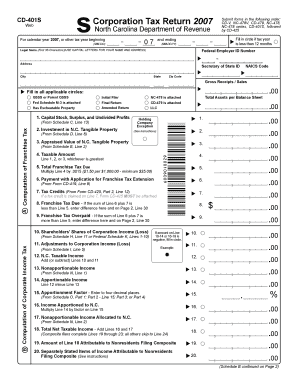

S CD 401S Web Corporation Tax Return Submit Forms in the Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, 2024-2026

What is the S CD 401S Web Corporation Tax Return?

The S CD 401S Web Corporation Tax Return is a specific form used by corporations in North Carolina to report their income, deductions, and credits for tax purposes. This form is essential for ensuring compliance with state tax regulations. The submission process involves several other forms, including CD V, NC 478V, CD 479, NC 478, NC 478 Series, and CD 425, which must be completed in a specific order. Each form serves a unique purpose in the overall tax filing process, contributing to a comprehensive overview of the corporation's financial activities for the calendar year or other specified tax year.

Steps to Complete the S CD 401S Web Corporation Tax Return

Completing the S CD 401S Web Corporation Tax Return involves several key steps:

- Gather all necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the CD V form to report the corporation's income and deductions.

- Complete the NC 478V and CD 479 forms, which provide additional details on specific deductions and credits.

- Prepare the NC 478 and NC 478 Series forms for any additional state-specific requirements.

- Finalize the S CD 401S form, ensuring all information is accurate and complete.

- Submit the completed forms in the specified order, followed by the CD 425 form.

Legal Use of the S CD 401S Web Corporation Tax Return

The S CD 401S Web Corporation Tax Return is a legally mandated document for corporations operating in North Carolina. Its proper completion and timely submission are crucial for compliance with state tax laws. Failure to file this return can result in penalties, interest on unpaid taxes, and potential legal repercussions. Understanding the legal implications of this form ensures that corporations maintain good standing with the North Carolina Department of Revenue.

Required Documents for the S CD 401S Web Corporation Tax Return

To successfully complete the S CD 401S Web Corporation Tax Return, several documents are required:

- Financial statements, including balance sheets and income statements.

- Prior year tax returns for reference.

- Documentation supporting deductions and credits claimed.

- Any relevant correspondence with the North Carolina Department of Revenue.

Filing Deadlines for the S CD 401S Web Corporation Tax Return

Corporations must adhere to specific filing deadlines for the S CD 401S Web Corporation Tax Return. Typically, the deadline aligns with the end of the corporation's fiscal year. For calendar year filers, the due date is usually April fifteenth of the following year. It is essential to stay informed about any changes to these deadlines to avoid late fees and penalties.

Form Submission Methods for the S CD 401S Web Corporation Tax Return

The S CD 401S Web Corporation Tax Return can be submitted through various methods, including:

- Online submission via the North Carolina Department of Revenue's website.

- Mailing hard copies of the completed forms to the appropriate address.

- In-person submission at designated tax offices.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely receipt by the tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct s cd 401s web corporation tax return submit forms in the following order cd v nc 478v cd 479 nc 478 nc 478 series cd 401s

Create this form in 5 minutes!

How to create an eSignature for the s cd 401s web corporation tax return submit forms in the following order cd v nc 478v cd 479 nc 478 nc 478 series cd 401s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the S CD 401S Web Corporation Tax Return process?

The S CD 401S Web Corporation Tax Return process involves submitting forms in a specific order: CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, followed by CD 425 to the North Carolina Department Of Revenue for the calendar year or other tax year. This structured approach ensures compliance and accuracy in your tax submissions.

-

How does airSlate SignNow simplify the S CD 401S Web Corporation Tax Return submission?

airSlate SignNow simplifies the S CD 401S Web Corporation Tax Return submission by providing an intuitive platform that allows users to easily eSign and send documents. With our solution, you can manage all required forms, including CD V, NC 478V, and others, in one place, streamlining the entire process.

-

What are the pricing options for using airSlate SignNow for tax submissions?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can efficiently manage your S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, Followed By CD 425 North Carolina Department Of Revenue For Calendar Year , Or Other Tax Year without breaking the bank.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features for tax document management, including customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial for managing the S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, Followed By CD 425 North Carolina Department Of Revenue For Calendar Year , Or Other Tax Year.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, enhancing your workflow. This integration allows for efficient management of the S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, Followed By CD 425 North Carolina Department Of Revenue For Calendar Year , Or Other Tax Year, ensuring all your financial data is in sync.

-

What are the benefits of using airSlate SignNow for tax submissions?

Using airSlate SignNow for tax submissions offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By utilizing our platform for the S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, Followed By CD 425 North Carolina Department Of Revenue For Calendar Year , Or Other Tax Year, you can focus more on your business and less on paperwork.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes the security of your sensitive tax documents. Our platform employs advanced encryption and security protocols to ensure that your S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S, Followed By CD 425 North Carolina Department Of Revenue For Calendar Year , Or Other Tax Year are protected at all times.

Get more for S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S,

- Vial of life vial of life vial of life vial of life vial of life vial of life form

- Boise city towing form

- Application frapps horizonsolana comwils04 form

- Download application form techno india agartala

- Orthodontic consultation bformb dental history bmedical historyb central bb centralortho

- Police receipt form

- Provider referral bform requestb for pre bb

- Renewal agreement template form

Find out other S CD 401S Web Corporation Tax Return Submit Forms In The Following Order CD V, NC 478V, CD 479, NC 478, NC 478 Series, CD 401S,

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word