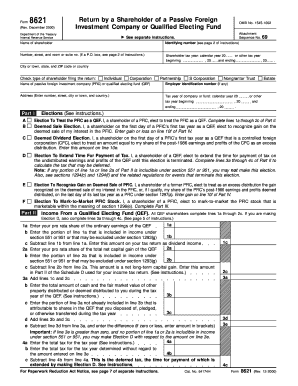

Form 8621 2000

What is the Form 8621

The Form 8621 is a tax form used by U.S. taxpayers to report information regarding their interests in certain foreign corporations. Specifically, it is utilized by shareholders of Passive Foreign Investment Companies (PFICs). This form is essential for ensuring compliance with U.S. tax laws and for reporting income derived from these foreign entities. Understanding the requirements and implications of this form is crucial for taxpayers who hold investments in foreign corporations.

Steps to complete the Form 8621

Filling out the Form 8621 involves several important steps to ensure accuracy and compliance. The process typically includes:

- Gathering relevant financial information about the foreign corporation, including income statements and balance sheets.

- Determining your status as a shareholder and the type of income you need to report.

- Completing the required sections of the form based on the information collected.

- Reviewing the completed form for accuracy before submission.

Each section of the form requires specific details, so careful attention to the instructions is necessary to avoid errors.

How to use the Form 8621

The Form 8621 is used primarily for reporting purposes. Taxpayers must file this form if they are shareholders in a PFIC and need to report income, gains, or distributions from that corporation. The form allows taxpayers to elect certain tax treatments, such as the Qualified Electing Fund (QEF) election, which can impact how income is taxed. Proper use of this form can lead to more favorable tax outcomes and compliance with IRS regulations.

Legal use of the Form 8621

To ensure the legal validity of the Form 8621, it is important to comply with IRS guidelines and deadlines. Filing the form accurately and on time helps avoid penalties and ensures that all income from foreign investments is reported correctly. Taxpayers should also maintain records of their foreign investments and any correspondence with the IRS regarding the form to support their filings in case of an audit.

Required Documents

When filling out the Form 8621, several documents are typically required to support the information provided. These may include:

- Financial statements from the foreign corporation.

- Documentation of any distributions received from the PFIC.

- Records of previous Form 8621 filings, if applicable.

- Any correspondence with the IRS related to foreign investments.

Having these documents on hand can streamline the completion process and ensure that all necessary information is accurately reported.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 8621 is crucial for compliance. Generally, the form must be filed by the due date of your income tax return, including extensions. For most taxpayers, this means the form is due on April 15 of the following year. However, if you are filing for a foreign corporation or have special circumstances, it is advisable to check for any specific deadlines that may apply to your situation.

Quick guide on how to complete form 8621 1661294

Prepare Form 8621 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Form 8621 on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and eSign Form 8621 with ease

- Locate Form 8621 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8621 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8621 1661294

Create this form in 5 minutes!

How to create an eSignature for the form 8621 1661294

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is Form 8621 and why do I need to fill it out?

Form 8621 is used by U.S. taxpayers to report interests in foreign corporations, particularly passive foreign investment companies (PFICs). Understanding how to fill out Form 8621 is crucial for compliance with IRS regulations and to avoid potential penalties.

-

How can airSlate SignNow help me fill out Form 8621?

airSlate SignNow provides an intuitive platform that simplifies the form-filling process. With features like templates and digital signatures, users can efficiently manage and submit Form 8621, ensuring that all necessary information is accurately provided.

-

Are there any costs associated with using airSlate SignNow for Form 8621?

Yes, airSlate SignNow offers various pricing plans suited to different needs. While there is a cost associated with utilizing the platform for how to fill out Form 8621, the investment can save time and reduce errors compared to manual methods.

-

Can I integrate airSlate SignNow with other tools I use for managing Form 8621?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enabling you to manage your Form 8621 and related documents efficiently. This integration enhances your workflow and allows for better data organization.

-

What features does airSlate SignNow offer for filling out forms like Form 8621?

airSlate SignNow offers features such as customizable templates, document editing, and electronic signatures which streamline the process of how to fill out Form 8621. These tools help ensure that users complete the form accurately and efficiently.

-

Is there customer support available if I need help with Form 8621?

Yes, airSlate SignNow provides comprehensive customer support. If you have questions about how to fill out Form 8621 or encounter any issues, their support team is available to assist you promptly.

-

Can I save my progress when filling out Form 8621 on airSlate SignNow?

Yes, airSlate SignNow allows you to save your progress when filling out Form 8621. This feature enables you to return to your document later without losing any information, ensuring a more flexible and user-friendly experience.

Get more for Form 8621

- Commercial building or space lease kansas form

- Kansas relative caretaker legal documents package kansas form

- Kansas bankruptcy guide and forms package for chapters 7 or 13 kansas

- Bill of sale with warranty by individual seller kansas form

- Bill of sale with warranty for corporate seller kansas form

- Bill of sale without warranty by individual seller kansas form

- Bill of sale without warranty by corporate seller kansas form

- Verification of creditors matrix kansas form

Find out other Form 8621

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document