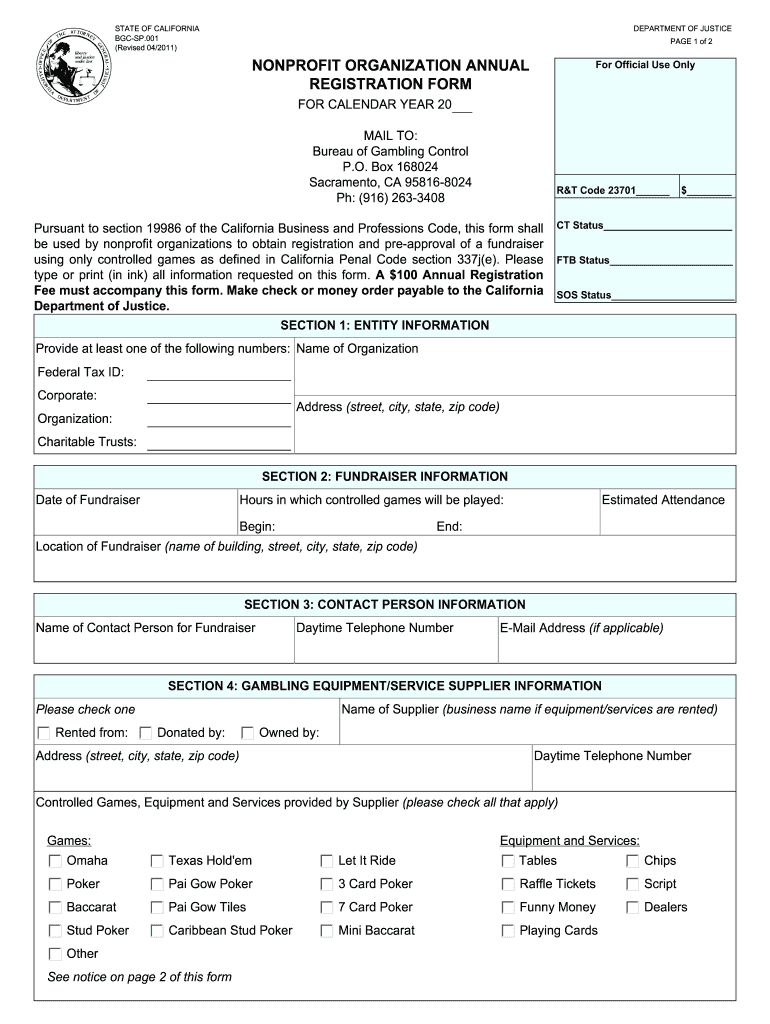

Ca Form Bgc Sp 001

Understanding the non profit organization form

The non profit organization form is a crucial document for entities seeking to establish themselves as non profit organizations in the United States. This form outlines the organization’s purpose, structure, and operations, ensuring compliance with federal and state regulations. It typically includes information such as the organization’s name, mission statement, and the names of the board members. Properly completing this form is essential for obtaining tax-exempt status under IRS guidelines.

Key elements of the non profit organization form

Several key elements must be included in the non profit organization form to ensure its validity and compliance. These elements typically encompass:

- Mission Statement: A clear and concise description of the organization’s purpose and goals.

- Board of Directors: Names and addresses of the individuals serving on the board, demonstrating governance structure.

- Organizational Structure: Information on how the organization will operate, including any committees or divisions.

- Financial Information: Initial budget estimates and funding sources, which help establish financial viability.

Steps to complete the non profit organization form

Completing the non profit organization form involves several important steps to ensure accuracy and compliance:

- Gather necessary information about the organization, including its mission, structure, and board members.

- Fill out the form accurately, ensuring all sections are completed with the required details.

- Review the form for any errors or omissions to prevent delays in processing.

- Submit the form to the appropriate state agency, along with any required fees and supporting documents.

Legal use of the non profit organization form

The legal use of the non profit organization form is governed by both federal and state laws. To be recognized as a legal entity, the form must be filed with the appropriate state agency, often the Secretary of State. This filing grants the organization legal status, allowing it to operate, receive tax-exempt donations, and apply for grants. Compliance with IRS regulations is also necessary to maintain tax-exempt status, which requires adherence to specific operational guidelines.

IRS Guidelines for non profit organizations

The Internal Revenue Service (IRS) provides specific guidelines for non profit organizations, particularly regarding tax-exempt status. Organizations must apply using Form 1023 or Form 1023-EZ, depending on their size and complexity. The IRS evaluates applications based on the organization’s purpose, activities, and compliance with the law. Understanding these guidelines is essential for any non profit seeking to operate legally and effectively.

Required documents for the non profit organization form

When submitting the non profit organization form, several supporting documents may be required to establish legitimacy and compliance. Commonly required documents include:

- Bylaws: Rules governing the organization’s operations.

- Conflict of Interest Policy: A statement outlining how potential conflicts will be managed.

- Financial Statements: Initial budgets or financial projections to demonstrate fiscal responsibility.

- Proof of Incorporation: Documentation showing that the organization is legally recognized.

Quick guide on how to complete nonprofit organization annual registration form

Fulfill Ca Form Bgc Sp 001 effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Ca Form Bgc Sp 001 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest method to modify and electronically sign Ca Form Bgc Sp 001 without hassle

- Obtain Ca Form Bgc Sp 001 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Alter and electronically sign Ca Form Bgc Sp 001 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the ICSI registration form?

Online Registration for CS Foundation | Executive | ProfessionalCheck this site

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How many nonprofit organizations are out there? Is there any statistic by geography on how many get created annually?

