Iowa Withholding Annual VSP Report Iowa Department of 2020-2026

What is the Iowa Withholding Annual VSP Report?

The Iowa Withholding Annual VSP Report, commonly referred to as the 2015 Iowa report, is a crucial document for employers in Iowa. This report summarizes the total amount of state income tax withheld from employees’ wages throughout the year. It is essential for ensuring compliance with state tax regulations and for accurately reporting withholding amounts to the Iowa Department of Revenue. Understanding this report is vital for maintaining proper tax records and fulfilling legal obligations.

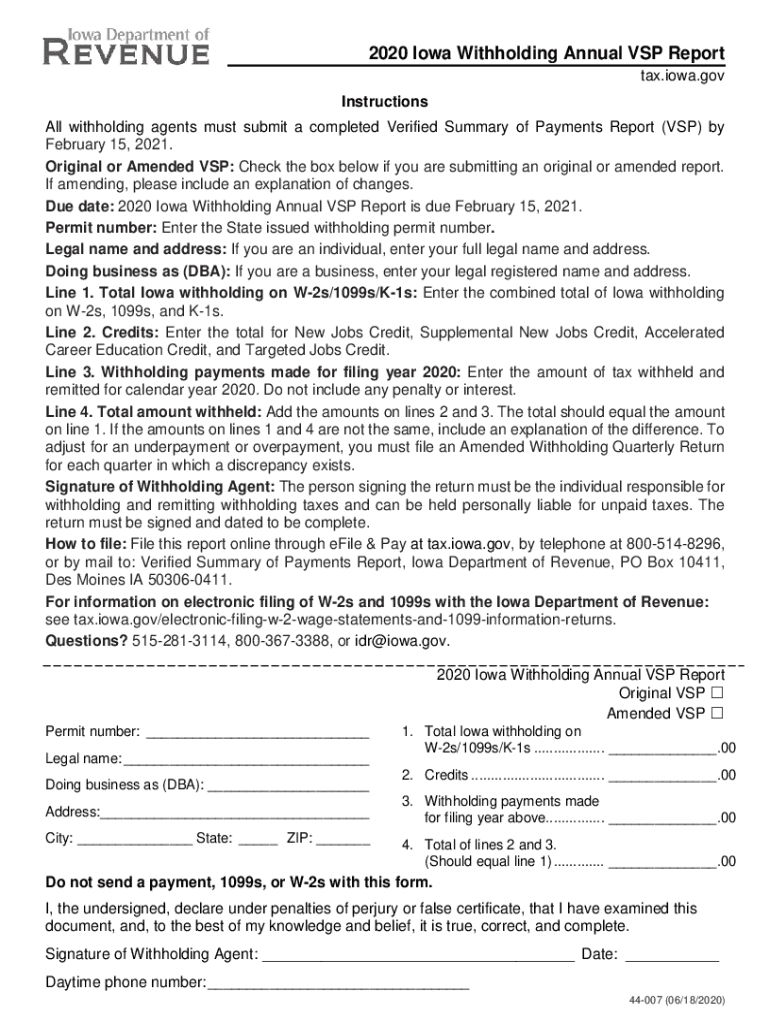

Steps to Complete the Iowa Withholding Annual VSP Report

Completing the Iowa Withholding Annual VSP Report involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant payroll records for the year, including total wages paid and the amount of state income tax withheld. Next, use these figures to fill out the report accurately. It is important to double-check all entries for correctness, as errors can lead to penalties. Once completed, the report must be submitted to the Iowa Department of Revenue by the specified deadline to avoid any compliance issues.

Legal Use of the Iowa Withholding Annual VSP Report

The Iowa Withholding Annual VSP Report serves as a legally binding document that employers must file annually. It is essential for documenting the withholding amounts and ensuring that the employer complies with state tax laws. This report can be used by the Iowa Department of Revenue to verify that employers are correctly withholding and remitting state income taxes. Failure to file this report can result in penalties and interest on unpaid taxes, making it imperative for employers to understand its legal significance.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Iowa Withholding Annual VSP Report to ensure timely submission. Typically, the report is due by January 31 of the following year. It is crucial to mark this date on your calendar and prepare the report well in advance to avoid last-minute issues. Additionally, staying informed about any changes to deadlines or requirements from the Iowa Department of Revenue is important for compliance.

