CD 401S SCorporation Tax Return N C Department of 2008

What is the CD 401S SCorporation Tax Return N C Department Of

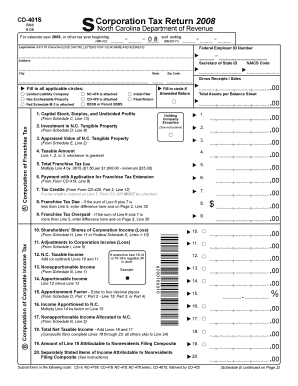

The CD 401S SCorporation Tax Return is a tax form specifically designed for S corporations operating in North Carolina. This form is crucial for reporting the income, gains, losses, deductions, and credits of the corporation. Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their individual tax returns. The CD 401S ensures that the state receives the necessary information to assess the tax obligations of these entities. It is important for compliance with state tax laws and for maintaining good standing with the North Carolina Department of Revenue.

Steps to complete the CD 401S SCorporation Tax Return N C Department Of

Completing the CD 401S SCorporation Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form with the corporation's financial information, ensuring that all entries are accurate and complete. Pay particular attention to the sections that require detailed reporting of income and expenses. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form to the North Carolina Department of Revenue by the designated deadline, either electronically or via mail.

Legal use of the CD 401S SCorporation Tax Return N C Department Of

The CD 401S SCorporation Tax Return is legally binding and must be filed in accordance with North Carolina tax laws. It serves as an official record of the corporation's financial activities for the tax year. Accurate completion and timely submission of this form are essential to avoid penalties and ensure compliance with state regulations. The form must be signed by an authorized officer of the corporation, affirming that the information provided is true and correct to the best of their knowledge. This legal requirement underscores the importance of maintaining meticulous records and adhering to filing guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the CD 401S SCorporation Tax Return are critical for compliance. Generally, the return is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on March 15. It is essential to be aware of any extensions that may apply and to file for them if necessary. Missing the deadline can result in penalties and interest on any unpaid taxes, so timely submission is crucial for all S corporations in North Carolina.

Form Submission Methods (Online / Mail / In-Person)

The CD 401S SCorporation Tax Return can be submitted through various methods, providing flexibility for businesses. Corporations can file the form electronically via the North Carolina Department of Revenue’s online portal, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate address listed on the form instructions. In-person submissions are also an option, though this method may not be as commonly used. Regardless of the submission method, it is important to retain a copy of the filed form and any confirmation of submission for record-keeping purposes.

Key elements of the CD 401S SCorporation Tax Return N C Department Of

Several key elements are essential to the CD 401S SCorporation Tax Return. These include the corporation's identifying information, such as its name and federal employer identification number (EIN). The form requires detailed reporting of income, including gross receipts and other sources of revenue. Additionally, it includes sections for reporting deductions, credits, and any other adjustments that may impact the corporation's taxable income. Understanding these key components is vital for accurate reporting and compliance with North Carolina tax regulations.

Quick guide on how to complete cd 401s scorporation tax return 2008 nc department of

Effortlessly Prepare CD 401S SCorporation Tax Return N C Department Of on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and seamlessly. Manage CD 401S SCorporation Tax Return N C Department Of on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The simplest way to modify and electronically sign CD 401S SCorporation Tax Return N C Department Of without hassle

- Obtain CD 401S SCorporation Tax Return N C Department Of and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign CD 401S SCorporation Tax Return N C Department Of to ensure top-notch communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cd 401s scorporation tax return 2008 nc department of

Create this form in 5 minutes!

How to create an eSignature for the cd 401s scorporation tax return 2008 nc department of

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a CD 401S SCorporation Tax Return N C Department Of?

The CD 401S SCorporation Tax Return N C Department Of is a form used by S Corporations to report income, deductions, and other tax information to the North Carolina Department of Revenue. Filing this return is essential for compliance and ensuring that your business meets state tax regulations.

-

How can airSlate SignNow assist with the CD 401S SCorporation Tax Return N C Department Of?

airSlate SignNow provides an easy-to-use platform to eSign and manage your CD 401S SCorporation Tax Return N C Department Of documents efficiently. By digitizing the signing process, you can expedite submission and maintain compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for my CD 401S SCorporation Tax Return N C Department Of?

airSlate SignNow offers various pricing plans to fit your business needs. Whether you have a small team or a larger corporation, you can choose an affordable plan that includes features tailored for managing your CD 401S SCorporation Tax Return N C Department Of.

-

Are there any special features available for managing CD 401S SCorporation Tax Return N C Department Of?

Yes, airSlate SignNow includes features like customizable templates, automated reminders, and detailed tracking to help you manage your CD 401S SCorporation Tax Return N C Department Of effectively. These features streamline the document process and ensure you do not miss any critical deadlines.

-

Can I integrate airSlate SignNow with other software for my CD 401S SCorporation Tax Return N C Department Of?

Absolutely! airSlate SignNow supports integrations with various accounting and business management software, making it easier to manage your CD 401S SCorporation Tax Return N C Department Of. This integration allows seamless data transfer and efficient document handling.

-

What are the benefits of using airSlate SignNow for my tax needs?

Using airSlate SignNow for your CD 401S SCorporation Tax Return N C Department Of offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for your sensitive tax information. The platform also allows for easy collaboration among team members.

-

Is airSlate SignNow user-friendly for filing CD 401S SCorporation Tax Return N C Department Of?

Yes, airSlate SignNow is designed with user experience in mind, ensuring that even those with minimal tech skills can navigate the tool effectively. You can easily eSign your CD 401S SCorporation Tax Return N C Department Of and manage documents with just a few clicks.

Get more for CD 401S SCorporation Tax Return N C Department Of

- Maryland revocation form

- Company employment policies and procedures package maryland form

- Revocation of power of attorney for care of child or children maryland form

- Statutory designation of standby guardian maryland form

- Newly divorced individuals package maryland form

- Maryland statutory form

- Contractors forms package maryland

- Md attorney form

Find out other CD 401S SCorporation Tax Return N C Department Of

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document