Fillable Online SPAN 307 Cultures of Latin America 4 Fax 2020-2026

Understanding the 2020 Guam Gross Receipts Tax

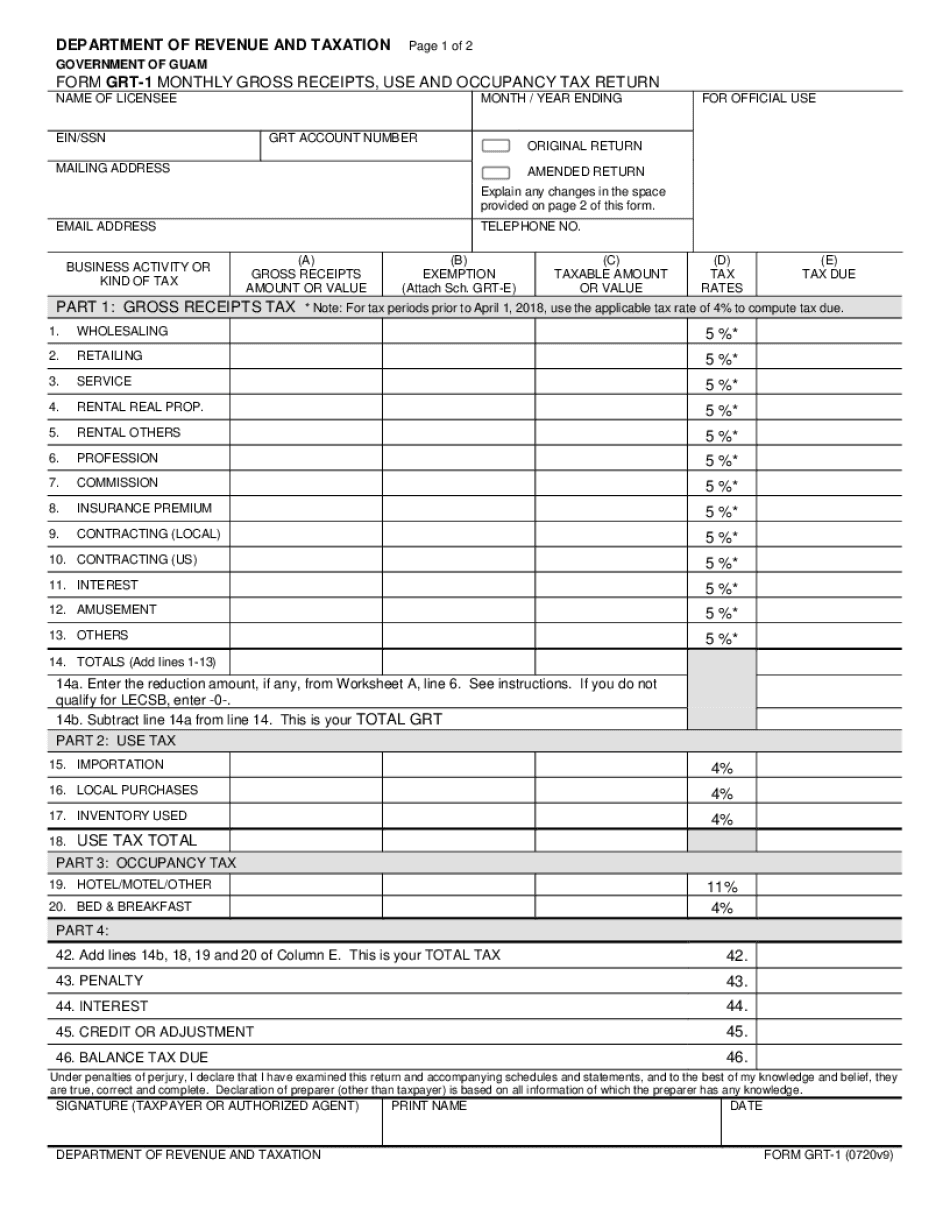

The 2020 Guam Gross Receipts Tax (GRT) is a tax levied on the gross income of businesses operating in Guam. It applies to various types of entities, including corporations, partnerships, and sole proprietorships. The tax is calculated based on the total revenue generated from business activities conducted within the territory. It is important for businesses to accurately report their gross receipts to ensure compliance with local tax regulations.

Steps to Complete the 2020 Guam GRT1 Form

Completing the 2020 Guam GRT1 form involves several key steps:

- Gather all necessary financial documents, including sales records, invoices, and receipts.

- Calculate the total gross receipts for the year, ensuring all income sources are included.

- Fill out the GRT1 form with accurate figures, following the instructions provided by the Guam Department of Revenue and Taxation.

- Review the completed form for any errors or omissions before submission.

- Submit the form either online or by mail, adhering to the specified deadlines.

Filing Deadlines for the 2020 Guam GRT1

It is crucial to be aware of the filing deadlines for the 2020 Guam GRT1. Typically, businesses must file their GRT returns quarterly, with specific due dates for each quarter. For the 2020 tax year, the deadlines are as follows:

- First Quarter: Due April 30, 2020

- Second Quarter: Due July 31, 2020

- Third Quarter: Due October 31, 2020

- Fourth Quarter: Due January 31, 2021

Required Documents for Filing the 2020 Guam GRT1

When filing the 2020 Guam GRT1, certain documents are required to support the information provided on the form. These include:

- Financial statements detailing income and expenses.

- Copies of sales invoices and receipts.

- Any relevant tax exemption certificates, if applicable.

Penalties for Non-Compliance with the Guam GRT

Failure to comply with the Guam Gross Receipts Tax regulations can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is essential to file the GRT1 form accurately and on time to avoid these consequences.

Digital vs. Paper Version of the GRT1 Form

Businesses have the option to file the 2020 Guam GRT1 form either digitally or through a paper submission. The digital version offers several advantages, including faster processing times and reduced risk of errors. However, some businesses may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensuring accuracy is vital.

Quick guide on how to complete fillable online span 307 cultures of latin america 4 fax

Effortlessly Prepare Fillable Online SPAN 307 Cultures Of Latin America 4 Fax on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Fillable Online SPAN 307 Cultures Of Latin America 4 Fax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The Easiest Method to Edit and Electronically Sign Fillable Online SPAN 307 Cultures Of Latin America 4 Fax with Ease

- Locate Fillable Online SPAN 307 Cultures Of Latin America 4 Fax and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), shareable link, or download it to your computer.

Eliminate concerns about lost or mishandled documents, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign Fillable Online SPAN 307 Cultures Of Latin America 4 Fax and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online span 307 cultures of latin america 4 fax

Create this form in 5 minutes!

How to create an eSignature for the fillable online span 307 cultures of latin america 4 fax

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What documents do I need for filing my 2020 Guam gross tax?

To accurately file your 2020 Guam gross tax, you'll need your income statements, any applicable deductions, and relevant tax forms. airSlate SignNow allows you to securely manage and eSign these documents, ensuring you have everything needed for a smooth filing process.

-

How can airSlate SignNow help streamline my 2020 Guam gross tax filing?

airSlate SignNow provides a user-friendly platform to manage and eSign your tax documents, which can signNowly streamline your 2020 Guam gross tax filing. With features like templates and automated reminders, you can ensure that your documents are prepared and signed in a timely manner.

-

Is airSlate SignNow cost-effective for managing 2020 Guam gross tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing all your 2020 Guam gross tax documents. With affordable pricing plans, businesses can easily handle document signing and management without breaking the bank, allowing you to focus on more important tasks.

-

Can I use airSlate SignNow to collaborate with my accountant on my 2020 Guam gross tax?

Absolutely! airSlate SignNow allows you to share documents securely with your accountant, enabling easy collaboration on your 2020 Guam gross tax. You can eSign documents and track changes in real-time, making the process smooth and efficient.

-

What integrations does airSlate SignNow offer for managing 2020 Guam gross tax documents?

airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and Salesforce to help you manage your 2020 Guam gross tax documents seamlessly. These integrations allow you to store, share, and manage documents in one convenient location, enhancing your workflow.

-

How secure is my information with airSlate SignNow while handling my 2020 Guam gross tax?

Your information is highly secure with airSlate SignNow. We employ industry-leading encryption to protect your documents, especially when handling sensitive data related to your 2020 Guam gross tax, ensuring your peace of mind during the eSigning process.

-

What features does airSlate SignNow provide for completing my 2020 Guam gross tax?

airSlate SignNow offers robust features including customizable templates, bulk sending, and an intuitive signing interface to facilitate your 2020 Guam gross tax process. These tools help you efficiently manage and complete your tax documentation with minimal hassle.

Get more for Fillable Online SPAN 307 Cultures Of Latin America 4 Fax

Find out other Fillable Online SPAN 307 Cultures Of Latin America 4 Fax

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document