About Form 1042 T, Annual Summary and Transmittal of IRS

What is Form 1042 T?

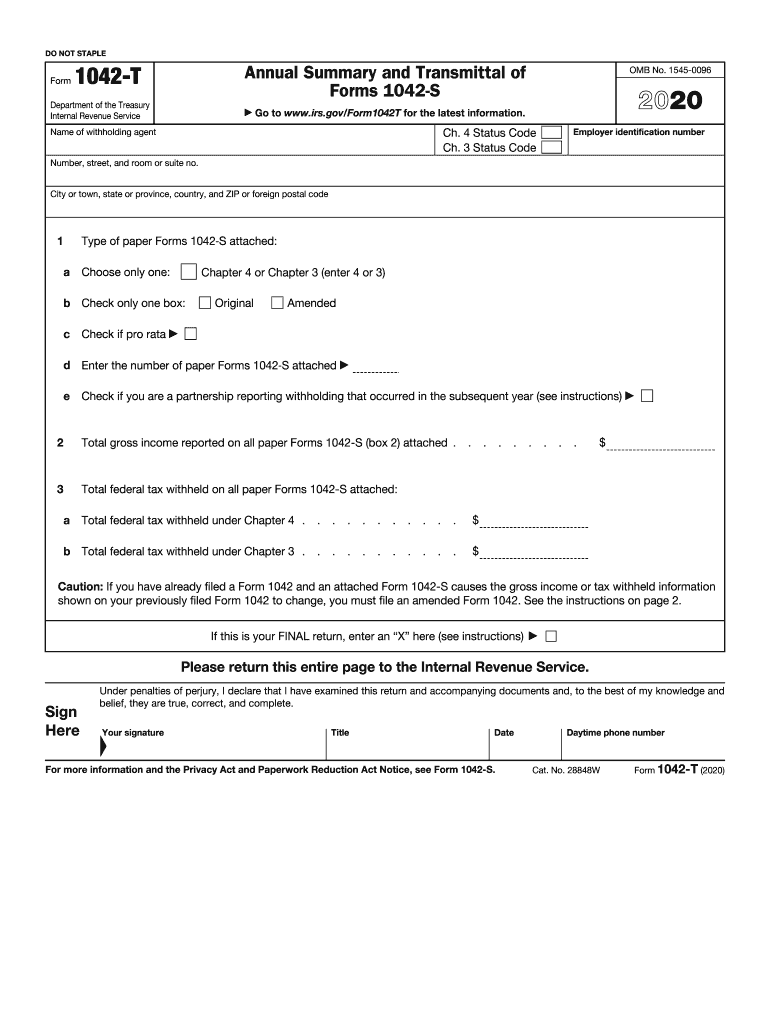

The Form 1042 T, known as the Annual Summary and Transmittal of Forms 1042-S, is a crucial document for reporting certain income paid to foreign persons. This form is primarily used by withholding agents to summarize the information reported on the individual Forms 1042-S. It provides the IRS with a comprehensive overview of the income paid, withholding tax amounts, and the recipients of those payments. Understanding the purpose of this form is essential for compliance with U.S. tax regulations, especially for businesses that deal with international clients or employees.

Steps to Complete Form 1042 T

Completing Form 1042 T involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the payments made to foreign persons, including the total amount withheld and the details of each recipient. Next, fill out the form by entering the required information in the designated fields. This includes your name, Employer Identification Number (EIN), and the total number of Forms 1042-S being submitted. Review the completed form for any errors before submission, as inaccuracies can lead to penalties.

Filing Deadlines for Form 1042 T

Timely filing of Form 1042 T is critical to avoid penalties. The form must be submitted to the IRS by March 15 of the year following the calendar year in which the payments were made. If you are submitting Forms 1042-S along with Form 1042 T, ensure that these are also filed by the same deadline. In cases where you need additional time, you may file for an extension, but be aware that this does not extend the payment deadline for any withheld taxes.

Form Submission Methods

Form 1042 T can be submitted to the IRS through various methods. You can file the form electronically using the IRS e-file system, which is the preferred method for many businesses due to its efficiency and speed. Alternatively, you can mail the completed form to the appropriate IRS address. If you choose to file by mail, ensure that you send it well before the deadline to account for any potential delays in processing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with Form 1042 T can result in significant penalties. The IRS imposes fines for late filing, which can escalate based on how late the form is submitted. Additionally, inaccuracies in the form can lead to further penalties, including interest on unpaid taxes. It is essential to understand these penalties to emphasize the importance of accurate and timely filing.

Legal Use of Form 1042 T

Form 1042 T is legally binding when completed and submitted according to IRS regulations. It serves as a formal declaration of the income paid to foreign persons and the taxes withheld. To ensure legal compliance, it is important to follow all guidelines set forth by the IRS, including accurate reporting and timely submission. Proper use of this form helps maintain transparency and accountability in international financial transactions.

Quick guide on how to complete about form 1042 t annual summary and transmittal of irs

Complete About Form 1042 T, Annual Summary And Transmittal Of IRS effortlessly on any gadget

Digital document management has become favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed materials, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delays. Handle About Form 1042 T, Annual Summary And Transmittal Of IRS on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to edit and eSign About Form 1042 T, Annual Summary And Transmittal Of IRS seamlessly

- Locate About Form 1042 T, Annual Summary And Transmittal Of IRS and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional hand-signed signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign About Form 1042 T, Annual Summary And Transmittal Of IRS and ensure excellent communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1042 t annual summary and transmittal of irs

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What are the form 1042 t instructions?

The form 1042 t instructions provide a comprehensive guide for filing Form 1042-S, which reports income and withholding for non-resident aliens. It's crucial to follow these instructions to ensure accurate reporting and compliance with IRS regulations. Understanding these guidelines can prevent costly mistakes in tax filings.

-

How can airSlate SignNow help with form 1042 t instructions?

airSlate SignNow streamlines the process of preparing and signing documents like the Form 1042-S by providing an intuitive platform. Our solution allows users to easily upload, edit, and eSign documents while following the essential form 1042 t instructions. This efficiency helps you stay organized and compliant with tax requirements.

-

Is there a cost associated with using airSlate SignNow for form 1042 t instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective while providing all the tools necessary for seamless handling of documents, including those related to form 1042 t instructions. Contact us for more detailed pricing information.

-

Are there any features specifically designed for managing form 1042 t instructions?

airSlate SignNow includes features tailored for tax document management, such as customizable templates and guided workflows. These features ensure that you can easily align your document preparation process with the form 1042 t instructions. This capability enhances your efficiency and supports accurate submissions.

-

Can I integrate airSlate SignNow with other applications for form 1042 t instructions?

Absolutely! airSlate SignNow offers a variety of integrations with popular applications to enhance your document management process. You can easily import data or export documents related to form 1042 t instructions into other platforms, streamlining your workflow and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for form 1042 t instructions?

Using airSlate SignNow for form 1042 t instructions offers numerous benefits such as time savings, increased accuracy, and improved collaboration. Our platform simplifies the signing process, making it easier to gather signatures quickly while ensuring all necessary instructions are followed. This ultimately leads to a stress-free experience during tax season.

-

How do I get started with airSlate SignNow for form 1042 t instructions?

Getting started with airSlate SignNow is simple! Just sign up for an account on our website, then explore our user-friendly interface to access tools for managing your documents according to form 1042 t instructions. Our support resources are available to help you at any step of the process.

Get more for About Form 1042 T, Annual Summary And Transmittal Of IRS

Find out other About Form 1042 T, Annual Summary And Transmittal Of IRS

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word