There's a lot. You didn't specify if you were just interested in nonprofits in the United States or not, but let's assume that that's true. You can access data in a few ways:National Center for Charitable Statistics (NCCS) - http://nccs.urban.orgThe IRS Business Master File - http://www.irs.gov/Charities-&-N...The Nonprofit Almanac - http://www.urban.org/features/no...The Center for Civil Societies - http://ccss.jhu.eduSome Quick BackgroundFirst, almost all of this data comes from the IRS and the there are a large number of organizations that do not need to report to the IRS. That said, most nonprofit / not-for-profits do have some IRS paperwork that they are required to complete annually. But most of the data that you'll have access to are from those nonprofits who have to complete Form 990s. There are considered 'charitable organizations'. Not all nonprofits are charitable organizations.Basic FactsThe NCCS states there are currently 1,521,052 nonprofits or tax-exempt organizations— remember not all nonprofits are tax-exempt / charitable. The basic breakdown of that is:1.05 Million charities101 Thousand foundations, and369 Thousand associations, civic, fraternal, membership and other organizations.Growth FactsActual rates of growth or number of new nonprofits can be a bit harder to determine, since you can't just use the total number of nonprofits each year. Just like any other industry, nonprofits start and fail, grow and die, loose their status or change status, etc.That said, here are some stats from NCCS from 2012, 2013, and 2014:20121.6 million registered nonprofits24% increase from 2000 (12 year comparison)$804.8 Billion to economy5.5% U.S. GDP20131.58 million registered nonprofits21% increase from 2001 (12 year comparison)$836.9 Billion to economy5.6% U.S. GDP20141.44 million registered nonprofits8.6% increase from 2002 (12 year comparison)$887.3 Billion to economy5.4% U.S. GDPWhile the overall number of nonprofits decreased between 2012-2014, there was signNow growth in the sector. The IRS made concerted efforts to clean dead organizations from the files, revoke exemption status from nonprofits that violated requirements, etc. The sector brings in over $1.5 Trillion in revenues and when the economy was contracting, many numbers indicated that the sector was growing. Though whose stats were used, I don't know.What is known is that nonprofit employment increased during the recession, regardless if that were new jobs at new organization or new jobs at pre-existing organizations. Lester Salamon, who has done excellent research for John Hopkins Center for Civil Society has a good summary: http://ccss.jhu.edu/wp-content/uploads/downloads/2012/01/NED_National_2012.pdfThey also have a program that offers some insights into country-by-country comparisons: http://ccss.jhu.edu/research-projects/comparative-nonprofit-sector-project/I believe most of the data, at least in overview form can be broken down by geography, to at least the county level. Many states also track some data, so more data can be found from state departments such as various Departments of Commerce. I've seen the data filed or collected in a number of different department names, so you may have to search for it. For example, in Wisconsin I believe its the Department of Revenue.Happy Researching!

Create this form in 5 minutes!

How to create an eSignature for the nonprofit organization annual registration form

How to create an electronic signature for the Nonprofit Organization Annual Registration Form in the online mode

How to make an electronic signature for your Nonprofit Organization Annual Registration Form in Google Chrome

How to generate an electronic signature for signing the Nonprofit Organization Annual Registration Form in Gmail

How to generate an electronic signature for the Nonprofit Organization Annual Registration Form right from your smartphone

How to make an eSignature for the Nonprofit Organization Annual Registration Form on iOS devices

How to make an eSignature for the Nonprofit Organization Annual Registration Form on Android OS

People also ask

-

What is a non profit form and how can airSlate SignNow assist with it?

A non profit form is a document used by nonprofits for various legal and administrative purposes. airSlate SignNow simplifies the signing process for these forms, allowing organizations to collect eSignatures quickly and securely, ensuring compliance and efficiency in their operations.

-

How much does it cost to use airSlate SignNow for managing non profit forms?

airSlate SignNow offers various pricing plans tailored for nonprofits, with cost-effective options designed to meet their budgets. By utilizing the platform, organizations can save on printing and mailing costs associated with traditional forms, making it a budget-friendly choice for managing non profit forms.

-

What features does airSlate SignNow offer for non profit forms?

airSlate SignNow includes features such as customizable templates, bulk sending, and automated reminders, all designed to streamline the signing process for non profit forms. These features enhance productivity and ensure that no form is left unsigned, helping organizations operate more efficiently.

-

Can I integrate airSlate SignNow with other tools I use for non profit management?

Yes, airSlate SignNow offers various integrations with popular tools such as CRM systems, project management software, and accounting platforms. This allows nonprofits to seamlessly manage their non profit forms alongside their existing workflows, ensuring a holistic approach to document management.

-

How secure is the signing process for non profit forms with airSlate SignNow?

airSlate SignNow prioritizes security with features such as encryption, secure cloud storage, and access controls. This ensures that all non profit forms are protected, allowing organizations to confidently collect sensitive information through eSignatures.

-

Can airSlate SignNow help with compliance for non profit forms?

Absolutely! airSlate SignNow helps ensure compliance with legal standards by providing a fully auditable trail of all signed non profit forms. This feature is vital for organizations to meet regulatory requirements and maintain transparency in their operations.

-

Is it easy to create non profit forms using airSlate SignNow?

Yes, airSlate SignNow provides an intuitive interface that makes creating non profit forms easy and straightforward. Users can customize templates to fit their specific needs, allowing them to focus on their mission rather than administrative tasks.

Get more for Ca Form Bgc Sp 001

- Form excused

- Letter of recommendation for promotion for physician form

- Year 4 rotation evaluation form away electives ttuhsc

- Albany medical center financial aid forms

- Uniform violation

- Foundations in pa that support families form

- Pdsa worksheet unc school of medicine med unc form

- Financial aid appeal form kamehameha schools apps ksbe 36568581

Find out other Ca Form Bgc Sp 001

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online