Required Documents

To complete the Iowa Withholding Annual VSP Report, certain documents are necessary. Employers should gather payroll records that detail total wages paid and the state income tax withheld throughout the year. Additionally, any prior year reports may be useful for reference. Having accurate and organized documentation is essential for ensuring that the report is filled out correctly and submitted on time.

Penalties for Non-Compliance

Failure to file the Iowa Withholding Annual VSP Report or submitting it late can result in significant penalties. The Iowa Department of Revenue may impose fines based on the amount of tax owed, and interest may accrue on any unpaid taxes. Employers should take these penalties seriously, as they can add up quickly and impact the overall financial health of the business. Understanding the consequences of non-compliance underscores the importance of timely and accurate reporting.

Examples of Using the Iowa Withholding Annual VSP Report

Employers may encounter various scenarios where the Iowa Withholding Annual VSP Report is utilized. For instance, a business may use this report to reconcile its payroll records with the amounts reported to the state. Additionally, it can serve as a reference for preparing tax returns and ensuring that all withholding amounts are accounted for. Employers may also use the report to assess their withholding practices and make necessary adjustments for the upcoming year.

Quick guide on how to complete iowa withholding annual vsp report iowa department of

Complete Iowa Withholding Annual VSP Report Iowa Department Of effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Iowa Withholding Annual VSP Report Iowa Department Of on any device with airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

The easiest way to modify and eSign Iowa Withholding Annual VSP Report Iowa Department Of seamlessly

- Obtain Iowa Withholding Annual VSP Report Iowa Department Of and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Iowa Withholding Annual VSP Report Iowa Department Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa withholding annual vsp report iowa department of

Create this form in 5 minutes!

How to create an eSignature for the iowa withholding annual vsp report iowa department of

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2015 ia annual cost for airSlate SignNow?

The 2015 ia annual pricing for airSlate SignNow is designed to be cost-effective and budget-friendly for businesses of all sizes. Subscribers can benefit from competitive rates that offer extensive features for document eSigning without breaking the bank. For detailed pricing options, please visit our pricing page.

-

What features are included in the 2015 ia annual subscription?

With the 2015 ia annual subscription, airSlate SignNow provides a comprehensive suite of features that streamline document management. Users can enjoy unlimited eSignatures, customizable workflows, and integration capabilities with popular applications. This ensures a seamless experience for businesses handling important documents.

-

How can airSlate SignNow benefit my business in the 2015 ia annual context?

airSlate SignNow benefits businesses by simplifying the document signing process, which saves time and enhances productivity. The 2015 ia annual service allows for quick eSigning from any device, reducing the need for physical paperwork. This efficiency leads to faster transactions and improved customer experiences.

-

What integrations are available with the 2015 ia annual plan?

The 2015 ia annual plan of airSlate SignNow includes integrations with numerous applications, such as Google Drive, Salesforce, and Dropbox. These integrations enhance workflow automation and facilitate easy document sharing across platforms. This connectivity makes it easier for businesses to maintain organized records.

-

Is there a trial available for the 2015 ia annual subscription?

Yes, airSlate SignNow offers a free trial for potential customers to experience the features included in the 2015 ia annual subscription. This trial allows businesses to test the eSigning capabilities and assess how it fits their needs before committing to a subscription. Sign up today to explore all the benefits firsthand.

-

Can I use airSlate SignNow for remote teams with the 2015 ia annual plan?

Absolutely! The 2015 ia annual plan is perfect for remote teams, enabling users to eSign documents from anywhere with an internet connection. This flexibility allows teams to collaborate effectively without geographical constraints, ensuring that all signing processes are efficient and secure.

-

Are there any limits to the number of documents I can sign with the 2015 ia annual plan?

The 2015 ia annual plan from airSlate SignNow allows for unlimited eSignatures, meaning users can sign as many documents as needed without facing restrictions. This unlimited access is beneficial for businesses with a high volume of contracts and agreements, providing signNow value for subscribers.

Get more for Iowa Withholding Annual VSP Report Iowa Department Of

- Quitclaim deed by two individuals to llc virginia form

- Warranty deed from two individuals to llc virginia form

- Affidavit of payment prior to sale corporation or llc virginia form

- Affidavit of payment prior to sale or refinance individual virginia form

- Quitclaim deed by two individuals to corporation virginia form

- Warranty deed corporation 497428053 form

- Va sale form

- Quitclaim deed from individual to corporation virginia form

Find out other Iowa Withholding Annual VSP Report Iowa Department Of

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer