California Extension 2019

What is the California Extension

The California Extension allows taxpayers to request additional time to file their state income tax returns. This extension is particularly useful for individuals and businesses who may need extra time to gather necessary documentation or complete their tax filings accurately. By obtaining this extension, taxpayers can avoid late filing penalties while ensuring they have the time needed to prepare their returns properly.

Steps to complete the California Extension

Completing the California Extension involves a few straightforward steps:

- Determine your eligibility for the extension based on your filing status and tax situation.

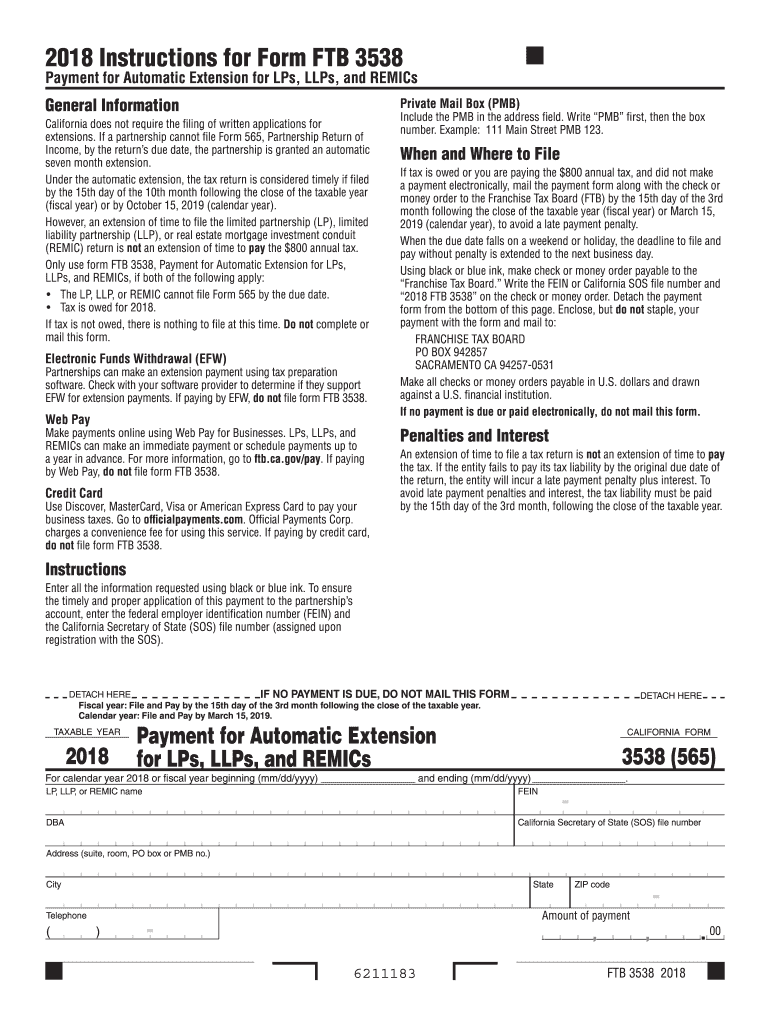

- Obtain the necessary form, typically the FTB 3538, which is the official California Extension form.

- Fill out the form accurately, providing all required information, including your estimated tax liability.

- Submit the completed form to the California Franchise Tax Board (FTB) by the original due date of your tax return.

- Make any estimated tax payments if required to avoid penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the California Extension. Generally, the extension request must be submitted by the original due date of the tax return, which is typically April 15 for individuals. For businesses, the deadlines may vary. Taxpayers should also note that while the extension provides additional time to file, it does not extend the time to pay any taxes owed. Payments are still due by the original deadline to avoid interest and penalties.

Required Documents

When applying for the California Extension, taxpayers should have certain documents ready to ensure a smooth process. These may include:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s, to estimate current year income.

- Documentation of any deductions or credits you plan to claim.

- Any other relevant financial documents that support your tax situation.

Legal use of the California Extension

The California Extension is a legally recognized method for taxpayers to request additional time for filing their state tax returns. To ensure compliance, it is important to follow the guidelines set forth by the California Franchise Tax Board. This includes submitting the extension request on time and paying any estimated taxes owed. Failure to adhere to these regulations may result in penalties or interest charges.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Extension form. The form can be filed online through the California Franchise Tax Board’s website, which offers a convenient and efficient method. Alternatively, taxpayers may choose to mail the completed form to the appropriate FTB address. In-person submissions are also possible at designated FTB offices, though this option may be less common. Regardless of the method chosen, it is essential to ensure that the form is submitted by the deadline to avoid penalties.

Quick guide on how to complete california extension

Effortlessly Prepare California Extension on Any Device

Digital document management has become widely accepted by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly and without delays. Manage California Extension on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign California Extension

- Locate California Extension and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign California Extension to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california extension

Create this form in 5 minutes!

How to create an eSignature for the california extension

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What are the form 565 instructions?

Form 565 instructions provide detailed guidance on how to properly complete and submit Form 565, which is essential for certain business tax filings. These instructions include information on eligibility, required documentation, and common pitfalls to avoid. Understanding these instructions is vital for ensuring compliance and avoiding errors.

-

How can airSlate SignNow help me with form 565 instructions?

airSlate SignNow simplifies the process of managing your form 565 instructions by allowing you to easily eSign and send documents securely. Additionally, our platform provides templates and organizational tools that can streamline the information gathering process necessary for form completion. This reduces the workload and enhances efficiency in your documentation process.

-

Are there any costs associated with using airSlate SignNow for form 565 instructions?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of different businesses looking to handle form 565 instructions. Each plan includes features that enhance document management and eSigning capabilities, ensuring you get the best value for your investment. Visit our pricing page for detailed options and choose the plan that suits you best.

-

What features does airSlate SignNow provide for managing form 565 instructions?

airSlate SignNow offers a robust set of features that supports the management of form 565 instructions. Key features include intuitive document workflow automation, secure storage for sensitive information, and real-time collaboration tools. These capabilities ensure you can easily access, complete, and share form-related documents without hassle.

-

Can I integrate airSlate SignNow with other platforms while following form 565 instructions?

Absolutely! airSlate SignNow seamlessly integrates with various software tools such as CRM systems, cloud storage services, and productivity apps. This allows you to streamline your workflow when managing form 565 instructions, ensuring all relevant information is available in one centralized location for efficiency.

-

What benefits does airSlate SignNow provide for businesses needing form 565 instructions?

Using airSlate SignNow for form 565 instructions offers several benefits, including increased efficiency and improved accuracy in document management. Our user-friendly platform reduces the time needed to prepare and sign forms while enhancing compliance through easy-to-follow templates. This ultimately leads to better productivity in your business operations.

-

How secure is airSlate SignNow when handling form 565 instructions?

Security is a top priority for airSlate SignNow, especially when managing sensitive documents like those related to form 565 instructions. Our platform employs industry-standard encryption and compliance measures to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

Get more for California Extension

Find out other California Extension

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe