8869 Form 2017

What is the 8869 Form

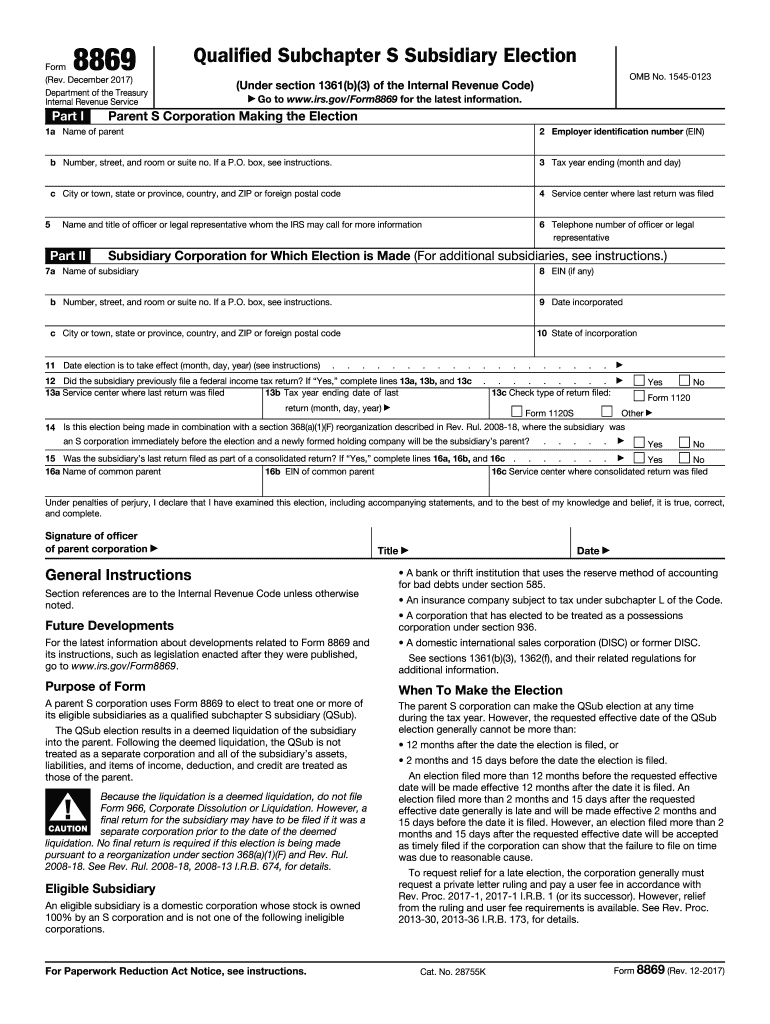

The 8869 form, officially known as the Qualified Subchapter S Subsidiary Election form, is a crucial document used by businesses in the United States. This form allows an eligible corporation to elect to treat a subsidiary as a qualified subchapter S subsidiary (QSub). By making this election, the subsidiary's income, deductions, and credits are treated as part of the parent S corporation, which can provide significant tax benefits.

How to use the 8869 Form

Using the 8869 form involves several key steps. First, ensure that your corporation meets the eligibility requirements to file as an S corporation. Next, fill out the form accurately, providing all necessary information about the parent corporation and the subsidiary. Once completed, submit the form to the IRS by the specified deadline to ensure the election is effective for the intended tax year.

Steps to complete the 8869 Form

Completing the 8869 form requires attention to detail. Here are the essential steps:

- Gather necessary information about the parent corporation and the subsidiary.

- Indicate the tax year for which the election is being made.

- Provide the names, addresses, and employer identification numbers (EINs) for both entities.

- Sign and date the form, ensuring that the authorized representative of the parent corporation completes this section.

- Submit the form to the IRS by the due date for it to be effective.

Legal use of the 8869 Form

The legal use of the 8869 form is governed by IRS regulations. When properly completed and submitted, the form allows the parent S corporation to elect QSub status for its subsidiary. This election must be made in compliance with IRS guidelines to ensure that the benefits of the election are valid. Failure to adhere to these guidelines may result in the election being denied.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 8869 form. It is essential to review these guidelines thoroughly to ensure compliance. The guidelines outline eligibility criteria, required information, and deadlines for submission. Adhering to these regulations helps avoid penalties and ensures that the election is recognized by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 8869 form are critical to the election's effectiveness. The form must be submitted to the IRS by the due date of the tax return for the parent S corporation for the year in which the election is to be effective. It is advisable to check the IRS calendar for specific dates and to plan accordingly to avoid missing the deadline.

Quick guide on how to complete 8869 form

Prepare 8869 Form effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can find the right template and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage 8869 Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

How to modify and electronically sign 8869 Form with ease

- Obtain 8869 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow accommodates your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 8869 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8869 form

Create this form in 5 minutes!

How to create an eSignature for the 8869 form

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is an 8869 form fillable?

The 8869 form fillable is a form used by taxpayers to request an extension of time to file certain tax returns. This electronic version allows for quick completion and submission, streamlining the extension process. Using an 8869 form fillable ensures that you easily meet deadlines and maintain compliance.

-

How can I access the 8869 form fillable?

You can access the 8869 form fillable directly through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and select the 8869 form template. This user-friendly interface makes it simple to obtain the necessary document for filing.

-

Is there a cost associated with using the 8869 form fillable?

AirSlate SignNow offers a cost-effective solution for managing forms, including the 8869 form fillable. While basic access may be free, premium features that enhance functionality and efficiency are available for a subscription fee. Check our pricing page for detailed subscription options.

-

What features does the 8869 form fillable include?

The 8869 form fillable includes features such as auto-fill personal information, electronic signature capabilities, and cloud storage for easy access. These features make the completion and submission of the form faster and more efficient. Plus, you can track the status of your submissions within the platform.

-

How does using the 8869 form fillable benefit my tax filing process?

Using the 8869 form fillable simplifies the tax filing process by reducing paperwork and potential errors. It allows you to complete forms electronically with minimal hassle. This facilitates a smoother experience, ensuring your extension requests are submitted accurately and on time.

-

Can I integrate the 8869 form fillable with other software tools?

Yes, airSlate SignNow offers integrations with various accounting and document management software, allowing you to seamlessly incorporate the 8869 form fillable into your existing workflow. This enables better data synchronization and management, enhancing your overall productivity.

-

Is the 8869 form fillable secure?

Absolutely! The 8869 form fillable on airSlate SignNow is designed with robust security protocols to protect your sensitive information. With SSL encryption and secure servers, you can trust that your data remains private and protected during the submission process.

Get more for 8869 Form

Find out other 8869 Form

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later