A1 Qrt 2019

What is the A1 Qrt?

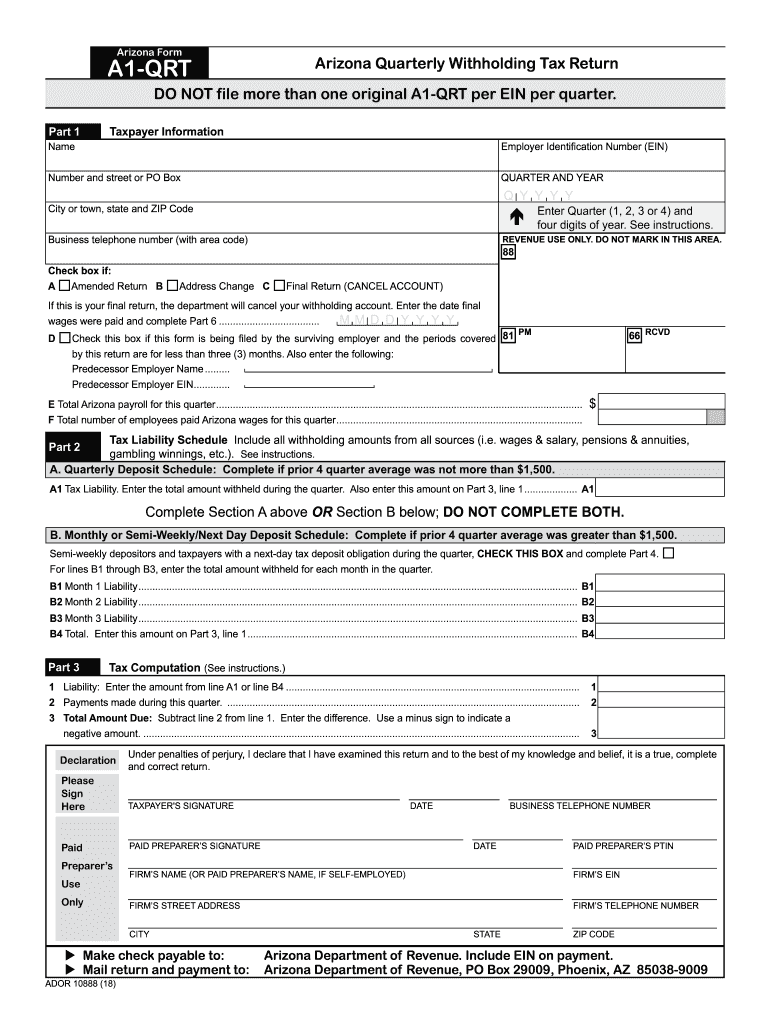

The Arizona Withholding Reconciliation Return, commonly referred to as the A1 Qrt, is a tax form used by employers in Arizona to report and reconcile the state income tax withheld from employee wages. This form is essential for ensuring that the correct amount of withholding tax has been submitted to the Arizona Department of Revenue throughout the year. Employers must accurately complete this form to comply with state tax regulations and avoid potential penalties.

Steps to complete the A1 Qrt

Completing the A1 Qrt involves several key steps:

- Gather necessary information, including total wages paid, total withholding amounts, and any adjustments for over- or under-withholding.

- Fill out the form with accurate data, ensuring that all fields are completed as required.

- Review the completed form for accuracy, checking calculations and ensuring all information is correct.

- Submit the form to the Arizona Department of Revenue by the specified deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the A1 Qrt. The form is typically due on or before the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the form is due by April 30. It is crucial to be aware of these deadlines to avoid late fees and ensure compliance with Arizona tax laws.

Key elements of the A1 Qrt

The A1 Qrt includes several important elements that must be accurately reported:

- Total wages paid: This is the total amount of wages paid to employees during the reporting period.

- Total state income tax withheld: This represents the total amount of state income tax withheld from employee wages.

- Adjustments: Any necessary adjustments for over- or under-withholding must be clearly indicated.

- Employer information: Accurate identification of the employer, including name, address, and tax identification number.

Who Issues the Form

The Arizona Department of Revenue is responsible for issuing the A1 Qrt. Employers can obtain the form from the department's official website or through authorized tax software that provides state tax forms. It is essential for employers to use the most current version of the form to ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the A1 Qrt. The form can be filed electronically through the Arizona Department of Revenue's online portal, which is often the preferred method for its convenience and speed. Alternatively, employers may choose to mail the completed form to the designated address provided by the department. In-person submissions may also be possible at local tax offices, but it is advisable to check ahead for availability and requirements.

Quick guide on how to complete a1 qrt

Complete A1 Qrt seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage A1 Qrt on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign A1 Qrt effortlessly

- Locate A1 Qrt and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your papers or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your alterations.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign A1 Qrt and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a1 qrt

Create this form in 5 minutes!

How to create an eSignature for the a1 qrt

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is an Arizona withholding reconciliation return?

An Arizona withholding reconciliation return is a form used by employers to reconcile their withholding tax payments with the amounts reported to the Arizona Department of Revenue. This process ensures that employees' state tax withholdings are accurately reported and that any discrepancies are addressed.

-

How can airSlate SignNow help with the Arizona withholding reconciliation return process?

airSlate SignNow simplifies the process of completing and submitting your Arizona withholding reconciliation return by providing an easy-to-use platform for document eSigning and management. You can quickly prepare, send, and store your reconciliation returns securely, ensuring compliance and efficiency in your payroll processes.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. These plans provide features specific to the management of documents and include tools for efficiently handling your Arizona withholding reconciliation return, helping you save time and resources.

-

Are there features specifically designed for tax document management?

Yes, airSlate SignNow includes features that streamline tax document management, such as templates and automated workflows. These features are particularly valuable when handling documents like the Arizona withholding reconciliation return, allowing you to ensure accuracy and save time.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and payroll software, enhancing your ability to manage the Arizona withholding reconciliation return alongside your existing systems. This integration helps to centralize your tax processes, making it easier to track and report your withholdings.

-

What are the benefits of using airSlate SignNow for tax reconciliation?

Using airSlate SignNow for your tax reconciliation offers several benefits, including improved accuracy, reduced paperwork, and faster processing times. By leveraging our platform for your Arizona withholding reconciliation return, you can enhance overall compliance and minimize the risk of penalties.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow takes security seriously and implements robust measures to protect your sensitive tax information, including encryption and compliance with data protection standards. This level of security ensures that your Arizona withholding reconciliation return and other important documents remain safe and confidential.

Get more for A1 Qrt

- General durable power of attorney for property and finances or financial effective upon disability utah form

- Essential legal life documents for baby boomers utah form

- General durable power of attorney for property and finances or financial effective immediately utah form

- Revocation of general durable power of attorney utah form

- Essential legal life documents for newlyweds utah form

- Ut legal documents form

- Essential legal life documents for new parents utah form

- General power of attorney for care and custody of child children or protected person utah form

Find out other A1 Qrt

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form