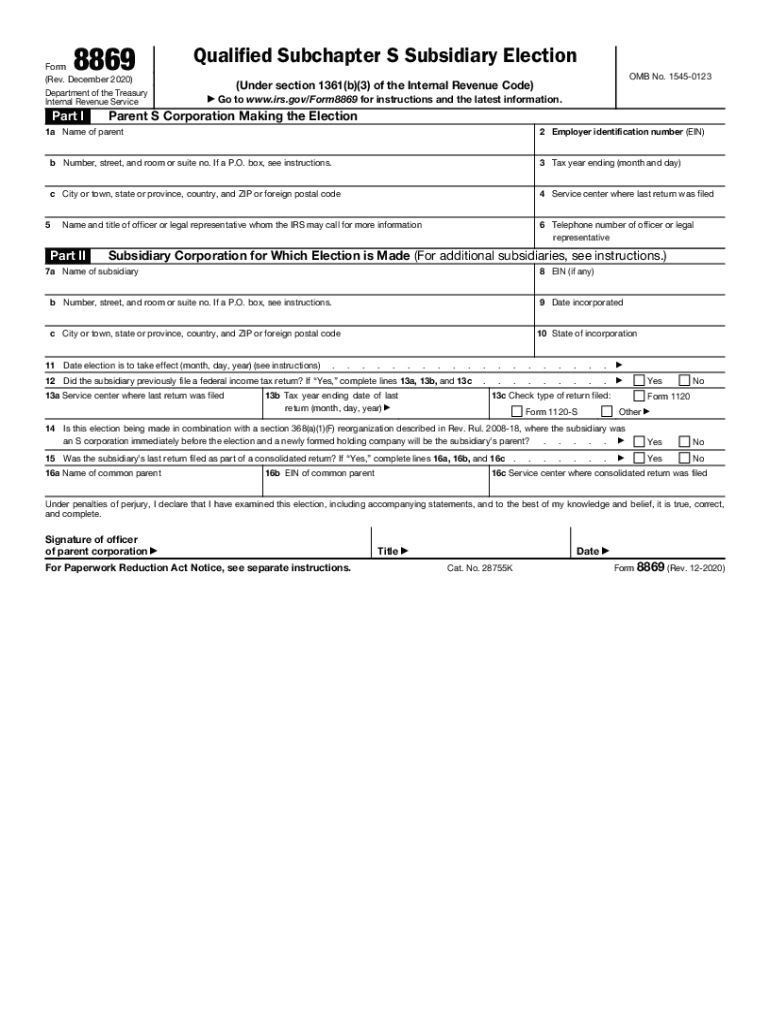

The Form 8869, titled "Qualified Subchapter S Subsidiary Election," is a crucial document for businesses seeking to elect a qualified subsidiary under Subchapter S of the Internal Revenue Code. This form allows a parent S corporation to treat certain subsidiaries as qualified subchapter S subsidiaries (QSub). By filing this form, the parent corporation can simplify its tax reporting and potentially reduce its overall tax liability. It is essential for entities that want to maintain the tax benefits of S corporation status while managing multiple subsidiaries.

Steps to Complete the Form 8869

Completing the Form 8869 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the parent S corporation and the subsidiary. This includes names, addresses, and Employer Identification Numbers (EINs). Next, accurately fill in the required sections of the form, ensuring that all details are correct. It is important to provide the date of the election and any other relevant information as specified in the form instructions. Finally, review the completed form for accuracy before submitting it to the IRS.

Legal Use of the Form 8869

The legal use of Form 8869 is governed by IRS regulations, which stipulate that the election must be made for a subsidiary to be treated as a QSub. This election allows the income, deductions, and credits of the subsidiary to be reported on the parent corporation's tax return, simplifying the tax process. To ensure the election is valid, it is crucial that the form is filed correctly and within the designated time frame. Failure to comply with these regulations can result in the loss of the QSub status and potential tax implications.

Filing Deadlines for Form 8869

Timely filing of Form 8869 is essential to ensure that the election is effective for the desired tax year. Generally, the form must be filed by the 15th day of the third month following the close of the tax year for which the election is to take effect. For example, if a corporation's tax year ends on December 31, the form must be filed by March 15 of the following year. It is advisable to check the IRS guidelines for any updates on deadlines and ensure that the form is submitted on time to avoid complications.

Eligibility Criteria for Form 8869

To be eligible to file Form 8869, the parent corporation must be an S corporation, and the subsidiary must meet specific criteria set by the IRS. The subsidiary must be a domestic corporation and must not have more than one class of stock. Additionally, the parent corporation must own at least 80% of the subsidiary's stock. Understanding these eligibility criteria is vital for businesses considering the QSub election, as non-compliance can lead to disqualification and potential tax consequences.

Obtaining the Form 8869

Form 8869 can be obtained directly from the IRS website or through various tax preparation software that includes IRS forms. It is important to ensure that the most current version of the form is used, as tax laws and requirements may change. Businesses should review the IRS instructions accompanying the form to ensure all necessary information is included and that the form is completed correctly.

Quick guide on how to complete form 8869 rev december 2020 qualified subchapter s subsidiary election

Complete Form 8869 Rev December Qualified Subchapter S Subsidiary Election effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 8869 Rev December Qualified Subchapter S Subsidiary Election on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to edit and electronically sign Form 8869 Rev December Qualified Subchapter S Subsidiary Election with ease

- Locate Form 8869 Rev December Qualified Subchapter S Subsidiary Election and click Get Form to initiate the process.

- Make use of the tools we provide to finish your form.

- Emphasize pertinent sections of your documents or conceal sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign option, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Form 8869 Rev December Qualified Subchapter S Subsidiary Election and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8869 rev december 2020 qualified subchapter s subsidiary election

Create this form in 5 minutes!

How to create an eSignature for the form 8869 rev december 2020 qualified subchapter s subsidiary election

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What features does airSlate SignNow offer for managing documents related to the 2020 s election?

airSlate SignNow provides a range of features to manage your documents effectively during the 2020 s election. With customizable templates and intuitive workflows, you can streamline the process of collecting signatures and sending documents. This ensures that you stay organized and compliant with election-related documentation needs.

-

How can airSlate SignNow help with compliance issues in the context of the 2020 s election?

Using airSlate SignNow can mitigate compliance issues surrounding the 2020 s election by providing an audit trail for all signed documents. This transparency is crucial for ensuring that all signatures are valid and that your documents adhere to legal requirements. Our platform offers secure storage, making it easy to keep track of all election-related documentation.

-

What are the pricing plans for airSlate SignNow for organizations preparing for the 2020 s election?

airSlate SignNow offers flexible pricing plans suitable for various organizations gearing up for the 2020 s election. Whether you’re a small business or a large corporation, you can choose a plan that best fits your needs without compromising on features. Monthly subscriptions and discounts for annual payments are available, making it a cost-effective choice.

-

Is airSlate SignNow easy to integrate with other tools while preparing for the 2020 s election?

Yes, airSlate SignNow easily integrates with a variety of third-party applications, which is especially beneficial during the 2020 s election season. This integration allows for seamless workflow management across platforms, helping you stay efficient. You can connect it with popular services like Google Drive and Salesforce for enhanced productivity.

-

Can airSlate SignNow support remote teams during the 2020 s election?

Absolutely! airSlate SignNow supports remote teams effectively as you navigate through the 2020 s election period. With its cloud-based platform, your team can access documents and collaborate from anywhere. This ensures that everyone stays aligned and no critical tasks are delayed, regardless of location.

-

How does airSlate SignNow enhance the workflow for document signing related to the 2020 s election?

airSlate SignNow enhances workflow for document signing during the 2020 s election by automating key processes. You can set reminders, track document status in real-time, and receive instant notifications when documents are signed. This efficiency signNowly speeds up the overall process, ensuring timely completion of essential election-related paperwork.

-

What security measures does airSlate SignNow use for documents associated with the 2020 s election?

Security is a top priority for airSlate SignNow, especially for documents related to the sensitive nature of the 2020 s election. We implement advanced encryption, multi-factor authentication, and compliance with industry standards to protect your information. You can sign documents with confidence, knowing that they remain secure and confidential.

Get more for Form 8869 Rev December Qualified Subchapter S Subsidiary Election

- Wyoming notice form 497432443

- Affidavit to allow service by publication wyoming 497432444 form

- Affidavit following service by publication wyoming 497432445 form

- Reply counterclaim 497432446 form

- Application for entry of default wyoming 497432447 form

- Affidavit of plaintiff in support of default wyoming form

- Entry of default wyoming 497432449 form

- Wyoming waiver form

Find out other Form 8869 Rev December Qualified Subchapter S Subsidiary Election

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself