Iowa Withholding Annual VSP Report Iowa Department of 2017

What is the Iowa Withholding Annual VSP Report Iowa Department Of

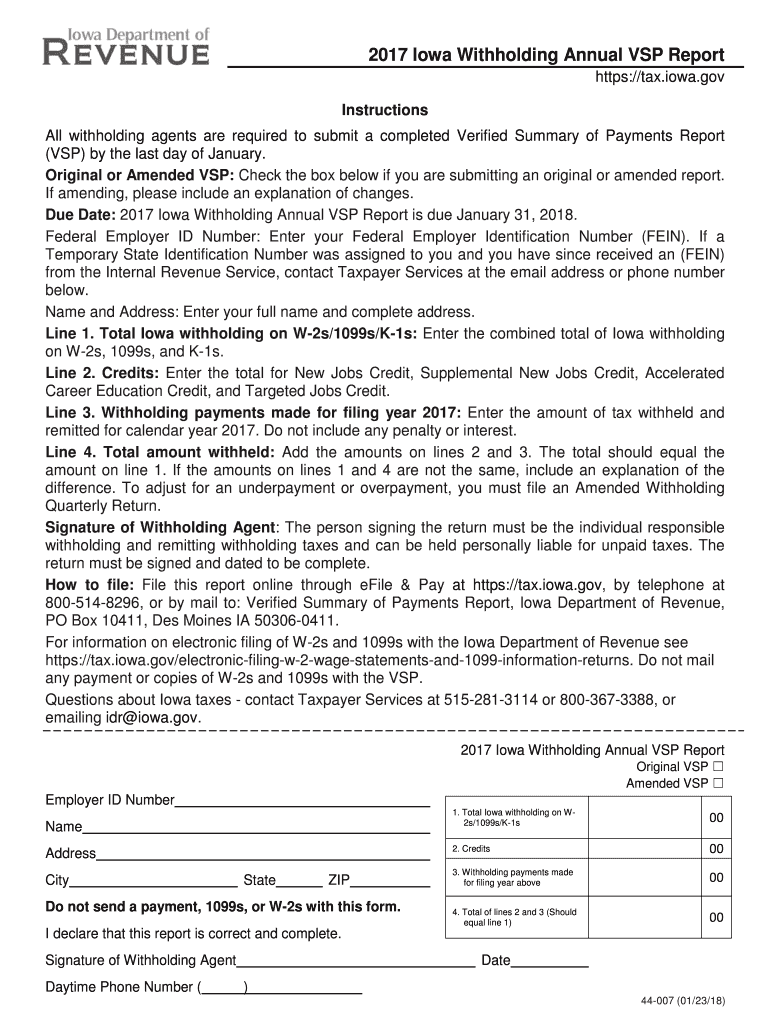

The Iowa Withholding Annual VSP Report is a crucial document for employers in Iowa. It is used to report the amounts withheld from employees' wages for state income tax purposes. This report is submitted annually to the Iowa Department of Revenue and ensures compliance with state tax laws. The VSP, or Voluntary Withholding Program, allows employers to withhold state taxes from payments made to certain non-residents, which is particularly important for businesses that engage with out-of-state workers.

Key elements of the Iowa Withholding Annual VSP Report Iowa Department Of

This report includes several key components that employers must accurately complete. Essential elements include:

- Employer Information: Name, address, and tax identification number.

- Employee Information: Names and Social Security numbers of employees from whom withholding was made.

- Withholding Amounts: Total amounts withheld for state income tax during the reporting period.

- Signature: An authorized signature certifying the accuracy of the information provided.

Steps to complete the Iowa Withholding Annual VSP Report Iowa Department Of

Completing the Iowa Withholding Annual VSP Report involves several steps to ensure accuracy and compliance:

- Gather all necessary employee wage and withholding information for the reporting year.

- Access the official form through the Iowa Department of Revenue website or obtain a hard copy.

- Fill out the form with accurate employer and employee details, ensuring all amounts are correct.

- Review the completed report for any errors or omissions.

- Sign the report to certify its accuracy.

- Submit the report to the Iowa Department of Revenue by the designated deadline.

Filing Deadlines / Important Dates

It is essential for employers to be aware of the filing deadlines for the Iowa Withholding Annual VSP Report. Typically, the report is due by January 31 of the year following the reporting period. Employers should also note any changes in deadlines due to holidays or state-specific regulations. Timely submission helps avoid penalties and ensures compliance with Iowa tax laws.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Iowa Withholding Annual VSP Report. The form can be submitted:

- Online: Through the Iowa Department of Revenue's online portal for electronic filing.

- By Mail: Printed forms can be mailed to the designated address provided by the Iowa Department of Revenue.

- In-Person: Employers may also choose to submit the report in person at local Department of Revenue offices.

Penalties for Non-Compliance

Failure to file the Iowa Withholding Annual VSP Report on time can result in penalties. These may include fines based on the amount of tax due and the length of the delay. Additionally, non-compliance can lead to increased scrutiny from tax authorities and potential legal consequences. Employers are encouraged to adhere to all filing requirements to avoid these issues.

Quick guide on how to complete 2016 iowa withholding annual vsp report iowa department of

Your assistance manual on how to prepare your Iowa Withholding Annual VSP Report Iowa Department Of

If you're unsure about how to create and submit your Iowa Withholding Annual VSP Report Iowa Department Of, here are some straightforward guidelines to simplify the tax filing process.

To begin, simply set up your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an intuitive and powerful documentation solution that lets you modify, generate, and finalize your income tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures and revisit to correct details as necessary. Optimize your tax management with enhanced PDF editing, eSigning, and convenient sharing options.

Complete the following steps to accomplish your Iowa Withholding Annual VSP Report Iowa Department Of in a matter of minutes:

- Create your account and start working on PDFs right away.

- Explore our collection to find any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Iowa Withholding Annual VSP Report Iowa Department Of in our editor.

- Enter the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Signature Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper may increase the chance of errors and delay refunds. Before you e-file your taxes, be sure to check the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 iowa withholding annual vsp report iowa department of

Create this form in 5 minutes!

How to create an eSignature for the 2016 iowa withholding annual vsp report iowa department of

How to make an eSignature for the 2016 Iowa Withholding Annual Vsp Report Iowa Department Of in the online mode

How to make an eSignature for the 2016 Iowa Withholding Annual Vsp Report Iowa Department Of in Chrome

How to generate an electronic signature for putting it on the 2016 Iowa Withholding Annual Vsp Report Iowa Department Of in Gmail

How to generate an electronic signature for the 2016 Iowa Withholding Annual Vsp Report Iowa Department Of from your mobile device

How to make an electronic signature for the 2016 Iowa Withholding Annual Vsp Report Iowa Department Of on iOS

How to create an eSignature for the 2016 Iowa Withholding Annual Vsp Report Iowa Department Of on Android OS

People also ask

-

What is the Iowa Withholding Annual VSP Report Iowa Department Of?

The Iowa Withholding Annual VSP Report Iowa Department Of is a document that businesses in Iowa must file annually to report the amount of state income withheld from employee pay. This report is essential for compliance with state tax regulations and helps ensure accurate withholding.

-

How can airSlate SignNow assist with the Iowa Withholding Annual VSP Report Iowa Department Of?

airSlate SignNow streamlines the process of preparing and submitting the Iowa Withholding Annual VSP Report Iowa Department Of. With our eSignature features, you can easily collect signatures from relevant parties and ensure your documents are securely filed.

-

What features does airSlate SignNow offer for managing the Iowa Withholding Annual VSP Report Iowa Department Of?

Our platform offers customizable templates, real-time tracking, and automated reminders to help you manage the Iowa Withholding Annual VSP Report Iowa Department Of efficiently. These features help you save time and reduce errors in your reporting process.

-

Is airSlate SignNow a cost-effective solution for filing the Iowa Withholding Annual VSP Report Iowa Department Of?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are competitive and provide you with the tools needed to manage your Iowa Withholding Annual VSP Report Iowa Department Of without incurring additional costs.

-

What are the benefits of using airSlate SignNow for the Iowa Withholding Annual VSP Report Iowa Department Of?

Using airSlate SignNow for your Iowa Withholding Annual VSP Report Iowa Department Of offers numerous benefits including increased efficiency, reduced paper usage, and enhanced security for sensitive documents. Our platform allows you to focus on your core business, knowing your reporting is handled effectively.

-

Can airSlate SignNow integrate with other software for managing the Iowa Withholding Annual VSP Report Iowa Department Of?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, simplifying your process when managing the Iowa Withholding Annual VSP Report Iowa Department Of. This integration allows for smooth data transfer and minimizes the risk of errors.

-

What types of businesses can benefit from airSlate SignNow when filing the Iowa Withholding Annual VSP Report Iowa Department Of?

Any business in Iowa that has employees subject to state withholding can benefit from using airSlate SignNow for the Iowa Withholding Annual VSP Report Iowa Department Of. This includes small businesses, large corporations, and everything in between, as our platform is scalable to meet diverse needs.

Get more for Iowa Withholding Annual VSP Report Iowa Department Of

Find out other Iowa Withholding Annual VSP Report Iowa Department Of

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now