Iowa Withholding Annual VSP Report 44 007 2015

What is the Iowa Withholding Annual VSP Report 44 007

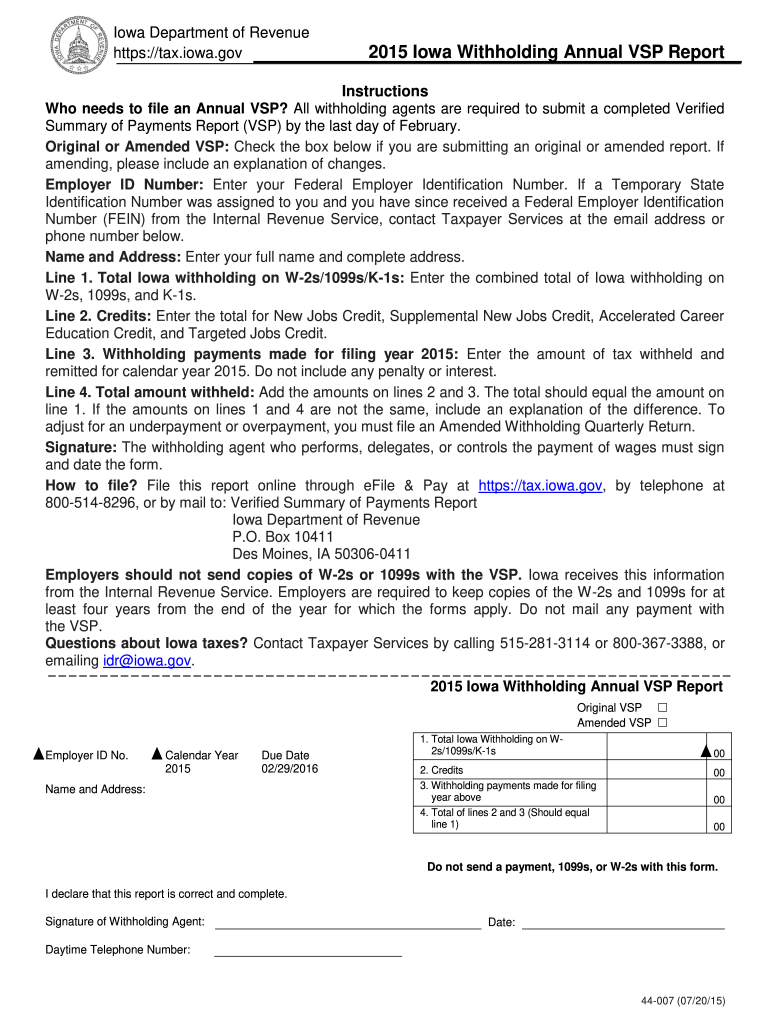

The Iowa Withholding Annual VSP Report 44 007 is a tax document required by the state of Iowa for employers to report the total amount of state income tax withheld from employees' wages throughout the year. This form is essential for ensuring compliance with Iowa tax laws and helps the state track tax revenues accurately. Employers must submit this report annually, detailing the withholding amounts for each employee, which assists in the proper allocation of state funds and resources.

How to use the Iowa Withholding Annual VSP Report 44 007

To effectively use the Iowa Withholding Annual VSP Report 44 007, employers should gather all necessary payroll data for the year. This includes total wages paid, the amount withheld for state income tax, and employee identification details. The form can be filled out online, allowing for easy data entry and submission. Accurate completion of this report is crucial for maintaining compliance with state regulations and avoiding potential penalties.

Steps to complete the Iowa Withholding Annual VSP Report 44 007

Completing the Iowa Withholding Annual VSP Report 44 007 involves several key steps:

- Collect all payroll records for the year, including wages and withholding amounts.

- Access the form online through the Iowa Department of Revenue website or a trusted eSignature platform.

- Input the required information accurately, ensuring all data matches your payroll records.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Iowa Withholding Annual VSP Report 44 007

The Iowa Withholding Annual VSP Report 44 007 is legally binding when completed and submitted in accordance with Iowa state law. Employers must ensure that the form is filled out truthfully and accurately to avoid legal repercussions. The use of electronic signatures is permitted, enhancing the efficiency and security of the submission process while adhering to the requirements set forth by the IRS and state regulations.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Iowa Withholding Annual VSP Report 44 007 to avoid penalties. The report is typically due by January 31 of the following year, allowing sufficient time for employers to compile their payroll data and complete the form. It is advisable to check for any updates or changes in deadlines each tax year to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Withholding Annual VSP Report 44 007 can be submitted through various methods to accommodate different preferences:

- Online Submission: Employers can fill out and submit the form electronically via the Iowa Department of Revenue's online portal.

- Mail: The completed form can be printed and sent via postal mail to the appropriate state office.

- In-Person: Employers may also choose to deliver the form directly to their local tax office, ensuring it is received by the deadline.

Quick guide on how to complete iowa withholding annual vsp report 44 007

Your assistance manual on preparing your Iowa Withholding Annual VSP Report 44 007

If you’re curious about how to finalize and send your Iowa Withholding Annual VSP Report 44 007, here are some brief pointers to streamline your tax submission process.

To start, you simply need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to edit, generate, and complete your income tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures, and return to adjust answers where necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the guidelines below to complete your Iowa Withholding Annual VSP Report 44 007 in no time:

- Set up your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Retrieve form to open your Iowa Withholding Annual VSP Report 44 007 in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save your revisions, print your copy, send it to your addressee, and download it onto your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return mistakes and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa withholding annual vsp report 44 007

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the iowa withholding annual vsp report 44 007

How to create an eSignature for the Iowa Withholding Annual Vsp Report 44 007 online

How to make an electronic signature for the Iowa Withholding Annual Vsp Report 44 007 in Google Chrome

How to generate an electronic signature for signing the Iowa Withholding Annual Vsp Report 44 007 in Gmail

How to generate an electronic signature for the Iowa Withholding Annual Vsp Report 44 007 from your smart phone

How to make an electronic signature for the Iowa Withholding Annual Vsp Report 44 007 on iOS

How to generate an eSignature for the Iowa Withholding Annual Vsp Report 44 007 on Android

People also ask

-

What is the Iowa Withholding Annual VSP Report 44 007?

The Iowa Withholding Annual VSP Report 44 007 is a necessary document that employers must submit to report their withholding tax for the state of Iowa. This report summarizes all withheld taxes from employees' wages throughout the year, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help me with the Iowa Withholding Annual VSP Report 44 007?

airSlate SignNow provides an efficient platform to prepare, eSign, and submit the Iowa Withholding Annual VSP Report 44 007. Our user-friendly interface simplifies the document management process, making it easy to gather necessary signatures and ensure timely submission.

-

What features does airSlate SignNow offer for managing the Iowa Withholding Annual VSP Report 44 007?

With airSlate SignNow, you can easily create, edit, and send the Iowa Withholding Annual VSP Report 44 007 digitally. Our platform includes features like customizable templates, real-time tracking of document status, and secure storage, ensuring that your documents are both accessible and safe.

-

Is airSlate SignNow cost-effective for businesses needing the Iowa Withholding Annual VSP Report 44 007?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our competitive pricing ensures that you receive powerful tools for managing documents like the Iowa Withholding Annual VSP Report 44 007 without breaking the bank.

-

Can airSlate SignNow integrate with other systems for better handling of the Iowa Withholding Annual VSP Report 44 007?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and payroll systems to streamline the process of filing the Iowa Withholding Annual VSP Report 44 007. This ensures that your data flows smoothly between platforms, reducing errors and improving efficiency.

-

What are the benefits of using airSlate SignNow for the Iowa Withholding Annual VSP Report 44 007?

The primary benefits of using airSlate SignNow for the Iowa Withholding Annual VSP Report 44 007 include enhanced efficiency, reduced paper usage, and improved compliance with filing deadlines. Our solution helps you stay organized and ensures that your reports are accurately completed and submitted on time.

-

What kind of customer support does airSlate SignNow offer for the Iowa Withholding Annual VSP Report 44 007?

airSlate SignNow provides robust customer support to assist you with any questions related to the Iowa Withholding Annual VSP Report 44 007. Our dedicated support team is available via chat, email, or phone to help you navigate the platform and optimize your document management processes.

Get more for Iowa Withholding Annual VSP Report 44 007

Find out other Iowa Withholding Annual VSP Report 44 007

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement